The macroeconomic aspects of climate neutrality – a European perspective

Central banks aim for macroeconomic stability, with a focus on ensuring low, predictable inflation. Over the last few years, it has become clear that the structural transformation required to mitigate climate change and the risks entailed by rising temperatures have a macroeconomic dimension which central banks cannot ignore. Specifically, climate risks could undermine financial stability, price stability and, ultimately, the conduct of monetary policy. That’s why central banks and financial institutions have made significant efforts to better understand the macroeconomic effects of climate change, in terms of both future economic growth and the greater vulnerability of economic activity to more frequent and severe climate-related shocks.

Central banks need to consider two types of climate risk: physical risks, meaning those directly attributable to climate change, such as heatwaves and wildfires, and transition risks, or the risks associated with the transition to a low-carbon economy. In this blog post, we aim to contribute to the discussion on transition risk by placing rough, energy-based estimates of technology costs for cutting greenhouse gases in a broader macroeconomic context.

A climate-neutral economy may well be cheaper than you think

Climate change is caused by greenhouse gas emissions, primarily carbon dioxide (CO2) resulting from economic activity. To meet the Paris Agreement temperature target by 2050, CO2 emissions need to decline to zero in the next 25 to 30 years. A large majority of CO2 emissions comes from the combustion of fuels for energy use, which is closely tied – although increasingly less so – to economic activity and well-being worldwide. Thus, it is first necessary to look at the available energy sources and their carbon content to understand the magnitude of the challenge we face.

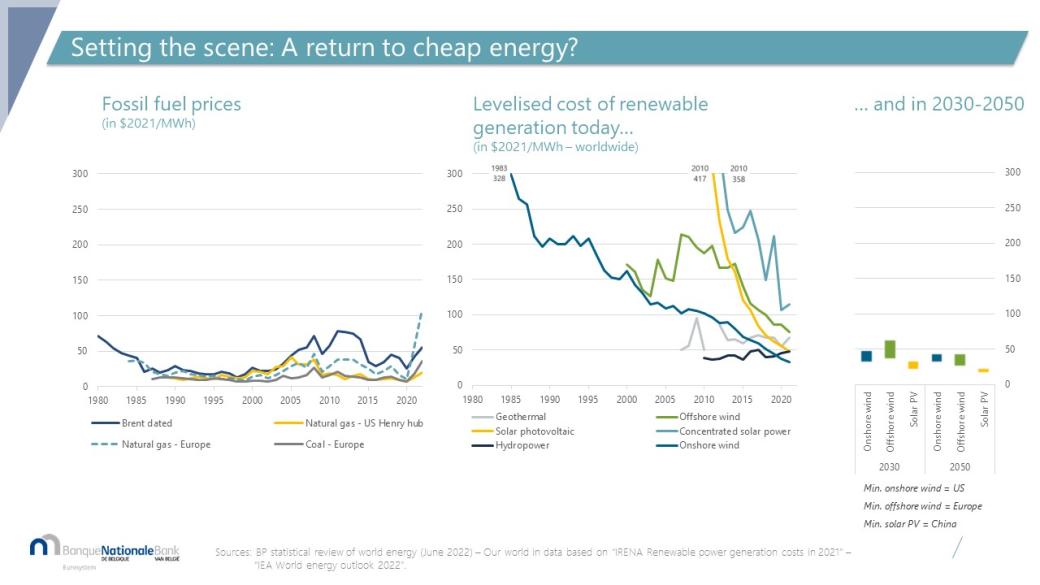

The good news is that the availability of decarbonised energy sources, such as renewables, is increasing.[1] A mere generation ago, renewable energy was in its infancy, with the cost vastly exceeding that of fossil fuels. Since then, the cost of renewables has plummeted while prices for fossil fuels have risen. Although the latter have decreased following last winter’s peak, they remain higher than before the outbreak of the war in Ukraine, while renewables are projected to become even cheaper.

Experts broadly agree that the decarbonisation of the power sector is achievable and cost-effective. From a pure energy cost perspective, heat pumps and electric vehicles already cost less than their fossil fuel alternatives. However, there are still some differences when it comes to capital costs, and electricity is not a perfect substitute for all fuel-related needs. Processes requiring high heat, energy storage or heavy transport by truck or plane may require alternative solutions. Finally, decarbonisation of the power sector will do little to combat other sources of greenhouse gases, such as methane emissions from the energy sector, cattle and decaying waste.

