Belgian households flock to new State note, leading to record fall in bank deposits

After the COVID-19 pandemic, the Belgian Debt Agency restarted issuing State notes with maturities ranging from three to 10 years. More recently, the agency issued its first one-year State note, set to mature on 4 September 2024. The issuance of the note and its unusually short maturity should be viewed against the backdrop of the very slow transmission of higher interest rates on the capital markets to the rates offered by Belgian banks to retail savers.[1] By issuing a retail product resembling a savings deposit (the popular Belgian regulated savings deposit combines a base rate with a loyalty premium earned after a period of 12 months), the finance minister had three goals: to stimulate competition amongst banks, resulting in higher deposit savings rates; to send a positive signal to the financial markets regarding Belgians’ saving capacity; and, finally, to offer households a safe, attractive short-term investment opportunity. Retail investor demand for the new State note was huge: more than 500 000 savers signed up and €21.9 billion was raised. According to Bloomberg, it was “Europe’s biggest-ever debt offering targeted exclusively at retail investors”.[2]

Leterme notes dwarfed

A key factor to explain the record demand is the note’s 3.3% gross coupon (resulting in a yield of 2.81% after tax),[3] which exceeded the interest rates banks were offering on household deposits at the time. Belgian households mainly save via regulated savings deposits which benefit from an annual withholding tax exemption (up to an amount of €980 in interest income for 2023). None of Belgium’s four largest commercial banks (which together hold about 70% of Belgian savings deposits) offered more than 1.5% on their savings accounts at the time of issuance, and rates at smaller banks did not exceed 2.5%. As for term deposits, those with an agreed maturity of up to one year offered 3.13% (before application of the 30% withholding tax) according to data from July 2023.

Demand for the new one-year State note greatly exceeded that for the second most successful issuance of State notes, the so-called “Leterme notes”. That offering raised €5.7 billion in the fall of 2011, with maturities ranging from three to eight years. The context was, however, very different. During the euro area sovereign debt crisis, yields and spreads on Belgian government bonds increased rapidly, with strong retail demand simultaneously evidencing households’ financing capacity and their confidence in Belgian sovereign debt.

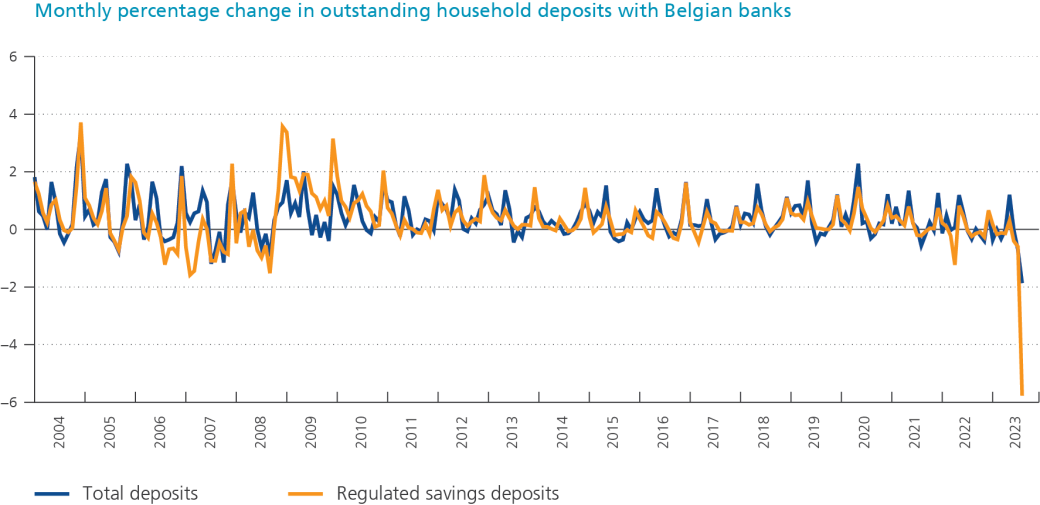

Spectacular drop in historical terms

Demand for the most recent issuance amounted to around 5% of the total value of household deposits (as measured in July 2023). However, the chart shows that household bank deposits fell by “only” 1.9%, or €8.1 billion, in August. While this is a very large drop in historical terms, it falls short of demand for the State note as the August banking statistics do not yet fully reflect the issuance. Indeed, these statistics report the situation on the last day of August while the subscription period for the State note ran until 1 September, with an official payment date of 4 September. The decline in household deposits in August is mainly attributable to early payments by investors who subscribed directly through the Debt Agency rather than via commercial banks. The latter subscriptions form the dominant share and will only show up in the September data. More precisely, regulated savings deposits fell by €17.8 billion or almost 6% in August, the largest drop since records started in 2000. This more substantial drop was due to an additional shift from savings deposits to term deposits (+€9.5 billion), as some banks were offering customers a return on term deposits similar to that of the State note. All in all, further large outflows in household bank deposits are expected to appear in the September data.

A shift in household financial assets

This episode also serves as a striking reminder that deposit statistics should not be interpreted as sending signals regarding saving in the macroeconomic sense, i.e. income minus consumption. According to the macroeconomic definition, saving can be done in various ways. These include depositing money in a bank account, buying government debt or investing in real assets such as housing. What we observed at the end of August is a shift in the composition of household financial assets, without any indication as to household consumption.

What is the share of State notes in the total financial assets of Belgian households? In the first quarter of 2023, Belgian households directly held approximately €1 billion of Belgian government debt: this exposure will now increase twentyfold. However, the financial assets of Belgian households total over €1500 billion, meaning domestic government bonds account for only 1.5% of this amount. Back in 2011, demand for the Leterme notes amounted to around 2% of the value of household bank deposits, and the direct exposure of households to government debt “only” doubled to reach approximately 1% of their total financial assets.

An outflow of funds for banks

For Belgian banks, this shift by retail savers to State notes represents a sizeable outflow of funds. Large buffers of liquid assets will help the sector to manage this liquidity shock, even if some banks may have to resort to (at times temporary) remedial actions, such as intra-group liquidity reshuffling or participation in refinancing operations with the central bank. Recourse to additional central bank funding has been very limited in this case and is not a cause for concern. And while the loss of cheap deposit funding may weigh on banks’ net interest income, the direct impact is expected to be limited. An increased sensitivity of savers to the remuneration of their savings may, however, have a greater impact in the period ahead. Nonetheless, banks have room to absorb downward pressures on their net interest income due to good profitability levels of late.

Consequences for public finances

The latest State note issuance is, of course, not without consequences for Belgian public finances and public debt management. You can read more on these aspects in the September issue of Belgian Prime News. This is a joint publication of the National Bank, the Belgian Debt Agency and a number of primary dealers. To find out what goes on behind the scenes at Belgian Prime News, check out this September 2022 article on our blog.

[1] See also the special topic in the March 2023 issue of Belgian Prime News.

[2] See https://www.bloomberg.com/news/articles/2023-09-04/belgium-sells-record-22-billion-of-bonds-to-retail-investors, 4 September 2023.

[3] The government has announced its intention to reduce the withholding tax applicable to this specific note.