Beware of the snowball!

The era of extremely low interest rates is over

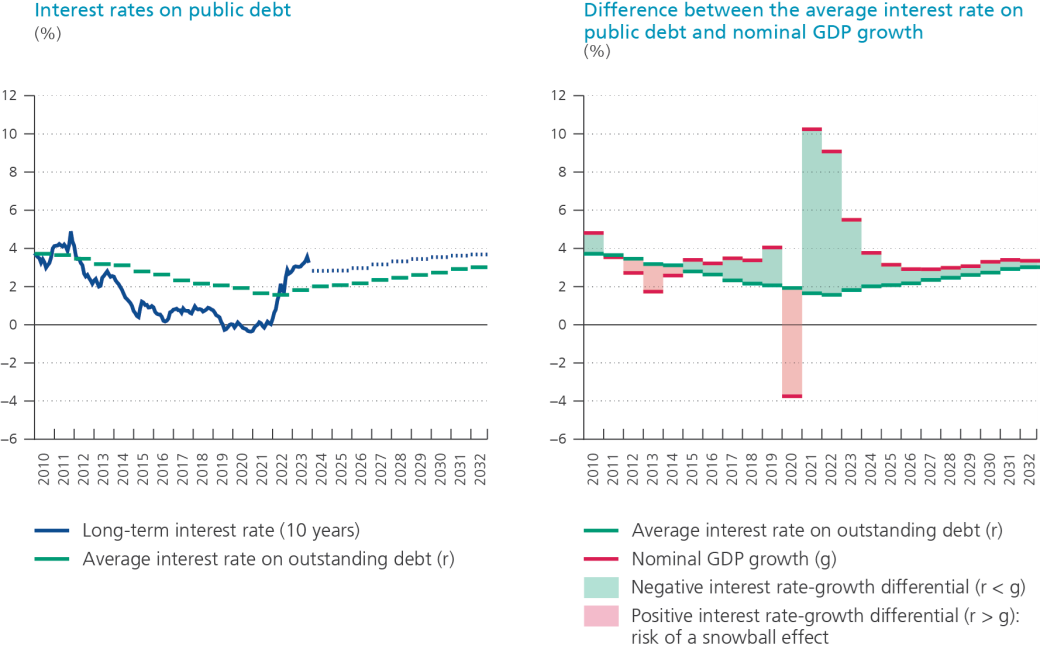

The high inflation seen in 2022 and its persistence in the euro area have led to a tightening of monetary policy and an overall rise in interest rates. For the Belgian government, borrowing rates have also risen. While the 10-year rate was close to 0% on average in 2021, it exceeded 3% on average in 2023 (see Figure 1).

These developments have put an end to several years of very low interest rates. According to market expectations in January 2024, interest rates on government debt will remain high - close to 3.5% - over the next few years. However, there is considerable uncertainty as to the trajectory that interest rates will actually take in the coming decade.

Higher interest rates will have a very gradual impact on interest payments in the coming years

Governments are constantly renewing their maturing debt. A rise in market interest rates is gradually reflected in interest payments when maturing public debt is refinanced.[1] Alongside maturing debt, governments must also finance the budget deficit annually. The higher the deficit, the more interest expenses rise.

To assess the impact that this new interest rate environment will have on public finances, we perform a simulation exercise for the next ten years, using market expectations up to 2023.[2]

