When to file?

Annual accounts must be filed with the Central Balance Sheet Office within thirty days from approval and at the latest within seven months from the close of the financial year.

In other words, the annual accounts should:

- be submitted for approval to the general meeting within six months from the close of the financial year, on the date and at the place provided for in the articles of association; and

- be filed by the directors or managers with the National Bank of Belgium within 30 days from approval (Arts 3.1, 3:10 and 3:12 CCA).

Exceptions to the rule of prior approval by the general meeting

- Companies in liquidation

In this case, the general meeting (GM) no longer has the power to approve the annual accounts. Nonetheless, the annual accounts must be submitted to the GM. The annual accounts must be filed within one month from the date of their submission to the GM (and no later than seven months from the close of the financial year). The liquidator must note the date on which the annual accounts were submitted to the GM. On the cover sheet of the annual accounts, the words “in liquidation” must be added to the company’s name.

- Foreign companies with a branch in Belgium

The annual accounts do not have to be approved by the general meeting if this requirement is not provided for by the law governing the company.

- Large public institutions not established in the form of a commercial company but with a corporate purpose of a commercial, financial or industrial nature

- General partnerships (VOF/SNC), limited partnerships (CommV/SComm) and cooperative companies with unlimited liability (CVOA)

- Consolidated financial statements

- Statements of assets and liabilities for migrating companies

In the event of late filing, a surcharge will be added to the filing fee.

NOTE The National Bank of Belgium advises against waiting until the last minute to file annual accounts. The large number of “last minute” filings sometimes leads to a saturation of the Filing application which can result in delays and late filings.

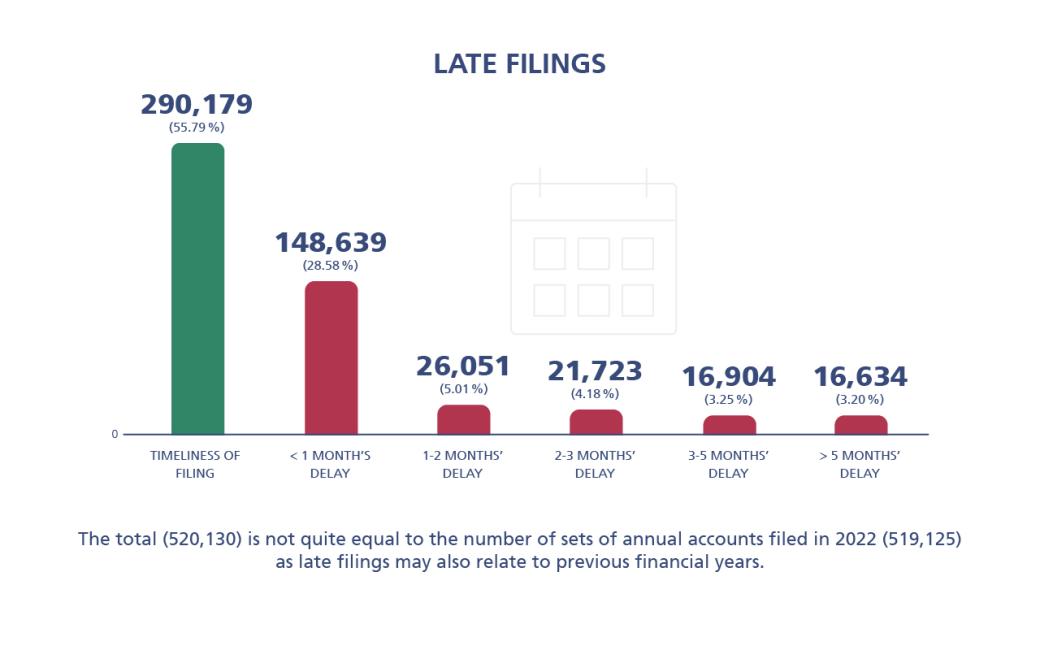

Overview of late filings