Are price hikes in Belgium being driven by greed?

The term “greedflation” emerged in the high inflationary context of 2022. Inflation was initially fed by surging energy prices but quickly became more widespread as other costs increased as well. Price rises became “normal” in the sense that they were generally accepted by consumers. Greedflation specifically refers to the opportunity provided by generalised rapid price increases for companies to raise their prices beyond the level justified by their own higher costs. Hence, it reflects a situation in which the opportunistic pursuit of profit contributes to inflationary pressures.

Absence of widespread greedflation in Belgium in 2022

When costs go up, companies tend to raise prices. By doing so, they seek to protect their profit margins. The key question is whether businesses have raised their prices more than necessary in order to maintain their margins.[1]

How can we know if companies in Belgium have increased their margins? While most studies rely on a macroeconomic indicator, namely profit share, to assess greedflation, our study is based on firm-level data. We analysed approximately 105,000 companies, examining their sales and costs, consisting of spending on intermediate inputs and wages. If growth in sales outstrips growth in costs, this indicates that a company has increased its prices beyond what is necessary to cover rising costs and safeguard its margin. On the other hand, if sales growth is lower than the increase in costs, this suggests that a company has raised its prices but not its margin.

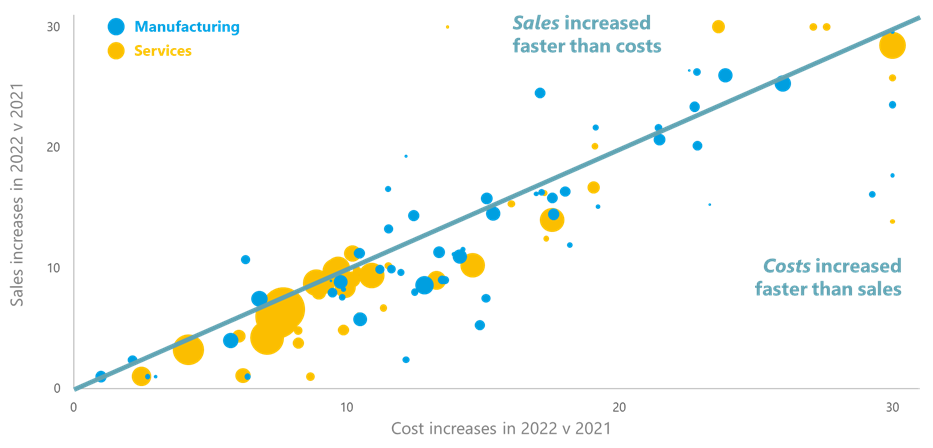

Figure 1 illustrates the relationship between sales and cost growth in various manufacturing and services sectors. When a sector is above the diagonal, this indicates that sales have increased faster than costs. As can be seen, cost increases were very different across sectors but generally more pronounced in manufacturing than in services. Most firms have not been able to fully pass on their cost increases, as evidenced by the fact that a majority lies below the diagonal. On the whole, these findings suggest an absence of widespread greedflation in Belgium in 2022.

Figure 1: In most sectors, cost growth outpaced sales growth in 2022

(percentage increase in sales and costs per sector)

