A problem shared is a problem halved: how the NBB shares risk within the Eurosystem

Euro area central banks share some revenues and risks with each other. This important and interesting arrangement is a crucial part of the Eurosystem, a unique form of cooperation between central banks in which everything hinges on the euro: a single currency and a single monetary policy. Behind this apparent simplicity lie the European Central Bank and 20 participating countries, each with its own budget and national central bank. This can quickly complicate matters, especially when it comes to the unified implementation of monetary policy.

The main objective of European monetary policy is to keep inflation at the desired level, specifically 2% over the medium term. To this end, the Eurosystem has a host of instruments at its disposal. For example, it grants credit to commercial banks, buys debt securities, and determines the interest rate on the deposits that commercial banks park with the Eurosystem. These instruments also help determine the financial risks for the Eurosystem.

Sound monetary policy, but not without risk

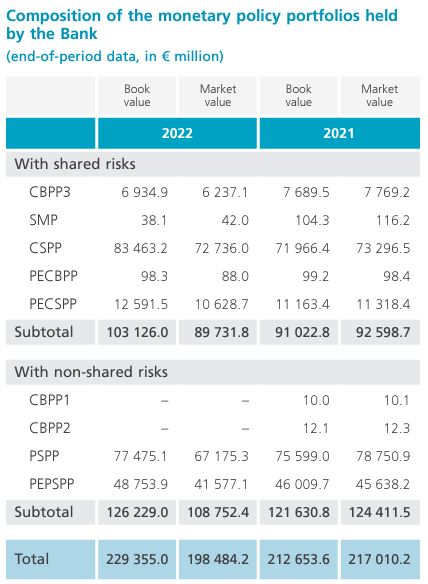

When considering central banks, the sums involved can quickly become staggering. Take, for example, the Eurosystem’s purchase programme for corporate debt (CSPP). Via the CSPP, the Eurosystem has bought more than €300 billion of such securities since 2016. Of the 20 national Eurosystem central banks, only six participate in this programme. The NBB is one of them. Our latest annual report shows that the Bank had €83.5 billion of debt securities from the CSPP programme on its balance sheet at the end of 2022. Of course, this is not without risk. This debt usually yields a fixed interest rate over a longer term which can be lower than the interest we pay on our liabilities. Moreover, default by issuers is also a risk. Fortunately, as a member of the Eurosystem, the NBB does not have to bear the risks associated with holding these many billions in securities on its own. Indeed, there is an agreement within the Eurosystem that risks – as well as revenues - are shared.

Our latest annual report shows that the Bank had €83.5 billion of debt securities from the CSPP programme on its balance sheet at the end of 2022. Of course, this is not without risk.

To illustrate the significance of this arrangement let us suppose that the NBB could buy securities only from the fictitious firm BelgianBaggeraar, and the Banque de France only from the fictitious AérienneFrançaise. What impact would this have on their respective level of risk? Without a redistribution mechanism, the NBB would lose a large share of its deposits were BelgianBaggeraar to go bankrupt. The same applies to the Banque de France and AérienneFrançaise. Through the redistribution mechanism, risk is pooled and redistributed between the NBB and the Banque de France. Both central banks will therefore record a loss slightly more often, as they are now at risk from two firms. But since the loss is shared, the amount thereof is consistently smaller.

So, the NBB’s risk has been divided, spread, and diversified. Of course, this doesn't mean that the risk has disappeared, only that really big hits will be less frequent. In addition, frequent but smaller losses provide more predictability in a given year than a very big loss due to an event of default.

Good agreements make good friends

The NBB therefore benefits from risk sharing in the Eurosystem, and good agreements are essential for this. Firstly, it is important to ensure real diversification. If AérienneFrançaise and BelgischeBaggeraar were always getting into financial difficulty at the same time, banks would ultimately fail to benefit from the redistribution mechanism. We call this phenomenon correlation. The Eurosystem limits correlation risks, for instance, by buying assets in a wide variety of commercial sectors. As the Eurosystem wishes to remain neutral at all times in the conduct of monetary policy, all sectors are fortunately treated equally.

The NBB therefore benefits from risk sharing in the Eurosystem, and good agreements are essential for this.

Risk sharing is, of course, not limited to two central banks. All 20 euro area central banks share revenues and risks, which must be acceptable to all 20 banks. This means there should be no surprises in this regard. The Eurosystem banks have agreed, for instance, not to buy securities that do not meet a certain credit quality. In this way, the risks to the system as a whole are further reduced.

Since 2022, climate-related risks have formed part of these agreements. The new agreements limit the transition risk of purchased debt securities. Transition risk is the financial loss resulting from the transition to a lower-carbon and more environmentally friendly economy and is mainly associated with firms with high greenhouse gas emissions.

Exceptions at one’s own risk

There are also important exceptions. The first is the exposure of a central bank to its own national government. The NBB, for example, has purchased a large share of debt securities from the Belgian state. The risk on this debt is not shared across the Eurosystem. Similarly, the Banca d'Italia does not share the risk from the Italian debt securities in its portfolio. Of course, without risk sharing, there can be no revenue sharing. This partly explains the differences in the bottom line of central banks in the Eurosystem.

This is by no means the only exception. For instance, when lending to commercial banks much depends on the quality of the collateral the central bank receives. If it meets the strictest quality requirements, the risk is shared. However, if the collateral falls under a still strict, but optional framework with more latitude, the risk is borne solely by the lending central bank.

In conclusion, we cannot correctly assess the financial risks to which the Bank is exposed by looking only at its balance sheet. To get the full picture, we need to look at the balance sheets of the other central banks in the Eurosystem as well. In doing so, we need to know which risks are shared and which are not.