Rising business costs, not fully passed on to sales prices, weighing more and more on economic activity

Substantial increases in business costs are leading to a contraction in economic activity: with profitability under pressure, many companies are being forced to scale back production. The negative effect on growth was already visible in September and will most likely become more pronounced in the fourth quarter of 2022. A recovery is nevertheless expected in the coming year. This finding of a new NBB survey, conducted in cooperation with federations representing businesses and self-employed persons, seems to confirm that the Belgian economy is heading for a brief recession, the extent of which is expected to be limited, although there is still substantial uncertainty in this regard. In addition, respondents expect cost increases and inflationary pressures to continue in the short term. However, they indicate that these increases are not being fully passed on to sales prices, suggesting that any wage-price spiral should lose traction gradually. Finally, the business confidence indicators measured by the survey show significant deterioration.

Between 26 and 28 September 2022, several Belgian federations representing companies and self-employed persons (BECI, SNI, UCM, UNIZO, UWE and VOKA) carried out an ad hoc survey amongst their members. This initiative, coordinated by the NBB and the Belgian business federation, the FEB, aims to gauge the perception of businesses and self-employed persons in the current economic climate, in particular having regard to the difficulties they are facing due to soaring energy prices and rising wages[1]. In terms of methodology, the approach was similar to that used for the surveys which have been conducted since March 2020 to assess the economic consequences of the COVID-19 pandemic. The questionnaire was adapted however to reflect the current situation and concerns. A total of 4 514 companies and self-employed persons responded. It is important to bear in mind, however, both the currently high degree of uncertainty and the subjectivity inherent in the survey data, meaning the results should be interpreted with caution.

Businesses and self-employed persons report a decline in output but expect the economic situation to improve in the course of 2023

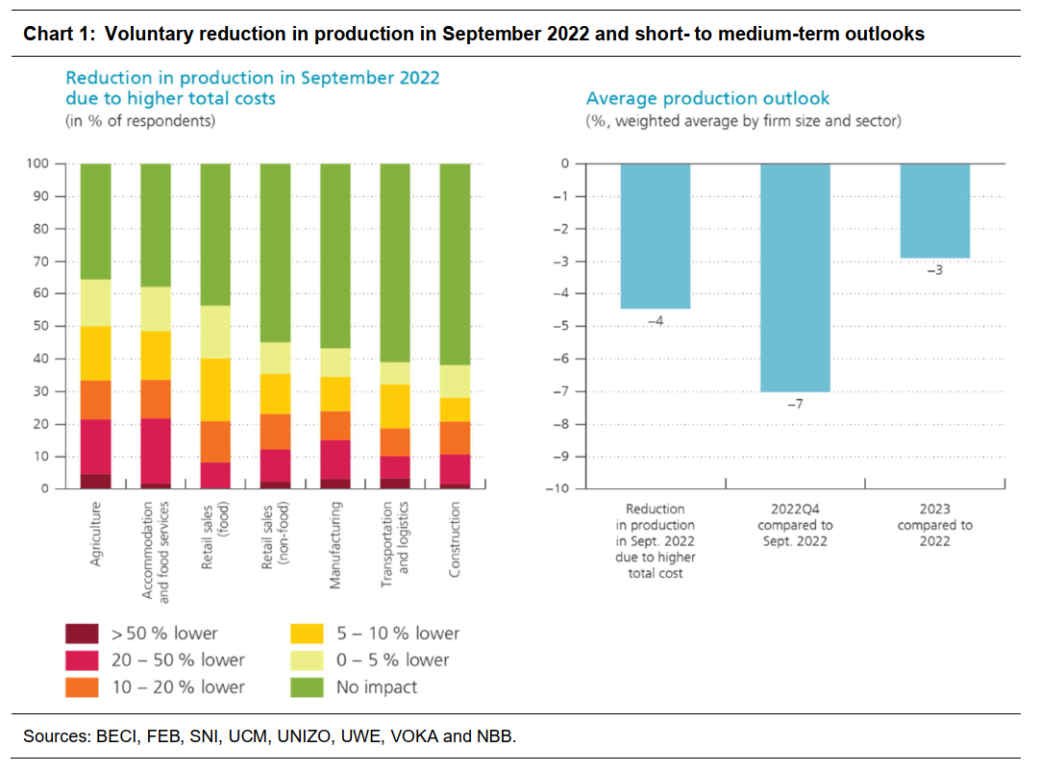

Substantial cost increases, in particular due to soaring energy prices and rapid wage indexation, are weighing on corporate profits. One third of businesses surveyed, including independent contractors, indicated that they had voluntarily reduced their production or supply of services in September 2022. Taking into account company size and added value by sector, the extent of this reduction can be estimated at 4 %. It should be noted that the results of this type of survey may overestimate the macroeconomic impact. The most affected sectors are agriculture, hospitality, retail (especially food) and manufacturing.