Higher input costs fuelled price increases

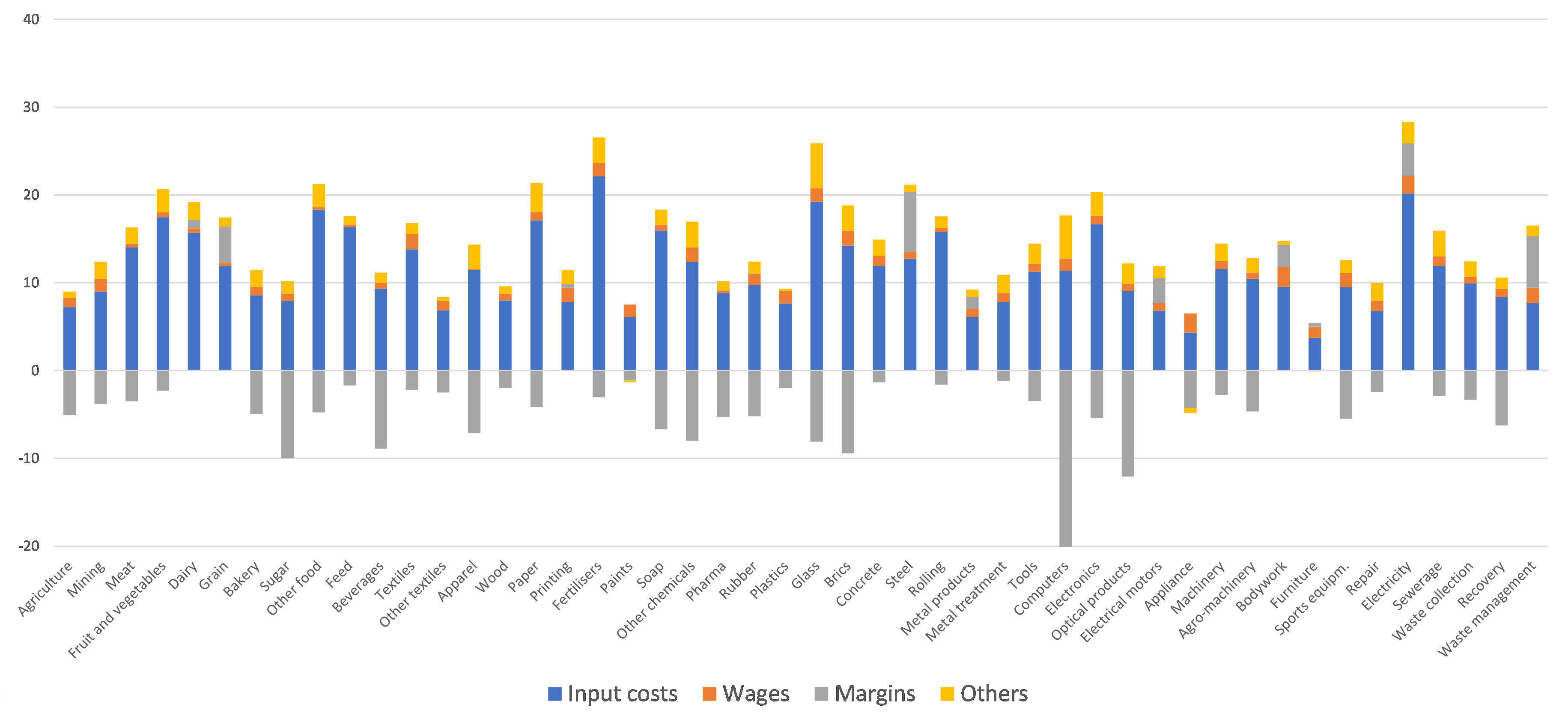

If firms’ margins have not increased, what were the drivers of the price increases seen in 2022? Were they caused by increased costs for materials and services used in production or rather by wage growth? Figure 2 illustrates the growth in the sales-per-worker ratio, which we consider a good indicator of actual price growth. The chart shows a breakdown of the change in the ratio into inputs, wages and margins.

In the Belgian manufacturing industry, prices rose substantially in 2022. In line with the abovementioned findings (Figure 1), the contribution of margins (represented by the grey bar) was negative in a majority of sectors. Margins rose in only a few sectors, such as grain and steel. In fact, the main driver of price increases was increased input costs (the blue bar), followed to a much lesser extent by wage growth (the orange bar).