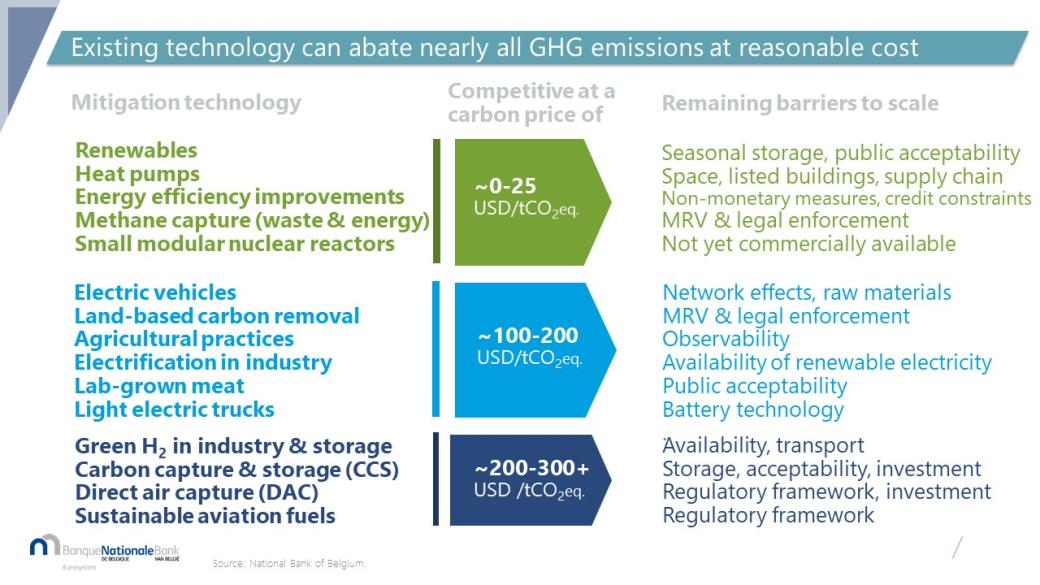

That being said, existing technologies could potentially cut nearly all these emissions and at moderate cost. Our analysis suggests that the energy sector could largely decarbonise at a carbon price not exceeding $25 per tonne of CO2 equivalent emitted.[2] The electrification of road transport and industry can be achieved for a carbon price of $100 to $200, while a carbon price of $300 will be sufficient to cut most other emissions and remove CO2 from the atmosphere, notably via afforestation or direct air capture.

All in all, this implies an average abatement cost of slightly more than €150 per tonne. This figure is, of course, subject to a significant amount of uncertainty, but it gives a fair idea of the cost of transitioning to net zero. Taking the example of the country we know best, Belgium, we estimate that eliminating greenhouse gas emissions will cost around €20 billion in total per year or roughly 3.5% of current GDP and 2.5% of 2050 GDP. This will represent a significant shock for the productive sector, a type of disturbance that macroeconomists call a supply shock. Supply shocks put central bankers in a dilemma because they simultaneously raise prices and inhibit economic activity, forcing them to arbitrage between price stability and economic growth. Although not negligible, these costs could translate into a mere 0.1 percentage point annual loss in growth throughout the transition period. It turns out that, having regard to the cost, decarbonisation is actually a “no brainer”.

The transition to climate neutrality: from if to how

The macroeconomic effects of the transition from a carbon-intensive to a net-zero economy will depend on various factors. Our calculations refer to the costs of technology, such as the cost of producing and installing solar panels. But the cost of cutting greenhouse gas emissions could be higher in the real world as behaviours may well change. For instance, households could offset some energy efficiency gains by heating renovated dwellings more than before. Moreover, market conditions could lead to higher profit margins and consumer prices that exceed the pure technological cost of production. Policies supporting free competition and trade between countries will thus play a vital role in ensuring optimally performing markets throughout the transition.

Economists and climate policy experts broadly agree that, when it comes to cutting emissions, the most efficient tool is carbon pricing. Putting a price tag on carbon makes carbon-intensive products relatively more expensive, thereby encouraging firms and consumers to innovate and move to low- and zero-carbon technologies. In short, appropriate carbon pricing can help to minimise the cost of the transition.

The EU Emissions Trading System (EU ETS) is a successful example of a carbon pricing mechanism. Recently, EU ETS prices reached €100 per tonne, before falling to around €85 per tonne. This is very significant but still insufficient to achieve full decarbonisation. In theory, the price of carbon should reflect the most expensive decarbonisation technology required to reach net zero. This price is likely substantial (see above the cost of direct air capture at $300) and would lead to severe economic disruption if implemented immediately.