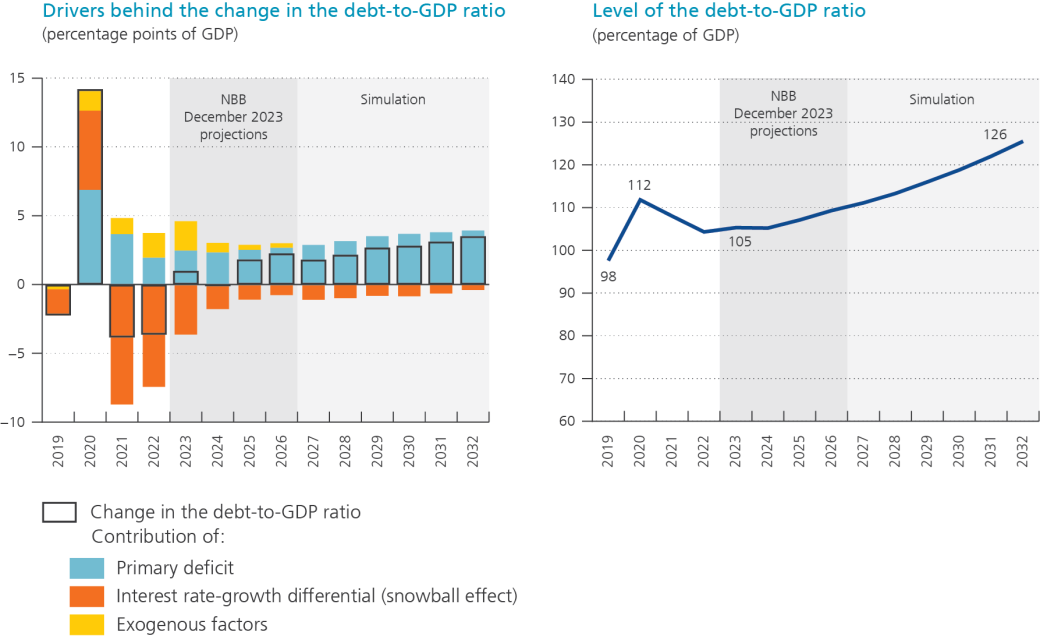

According to the simulation, the average interest rate on outstanding public debt rises from 1.8% in 2023 to 3% in 2032 (Figure 1). Interest expenses are expected to rise from around 1.8% of GDP in 2023 to 3.6% of GDP in 2032. Over the period 2013-2022, interest expenses fell by 0.2% of GDP on average per year, thus contributing to an improvement in the budget balance. Over the next ten years, the opposite will occur: interest expenses are expected to rise steadily, by 0.2% of GDP per year from 2023 onwards.

Will rising interest expenses have a snowball effect on the debt-to-GDP ratio?

Could the increase in the average interest rate on public debt have a “snowball effect” on Belgium's debt-to-GDP ratio? In other words, could it lead to a rapid and self-sustaining rise?

Such dynamics are based on two factors:

- An average interest rate (r) on outstanding public debt that is higher than the nominal GDP growth rate (g). In this case, due to the rise in interest expenses, the numerator of the debt-to-GDP ratio (total debt) will increase faster than the denominator (nominal GDP). The debt-to-GDP ratio then rises spontaneously as a result of a self-feeding process. The higher the debt ratio, the greater the effect of the interest rate-growth differential.

- A primary surplus insufficient to offset the upward effect of the positive interest rate-growth differential.

In the past, the average interest rate on Belgian debt was generally higher than the nominal GDP growth rate. As a result, a primary surplus was needed to prevent the debt-to-GDP ratio from spiralling out of control.

However, the average interest rate on public debt has been lower than nominal GDP growth since 2015 (Figure 1). In such a situation, the debt ratio quickly evaporates with a primary balance at zero or in surplus. Even with a limited primary deficit, the debt-to-GDP ratio does not necessarily increase.

Despite the recent rise in interest rates, the interest rate-growth differential is likely to remain negative for some time, according to the simulation. This is favourable for debt dynamics. The difference would, however, become smaller so that the possibility of a positive interest rate-growth differential increases. Moreover, the Belgian government records high primary deficits. The risk of an interest rate snowball automatically inflating the debt ratio is therefore real.

Irrespective of whether the interest rate-growth differential remains negative, persistently large primary deficits will seriously push up the debt ratio in the coming years. Between now and 2032, Belgian public debt could rise from 105% of GDP to around 126% of GDP (Figure 2). These developments will obviously depend on the future paths of market rates, economic growth and inflation as well as fiscal policy.

The conclusion is clear: even with a negative interest rate-growth differential, it will be necessary to reduce the primary budget deficit in order to reverse the upward trend in the Belgian debt ratio. As interest expenses rise, the budgetary effort required to do so will increase. When the average interest rate on government debt exceeds nominal GDP growth, the snowball effect of rising interest expenses risks increasing the debt ratio spontaneously and rapidly. It is therefore imperative to reduce the primary deficit in the short term.

[1] The average maturity of federal public debt has risen from approximately six years in the early 2010s to over ten years today. Spreading out debt maturity dates over time enables the government to limit the annual volume of debt requiring refinancing.

[2] Up to 2026, the results are based on the Bank's December 2023 economic projections, except for the government's interest charges. These are calculated on the basis of January 2024 market expectations according to which the 10-year interest rate on Belgian government bonds rises from 2.8% in 2024 to 3.7% in 2032. From 2027 onwards, (1) real GDP is derived from the December 2023 projections of potential GDP, (2) inflation is assumed to be 2%, which is equal to the price stability objective, (3) the primary balance (in % GDP) corresponds to that of 2026 and is increased by the expected annual increase in ageing costs (as calculated in the 2023 report of the Study Committee on Ageing), and (4) there are no exogenous factors.