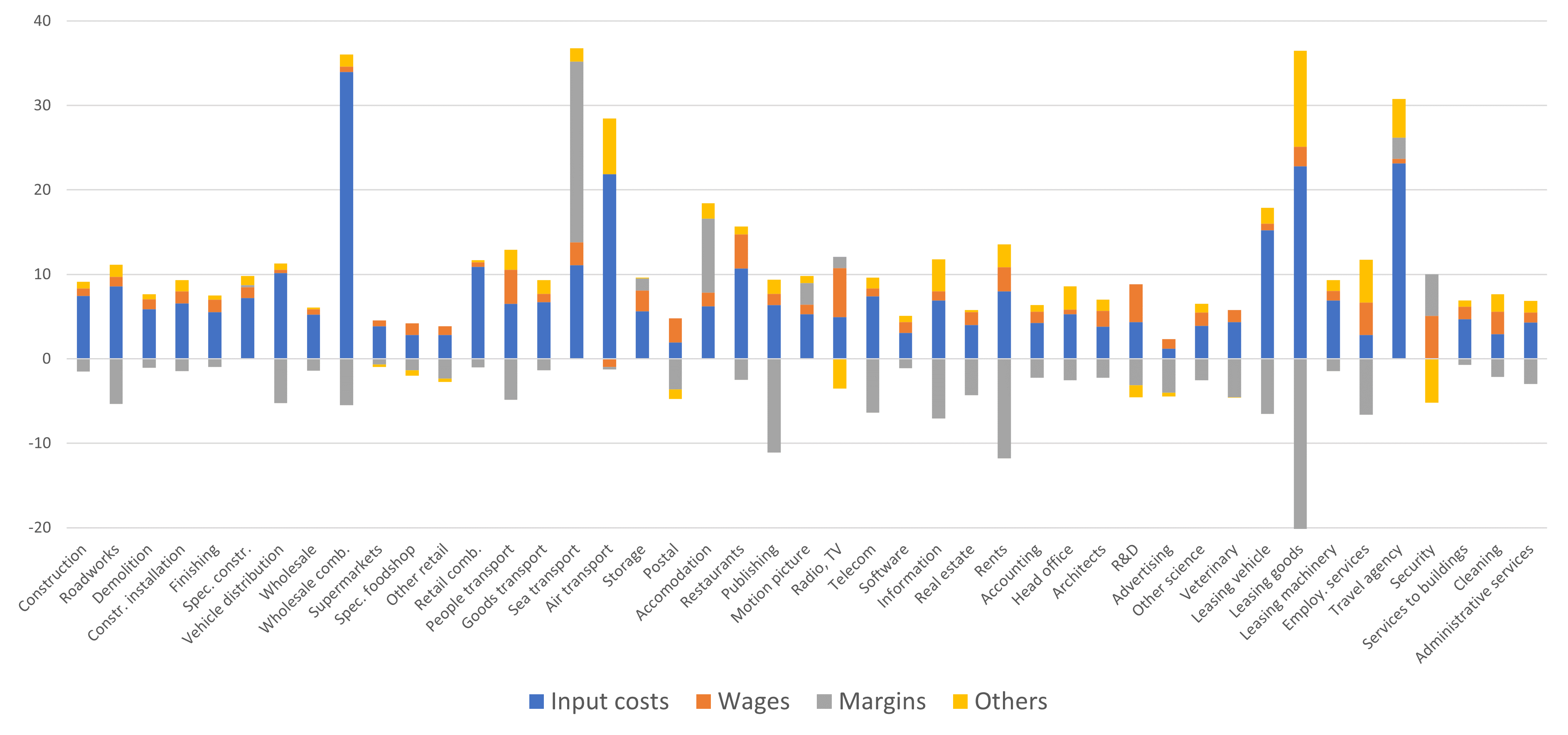

Widespread price increases were also seen in the services sectors in 2022, although these were less pronounced than in manufacturing. Margins fell in virtually all services sectors, with a few exceptions such as “sea transport” and “accommodation”. The wage effect was larger in services as labour typically represents a higher share of the total cost in these sectors. Still, input costs also played a major role in driving prices upwards. If excessive profit-seeking, or greedflation, had been widespread in Belgium, we would see many positive grey bars, which is not the case.

Figure 2: The contribution of margins to price increases was mostly negative

(decomposition of the change in sales per worker into inputs, wages and margins over the period 2021 – 2022, in pp contribution)

Our findings indicate that the price increases observed in Belgium in 2022 were not caused by higher margins. This is in contrast to the prevailing messages in the press.[2] There are a number of possible explanations for this difference. First, Belgium is a unique case scenario due to its system of automatic wage indexation. This mechanism restricts the ability of Belgian firms to significantly increase their margins, at least in the short term. Second, our analysis specifically focused on data from 2022, rather than considering trends from previous years. [3]

Notes

More information on the data and methodology used for this study can be found in a technical note.

[1] In this article, the term “margins” refers to profits expressed as a percentage of sales. Profits expressed in euros can also increase along with other economic factors, such as wages and government expenditure, especially in times of high inflation. However, in this article, we are referring not to profits in euros, which is a nominal value, but rather to the ratio of profit to sales. In practice, this concept controls for firm size and constitutes a “real” measure rather than a “nominal” one.

[2] See also European Central Bank blog, How tit-for-tat inflation can make everyone poorer”

[3] A separate study conducted in the United States found that the pursuit of higher margins drove inflation in 2021 but not in 2022.