One course of action could be to increase the carbon price progressively until a level compatible with net zero is reached. The problem, however, is that we are running out of time. Given the lead time for investments, we need to start cutting carbon on all fronts today. That’s why complements to carbon pricing, such as subsidies and regulatory policy instruments, are also relevant, despite theoretical concerns as to their efficiency. Reliance on regulatory instruments is fine as long as they are cost-effective and workable (see e.g. the ongoing debate in Germany about the use of gas boilers for residential heating).

As climate policy becomes an integral part of economic policy, it is crucial to secure broad public support. In contrast to earlier thinking, tolerance for regulatory measures perceived as intrusive is declining. Conversely, acceptance of carbon pricing as a policy instrument is increasing, particularly if carbon tax revenue gets returned to citizens to help shoulder the cost of decarbonisation, as is the case with the newly created European Social Climate Fund. Such public financial support for household decarbonisation should be needs-based, taking into account household income and wealth.

Policy sequencing also matters. Following Russia’s invasion of Ukraine, gas prices in Europe spiked as it appeared difficult to substitute or save gas in the very short term. An increased supply of sufficient quantities of decarbonised electricity – and, where electrification is uneconomical, decarbonised fuels – will need to go hand in hand with a more encompassing carbon pricing mechanism. For financial regulators such as central banks, the transition risks for the financial system often concern the enforcement of specific regulatory policy instruments (e.g., minimum energy-efficiency classes for residential buildings) rather than the smooth, fully anticipated introduction of a carbon price.

Take-aways for central banks

What are the implications of the climate transition for central banks? First, the transition will impact macroeconomic variables such as growth, real interest rates and inflation. We need to better understand these developments and integrate them into the conduct of our monetary policy. Two main mechanisms are at play at the same time. On the one hand, the transition to climate neutrality will require substantial investment, which could drive up interest rates globally. A carbon price, on the other hand, could push up prices and weigh on activity, presenting the central bank with a trade-off between keeping inflation low and protecting economic activity. If this sounds familiar, that’s because it is: the euro area faced the same dilemma after last year’s energy price shock.

The magnitude of both effects remains uncertain as central banks are still grappling with how to model the various transition channels consistently. We argue that the availability of cost-effective technologies to cut greenhouse gases allows the introduction of a sizable carbon price, without unduly increasing inflation or depressing output. The one prerequisite, however, is a secure, sufficient supply of increasingly cheaper decarbonised energy.

Looking beyond macroeconomics, climate change will also give rise to new risks for firms and households, which could ultimately lead to higher default rates. As a banking and insurance supervisor, we wish to make sure that these risks are well understood and taken into account by financial institutions. What is less obvious is the extent to which climate risks can be distinguished from other risks, such as those posed by volatile oil and gas prices, which tend to be well captured by standard financial and risk metrics.

Finally, there is the question of whether central banks should be involved in climate mitigation per se, for instance by buying carbon-efficient assets or by “tilting” portfolios towards decarbonisation. There is substantial disagreement on this point between the US Federal Reserve and the ECB, the latter being clearly more ambitious. Still, there is a consensus that the toolkit required to effectively manage the transition to a net-zero economy (which involves forms of taxation and subsidisation) primarily falls within the realm of fiscal policy. Also, as with any structural transition, there will be winners and losers in the process, meaning policy decisions should preferably be taken by elected decision-makers.

It is generally thought that central banks should not play a role with regard to allocative efficiency or the efficient functioning of markets. Rather they should focus on macroeconomic issues and price stability. We have also noted that there is a fine line between supporting EU policymaking, as foreseen by the Treaty on the Functioning of the European Union, and engaging in autonomous policymaking, which is forbidden by the Treaty. Finally, taking a pro-climate stance may create unwarranted expectations in other areas. Why provide support for the climate transition but not for innovative firms or SMEs or even energy security?

Returning to our main message, we find that, overall, achieving the Paris targets is feasible at a reasonable economic cost provided we focus on the right instruments. The EU’s Fit for 55 package is an excellent example of how to do so. The European Climate Law, with its increased focus on carbon pricing and its recognition of the need to mitigate distributive effects, is a good starting point.

This blog post is based on Pierre Wunsch’s keynote speech “A (somewhat European) perspective on the macro impact of climate change” at a conference on “The macroeconomic implications of climate action”, organised by the Peterson Institute for International Economics on 5 June 2023 in Washington, DC.

Footnotes

[1] Nuclear energy is also decarbonised, but concerns related to stagnant to rising costs, lead times and public opinion have made renewables the fastest-growing source of decarbonised energy in recent years. That being said, nuclear energy remains a relevant option in the transition to a net-zero economy.

[2] CO2 equivalent is the metric used to aggregate various greenhouse gases compared to the level of global warming a tonne of each causes compared to a tonne of CO2 over a 100-year time period.