Climate change doesn’t leave the financial sector cold

Climate targets and carbon footprints are not as far removed from financial institutions as you may think at first glance. Indeed, like other companies, these institutions need energy to heat their buildings, run their IT systems and for staff travel. In addition, they purchase corporate securities (bonds and shares) and extend credit to companies that emit greenhouse gases, such as CO2, and face climate risks to varying degrees.

Companies face climate risks

Companies may be exposed to physical risks, such as flooding or extreme weather conditions, due to climate change. These risks can cause property damage (to buildings and production facilities), halt production and disrupt supply chains.

In addition, companies with a large carbon footprint will eventually have to transition to low-carbon production. To this end, they will need to adapt their goods and services and, consequently, could suffer a loss in value due to the shift to a greener economy.

Climate risks weigh on financial institution portfolios

The physical risks to which companies are exposed and their carbon footprint impact the portfolios of financial institutions. In addition, investors are increasingly green-minded and want their money to be invested in a sustainable and climate-friendly manner. Banks are thus being urged by their customers to offer climate-friendly savings vehicles, so-called “green financial products”. Those who fail to do so risk losing customers and being unable to attract new (environmentally conscious) ones.

As an aside, it should be noted that financial institutions, like other companies, would be well advised to include environmental objectives in their policies in order to remain attractive to new hires.

The physical risks to which companies are exposed and their carbon footprint weigh on the portfolios of financial institutions. In addition, investors are increasingly green-minded and want their money to be invested in a sustainable and climate-friendly manner.

ECB releases climate-related indicators for the financial sector

Climate considerations are playing an ever-growing role in the financial sector and, for this reason, have been integrated into Eurosystem monetary policy. More information can be found in this ECB press release.

Specifically, an action plan was drawn up specifying three types of climate-related indicators for the financial sector, which is defined to include credit institutions, investment funds, insurance companies and pension funds.

The first two groups of indicators measure the climate risks faced by the financial sector. The risk level depends on the holdings of corporate securities and loans to companies exposed to physical risks or with a large carbon footprint. The third type of indicator focuses on green financial products.

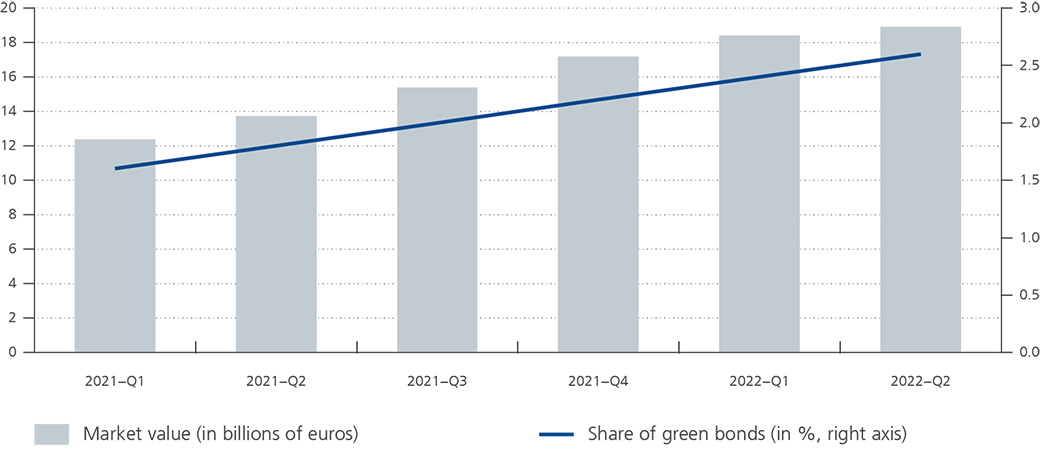

In the ECB’s Statistical Data Warehouse (SDW), it is now possible to find experimental indicators on the share of green bonds in securities issues and securities holdings in the euro area. The ECB’s definition of “green bonds” is based on data from commercial data providers and includes all bonds labelled by their issuer as green.

As can be seen, the share of green bonds is modest. At the end of the second quarter of 2022, Belgian investors held green bonds valued at around €19 billion, representing less than 3% of the total value of debt securities holdings. The situation is the same in the rest of the euro area.

In addition, the ECB’s webpage includes indicators on:

- the carbon footprint of euro area financial institutions and

- their exposure to physical risks through loans to companies and corporate securities held in their portfolios.

These indicators are available in the form of downloadable files but are subject to data-related and methodological limitations. Therefore, the ECB describes them as “analytical indicators”. In other words, the data are still a work in progress and should thus be used with caution.

Financial institutions need microdata

To accurately measure the carbon footprint of the companies in which they invest and their exposure to physical risks, financial institutions need detailed data sources.

