Operation of the guarantee scheme (envelope, calculation of losses, etc.)

3.7 How big is the guarantee scheme?

There is provision for a sum of € 50 billion. This means that new additional loans up to that amount are eligible for the guarantee scheme. This figure concerns the capital sum of the guaranteed loans.

Lenders are free to either use the entire envelope allocated to them for this (first) guarantee scheme or to reserve up to 20% of the envelope for the second guarantee scheme (see Section 4 below).

3.8 How exactly does the guarantee scheme work?

All banks can include part of the envelope in new additional loans and credit lines up to a maximum term of 12 months in proportion to their market share in outstanding loans and credit lines (all loan terms) granted to viable non-financial businesses, SMEs, self-employed persons and non-profit organisations on 31 December 2019. This market share is ascertained on the basis of FINREP (table 20.04) and scheme A (table 02.11) reporting and notified to all institutions by an individual standard NBB letter.

The guarantee does not apply to individual loans but to the whole portfolio of new additional loans granted by the bank concerned to Belgian non-financial businesses, SMEs, self-employed persons and non-profit organisations.

Once the guarantee scheme ends, the amount of losses recorded on loans under the guarantee scheme will be examined.

3.9 How long does the guarantee scheme apply?

In terms of time, the guaranteed loans are those granted between 1 April 2020 and 31 December 2020 for a maximum term of 1 year. The first guarantee scheme initially guaranteed loans granted until 30 September 2020. This period was extended until 31 December 2020 by Royal Decree of 16 September 2020. The King may, by a decree adopted after consultation in the Council of Ministers, extend this deadline and term if that is necessary owing to the severity and duration of the adverse impact of the coronavirus on the economy.

3.9/1 The Royal Decree, which was published on 15 April 2020, applies to loans granted from 1 April 2020. What does this retroactivity mean for loans granted between 1 and 15 April 2020?

The Royal Decree applies to these loans as well. There are three possibilities:

- The loan falls outside the scope of the Royal Decree (e.g. reinstatement, refinancing etc.). No special action is required.

- The loan qualifies as a “guaranteed loan” within the meaning of Article 4, § 1 of the Royal Decree. Two options:

- Unless the bank deselects the loan in accordance with Article 4, § 1, 4°, the Royal Decree applies to the loan and the bank should, where appropriate, agree with the customer on an amendment to the loan agreement;

- The bank deselects the loan to exclude it from the guarantee scheme (see question 3.17 et seq. for further details). The choice to deselect may only be made at the time the loan is granted; as such a choice can only be made in casu from 15 April 2020, banks exceptionally will have until the first planned monthly reporting to deselect loans granted between 1 and 15 April 2020.

3.10 What is the impact on the allocation if banks refuse their share?

The system is compulsory for banks (credit institutions under Belgian law and branches of foreign credit institutions) which had more than € 20,000 in outstanding loans and credit lines to non-financial businesses, SMEs, self-employed persons and non-profit organisations on 31 December 2019.

3.11 When will the losses be calculated?

The total state-guaranteed reference-portfolio will only be known on 1 January 2021, so that, at that time, the final 3% and 5% thresholds can be calculated for each credit institution on the actual total amount of until 31 December 2020 granted loans of maximum 12 months to the before the crisis viable Belgian non-financial undertakings which do not constitute a refinancing or a reinstatement of credit granted before 1 April 2020 to those customers and which do not exclusively serve to finance the foreign activities of the undertaking concerned. This reference-portfolio may be lower than, or at most equal to, the share of the € 50 billion envelope allocated to each bank. From 1 October 2021, and thereafter on the first day of each successive quarter, a bank will be able to submit an application requesting an interim advance from the federal government.

3.12 What commitment has the federal government taken on?

The burden will be shared between the financial sector and the government as follows:

- The first 3% of the losses on the whole reference-portfolio will be borne entirely by the bank.

- For losses between 3% and 5%, the bank and the government will each bear 50% of the losses.

- For losses exceeding 5%, the government will bear 80% of the losses and the bank will bear 20%.

3.13 How exactly will the losses guaranteed by the government be calculated?

The losses will be calculated at the level of the total portfolio of new additional loans for each bank. In practice, this means that if bank X incurs a loss of 4 % on its total reference-portfolio, bank Y incurs a loss of 1% and bank Z a loss of 6%, then the guarantee will be activated for banks X and Z according to the losses suffered (50 % government guarantee for losses between 3% and 5%, and 80% for losses in excess of 5%).