[1] There was no preliminary sampling for this survey, which therefore reflects the assessment of those businesses that decided to respond. However, the results have been adjusted to represent as closely as possible the composition of the value added of Belgian businesses. It should be noted that the results do not include public administration, defence, educational and healthcare services.

Smaller businesses report the most significant cutbacks in activity. Independent contractors and companies with fewer than ten employees have had to scale back more, by 8 % on average. In contrast, the negative impact of rising costs is more contained for very large companies.

Survey respondents expect economic activity to contract further in the fourth quarter of 2022. On average, they predict a 7 % contraction compared to September. Once again, the most significant declines are reported by smaller companies. That being said, looking towards 2023, businesses are in general less pessimistic and expect production to be only 3 % lower than in 2022. While still negative, this annual growth rate suggests some recovery in the course of 2023, although the level of uncertainty remains high.

The main reasons for the decline in activity are clearly rising wage costs and energy prices, cited by 60 % and 57 % of companies surveyed, respectively. These issues, particularly rising wage costs, have clearly intensified since the previous survey in March 2022. It should be noted that while soaring energy prices are one of the main factors hindering business activity, this is especially true in energy-intensive sectors (notably agriculture, food retailing, hospitality and manufacturing). Rising wages, on the other hand, have a more generalised negative effect on the Belgian economy.

Conversely, the share of respondents reporting "moderate" to "severe" supply problems decreased in September compared to six months ago. Most sectors more heavily dependent on supply chains, such as manufacturing, agriculture and construction, reported an improvement compared to March 2022. Businesses active in food-related sectors, such as hotels, restaurants and food retailers, on the other hand, reported a worsening of this issue, with around 40 % affected.

The concerns of businesses are also reflected in their heightened perception of bankruptcy risk compared to six months earlier. The current level is close to those reported in 2020, when the economy was in the throes of the COVID-19 pandemic, although it remains below the November 2020 peak during the second lockdown. The survey also revealed a significant deterioration in the area of food retail sales (bakeries, butchers, etc.). The specific indicator related to the degree of concern about the current state of the firm’s commercial activity has soared, showing the most pessimistic results reported since the first survey was carried out in early 2020. These indicators clearly point to a more alarming situation than suggested by the aforementioned production cuts and the NBB's monthly business confidence indicator, with the latter still well above its spring 2020 level. It is therefore possible that the survey indicators relating to the degree of concern and the risk of bankruptcy somewhat overestimate the extent of the current crisis.

Rising costs appear to be only partially passed on to sales prices, suggesting that any wage-price spiral should lose traction gradually