- Indeed, CO2 emissions by companies that produce similar goods or services can vary greatly depending on the production technology used. For example, emissions from a coal-fired power plant are many times higher than those from wind farms, hydroelectric power plants and photovoltaic power stations.

- The physical risk exposure of companies in the same sector can also vary greatly, depending on the location of their production facilities, amongst other things. For example, the factory where your favourite trainers are made may be located in a flood-prone area, while another manufacturer’s is not.

It is therefore important for financial institutions to analyse at the micro level the companies they lend to and whose bonds or shares they hold. Attention should be paid, for example, to CO2 emissions and the company’s precise location. Detailed climate and geographical data are also needed to assess whether a company is exposed to extreme weather conditions and natural disasters due to climate change.

A group of experts from the ECB and the euro area national central banks (including the NBB) consolidated these sets of raw data to calculate the indicators. The indicators were compiled using a uniform methodology applicable to all euro area countries.

Green bonds represent only a small share of total holdings of debt securities in Belgium and throughout the euro area.

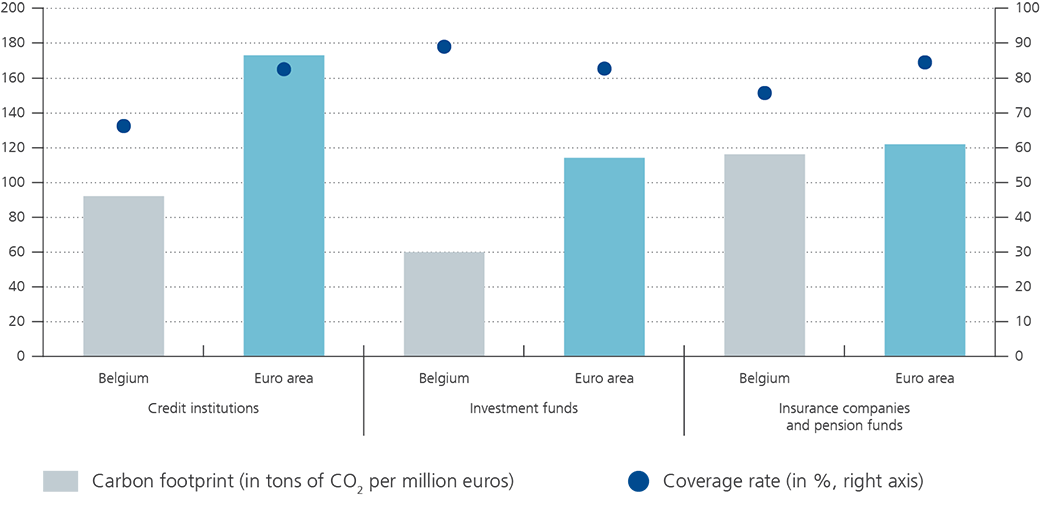

The following graph illustrates one of the transition risk indicators, namely carbon footprint. At the end of 2020, the carbon footprint for the corporate securities held by Belgian financial institutions was, on average, below that of all financial institutions in the euro area. It can also be seen that the carbon footprint differs across financial sectors. Finally, the right axis shows the indicator’s coverage ratio, namely the percentage of holdings for which the indicator could effectively be calculated. For certain instruments and sectors, it is relatively low due to the abovementioned data-related limitations.

Note: The carbon footprint is defined as the ratio between the emissions of companies financed by financial institutions and the outstanding value of the corporate securities held by these institutions.

The physical risk indicators, for their part, reflect the climate-related vulnerabilities of the companies to which euro area financial institutions lend or whose bonds or shares they hold. The indicators cover hazards related to climate change, such as coastal and river flooding, wildfires and storms, and attempt to estimate the damage to production facilities companies could suffer as a result. Based on this estimate, they provide a breakdown of holdings of loans and securities depending on the degree of exposure to physical risks.

Publication of the indicators is not an end point but rather the start of an action plan for the disclosure of harmonised climate-related data for the financial sector.

What do the indicators not yet account for?

Publication of the indicators is not an end point but rather the start of an action plan for the disclosure of harmonised climate-related data for the financial sector. The indicators will be further refined and expanded in the coming years, in cooperation with the national central banks.

Currently, for example, the indicators do not take into account all emissions throughout a company’s value chain (Scope 3 emissions), such as supplier emissions. Furthermore, it still not possible to produce harmonised indicators of CO2 emissions and the physical risks associated with residential real estate in mortgage loan portfolios due to a lack of homogeneous data across euro area countries.

New regulations will ensure that, in the future, additional and more consistent information is disclosed by companies and financial institutions. This will improve the quality of the indicators and facilitate their further expansion.