3.14 Which banks are covered by the guarantee scheme?

The guarantee scheme applies to Belgian banks and branches of foreign banks (both those from EU countries and those with their head office in a non-EU country). Institutions which, at the end of 2019, did not have a credit portfolio for businesses, SMEs and non-profit organisations amounting to more than € 20,000 are not covered by the guarantee scheme (de minimis). This is without prejudice to the fact that those banks may be covered by the arrangements concerning payment delays for mortgage borrowers.

3.15 Which loans are covered by the guarantee scheme?

In principle, all new additional loans and credit lines to viable Belgian undertakings with a maximum term of 12 months granted by the bank between 1 April 2020 and 31 December 2020[1], including the credits which have been repaid before 31 December 2020 must be covered by the guarantee scheme (until the bank’s share in the total envelope is reached).

The following credits do not fall within the scope of the guarantee scheme:

- refinancing loans which serve to repay loans granted before 1 April 2020;

- reinstatements of credits granted before 1 April 2020;

- credits granted to persons where the contract states that they can exclusively be used for the non-Belgian activities of this person;

- credits which have been specifically identified by the bank as deselected credits, for which the bank opts to keep them out of the scope of the guarantee scheme (cf. infra);

- leasing contracts;

- factoring contracts;

- consumer loans and mortgage loans which are governed by Book VII of the Code of Economic Law.

Loans up to a maximum of € 50 million are guaranteed for each business or group of associated businesses (cf. definition of associated company in the Companies Code) on outstanding (reinstated and not repaid) or available (not taken up) amounts. The “rolling stock” principle is used for the calculation of this amount, which means that guaranteed credits which have been repaid partially or in whole before 31 December 2020 can be replaced by new guaranteed loans. For larger amounts, government approval must be obtained. The application procedure for the approval is governed by a Ministerial Decree of 29 April 2020.

[1] The first guarantee scheme initially guaranteed loans granted until 30 September 2020; this period was extended until 31 December 2020 by Royal Decree of 16 September 2020.

3.15/1 Should any financing related to working capital and working capital reconstitution always be provided under the federal guarantee and therefore in the form of a loan with a term of less than 12 months?

No. The federal guarantee applies to all eligible loans with a maximum term of 12 months, regardless of the destination of the funds provided (see questions 3.15 and 3.16). Longer-term financing, which may inter alia be related working capital, falls outside the scope of the guarantee scheme, but can, if necessary, benefit from other government support measures. It is certainly not the intention of the federal guarantee scheme to prevent such financing in the longer term. Article 24 of the Royal Decree of 14 April 2020 does contain an anti-avoidance provision if the duration of a loan apparently deviates from the practice followed by the lender before 29 February 2020 and the lender would not be able to justify this deviation on objective grounds.

3.16 Does the guarantee scheme apply to all loan products (cash loans, overdraft facilities, investment loans, documentary credits, etc.)?

The guarantee scheme applies to all new additional loans and credit lines to all before the crisis viable customers with a maximum term of 12 months, except for the credits mentioned in the answer to question 3.15, and taking account of the limit of € 50 million (per counterparty or group of related counterparties), above which government approval must be obtained.

3.16/1 Do loans of indefinite duration (e.g. cash loans, straight loans, credit openings) fall under the guarantee scheme or not?

Only if these loans can be terminated by the lender or borrower in the first twelve months after they have been granted. In this context, one can think, for example, of lines of credit granted for an indefinite period of time but which can be terminated by the lender on a discretionary basis, even if the borrower satisfies the contractual conditions regarding of solvency and liquidity.As regards termination clauses for other loans with an initial duration of more than 12 months, and more in general, reference can also be made to the anti-circumvention rules in Article 24 of the Royal Decree and the anti-abuse provision in Article 35, 4° of the Royal Decree.

3.16/2 Does the guarantee scheme cover loans for which there is no liquidity need e.g. guarantee loans, given the limitation of the guaranteed principal laid down in Article 8, § 1 of the Royal Decree of 14 April 2020?

For the purposes of Article 8, § 1 of the Royal Decree, the NBB assumes that it should always be possible to determine a liquidity need on the basis of which the loan is granted and that, pursuant to Article 4 of the Royal Decree, eligible loans are hence guaranteed by the State guarantee. For guarantee loans specifically, the liquidity needs can be filled in as “the need for commitments by the borrower underlying the granting of the bank guarantee”.

3.17 How many loans that are in principle eligible for compensation under the guarantee scheme may be identified by a bank as remaining outside the scope of the guarantee scheme (so-called 'deselected loans')?

Each bank may exclude up to a maximum of 14.875 rounded off to 15 % of the total loans granted from the scope of the guarantee scheme. In other words, of 100 eligible loans, a minimum of 85 must be included in the guarantee scheme and a maximum of 15 must not be included; hence the draft Royal Decree refers to a deselection factor, which divides the total 'deselected' loans by the total guaranteed loans granted between 1 April 2020 and 31 December 2020, of a maximum of 0.175 (i.e. around 15/85). For the calculation of these amounts, a duration-average volume ratio is applied. For an example to illustrate the calculation of the deselection factor, see question 3.20.