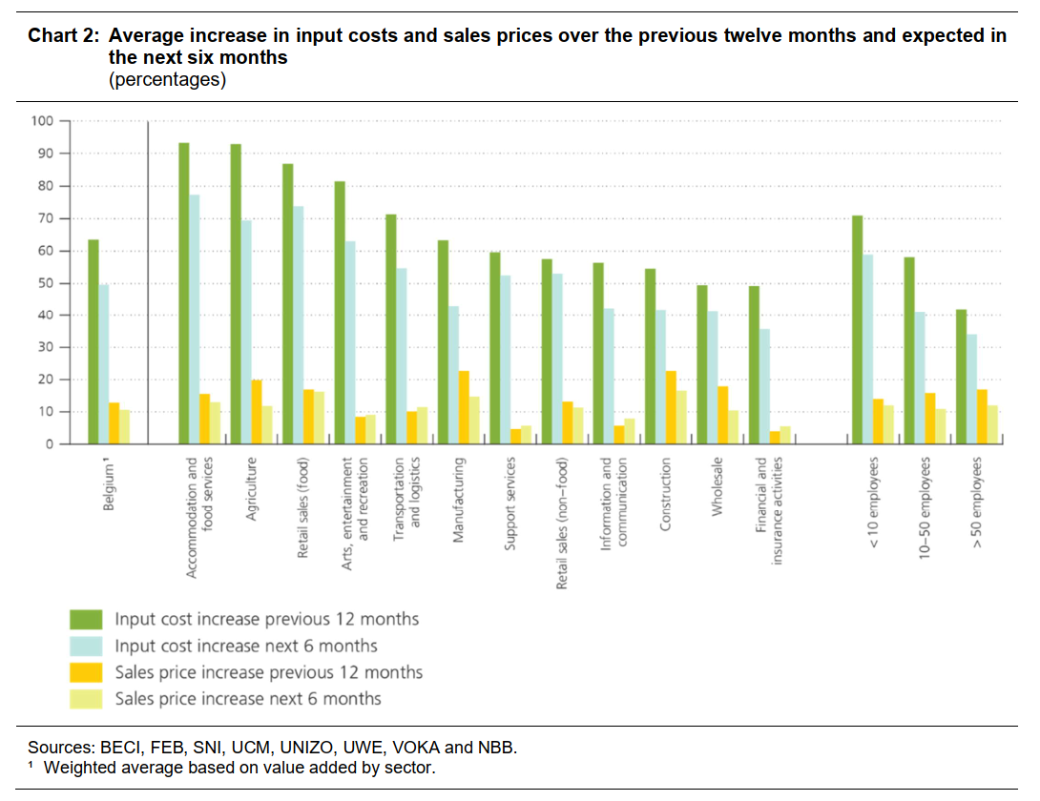

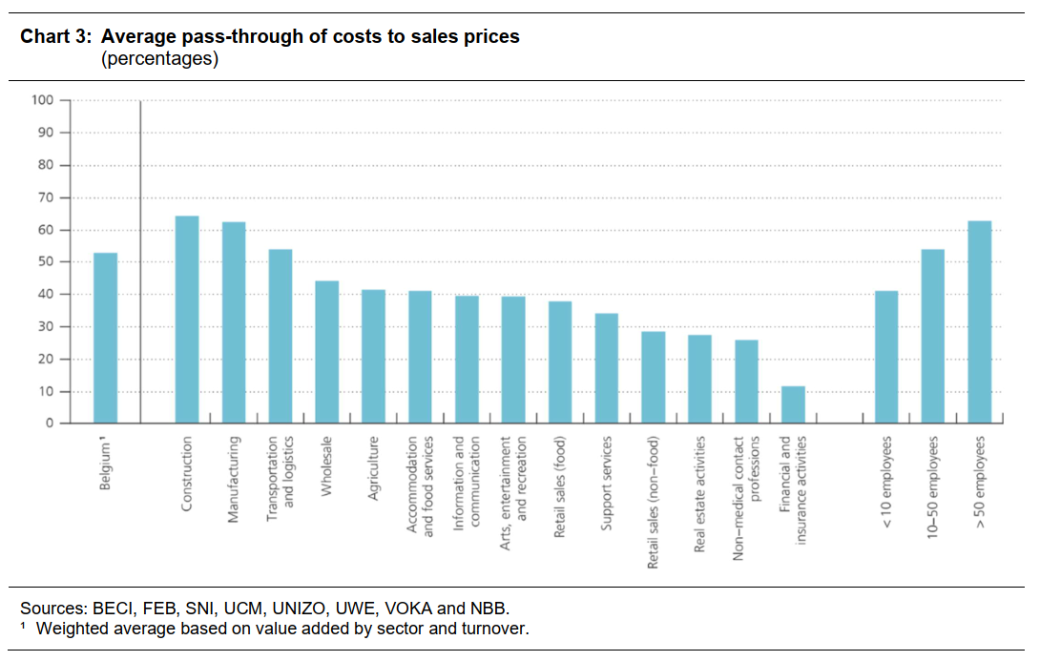

When faced with a significant rise in costs, a company may decide to pass on the increase (in whole or in part) to its sales prices, but this type of pass-through is not automatic and depends on the expected impact on sales volume and the term of ongoing contracts. Most companies surveyed have raised their prices in the past six months, particularly in sectors more heavily dependent on inputs, such as the building and manufacturing industries. As was observed in March 2022, the increase in sales prices over the last twelve months, estimated at 13 % on average, was lower than the increase in the cost of inputs (+63 %).

In response to the question regarding the extent to which higher costs lead to higher sales prices, companies clearly reported a partial pass-through. The largest firms indicated a higher pass-through on average, in the range of 63 %, while the average pass-through amounts to 54 % and 41 % for firms with 10 to 50 employees and those with fewer than 10 employees, respectively. This result probably reflects the greater pricing power of larger firms. Half of firms with more than 50 employees stated that they had included price adjustment clauses in their contracts, as opposed to only 15 % of self-employed workers and smaller businesses. Based on the survey results, the level of pass-through is slightly higher than 50 % for the market sector as a whole, which appears to be in line with the NBB's models and research[2] on this subject. This also means that any wage-price spiral should, in principle, quickly lose traction as soon as external cost pressure, in particular energy prices, subsides.

[2] Bijnens and Duprez (2022) estimate the average pass-through of costs to sales prices at around 60 %.

However, it is important to note that respondents expect inflation to remain very high over the next six months. This may be related to the delay in automatic indexation (with large wage increases still due, for example, on 1 January 2023). In addition, respondents also expect a further substantial increase in input costs, which is somewhat at odds with the recent decline in world prices for intermediate inputs and energy. However, given the reported magnitude of the increase in energy costs (see below), it is possible that the sharp rise in gas and electricity prices has not yet been fully passed on to costs for businesses and independent contractors. This could be due, for example, to temporary protection through fixed or hedging contracts.

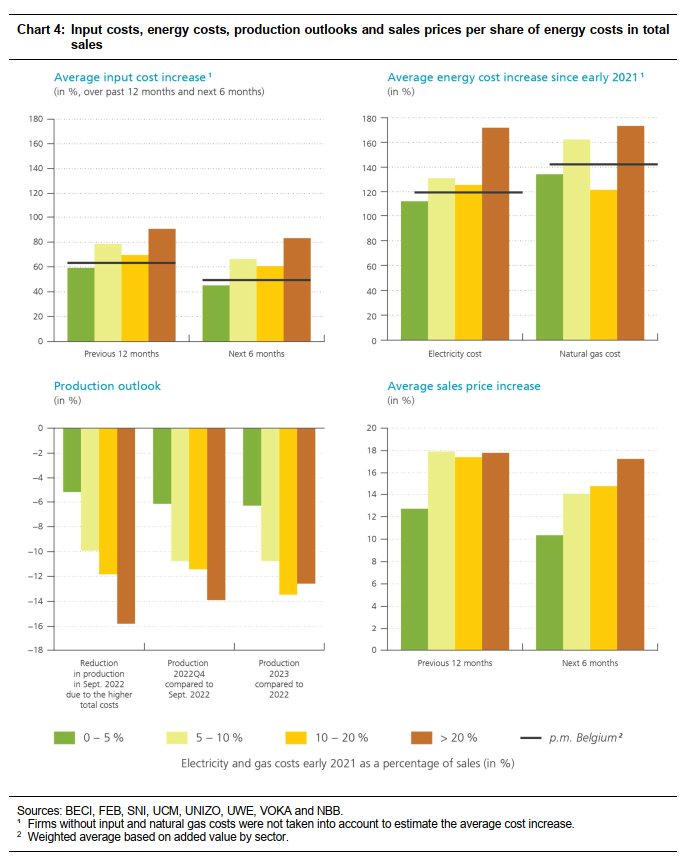

Energy-intensive businesses are undoubtedly more vulnerable

On average, at the beginning of 2021, gas and electricity costs represented more than 5 % of total sales for one fourth of respondents. Of the firms that responded to the survey, those that consume the most energy tend to be in the agriculture, food retail sales, hospitality and manufacturing industries. In total, between the beginning of 2021 and September 2022, companies reported an average increase of 120 % in their electricity bill and 143 % in their gas bill. This is still, especially for gas, well below the market price increases.

Obviously, the most energy-intensive firms are on average the most vulnerable to higher energy prices. These firms reported a greater reduction in their activities and expect to scale back more in the future than other companies.

Energy-intensive firms also report having increased their sales prices the most, although the differences between companies in this regard are clearly less pronounced Here, too, their expectations of a further increase are more pronounced than those of other companies surveyed.

Temporary unemployment expected to partially absorb the labour market shock and investment to fall sharply

On average, respondents expect to scale back their investment plans in the next two years. The extent of this reduction is significantly greater than the decline in activity: it is estimated to amount to 24 % on average compared to 2022. This is a notable worsening compared to the March 2022 survey (a 12 % drop). Small businesses are most likely to cut investment. These results should be interpreted with caution, however, given that companies anticipated a significant drop in investment during the COVID-19 pandemic, another period of great uncertainty, which ultimately did not materialise.

Employment is also expected to suffer due to current economic conditions, but to a lesser extent than investment. Taking into account company size and employment at sector level, respondents expect a contraction of 1.4 % on average over the next six months[3]. The decline is predicted to be more pronounced in the retail and hospitality sectors, as well as for small businesses and those heavily dependent on energy supplies. Once again, however, it should be noted that the COVID-19 crisis has shown that initial business forecasts can be too pessimistic, as the labour market has proved resilient. The current labour market shock will most likely be partially absorbed by temporary unemployment, as 40 % of companies surveyed expect to use this tool in the next six months.

[3] This estimate relates exclusively to employees, while the overall effect on private employment also includes independent contractors who stop working.