3.18 When should a bank choose to keep a loan that is in principle eligible for compensation under the guarantee scheme outside the scope of the guarantee scheme (so called "deselected loan”)?

The choice of whether or not to include a loan in the guarantee scheme is made exclusively when the loan is granted and is irrevocable. In this context, it is possible to grant both guaranteed and non-guaranteed loans to the same borrower.

3.19 Are the so-called "deselected loans" part of the reference portfolio based on which the amount of State aid is calculated?

Yes, they are. The deselected loans are not covered by the guarantee and the guarantee fee does not have to be paid, but the loans remain part of the reference portfolio together with the guaranteed loans. Moreover, if banks exceed the deselection factor of 0.175 (i.e. 'deselect' more than 14.875 rounded off to 15 % of the loans eligible under the guarantee scheme, an additional fee has to be paid on the guaranteed loans, while the deselected loans remain outside the scope of the guarantee scheme.

3.20 What is the sanction if the so-called 'deselected loans' represent more than 15 % of the reference portfolio?

On 31 December 2020, a deselection factor (exclusion factor) is calculated which is defined as a fraction with the following numerator and denominator:

- the numerator consists of the sum of the maximum available principal amount of each deselected loan on the date of granting, for all (deselected) loans granted from 1 April 2020 until 31 December 2020, multiplied in each case by a factor equal to the duration of the deselected loan, expressed in days. Deselected loans with a contractual maturity date prior to 31 December 2020 are also included in this numerator;

- the denominator consists of the sum of the maximum available principal amount of each guaranteed (not deselected) loan on the date of granting, for all guaranteed (not deselected) loans granted from 1 April 2020 until 31 December 2020, multiplied in each case by a factor equal to the duration of the guaranteed loan, expressed in days. Guaranteed loans with a contractual maturity date prior to 31 December 2020 are also included in this denominator.

If there is a positive difference between the deselection factor and 0.175, the guarantee fee due on the guaranteed (not deselected) loans is multiplied by a factor equal to one plus twice the aforementioned difference.

Example by way of illustration: a bank grants loans between 1 April 2020 and 31 December 2020 for a total amount of 100 on the date of granting:

- on 1 April, a deselected loan of 10 for a term of 30 days

- on 1 May, a loan of 30 for a term of 60 days

- on 1 June, a loan of 55 for a term of 120 days

- on 1 September, a deselected loan of 5 for a term of 360 days

Deselection factor = [(10 * 30) + (5 * 360)] / [(30 * 60) + (55 * 120)] = 0.25

In the above example, the reference portfolio on the basis of which the State's intervention is calculated is 100, even if the 'deselected' loans are not covered by the guarantee and the guarantee fee for these credits does not have to be paid. However, given that the deselection factor exceeds 0.175, the guarantee fee payable on the guaranteed (unselected) credits has to be multiplied by a factor of 1.15 (i.e. one plus twice the difference between the deselection factor of 0.25 and 0.175).

3.21 Can banks request additional securities for loans that were already running on 1 April 2020 or for so-called deselected loans?

Yes it can, provided that a proportional part of these securities, taking into account the available or outstanding principal amount of all loans concerned, is allocated to the secured loans granted by the bank to that borrower. If not, the guaranteed loss is reduced by all losses on the guaranteed loans granted by the bank to that borrower. A notable exception to this are contractual arrangements that were already in force between the bank and the borrower on 1 April 2020. These include margin calls or the conversion of mortgage mandates. In addition, the above condition does not apply to securities for new loans falling outside the scope of the guarantee scheme, e.g. investment loans with a maturity of more than 12 months.

3.22 Can businesses take on guaranteed loans of up to €50 million per bank without government approval?

No. The guarantee applies to the whole of the outstanding or available amounts on new and additional loans obtained from all Belgian banks up to a maximum of €50 million per business or group of associated businesses. If the aggregate outstanding or available amount of guaranteed new and additional loans exceeds that figure, government approval must be obtained and the bank therefore cannot take the decision alone.

3.22/1 What are the options for a loan application exceeding 50 million euro (e.g. 60 million euro)?

The general framework of the Royal Decree provides as follows:

- Article 4, § 1: The definition of “guaranteed loans” is not limited to “new money” loans of less than 50 million euro, so if a loan of 60 million euro is not “deselected”, it is considered a guaranteed loan in its entirety.

- Articles 7 and 8:

- a loan of > 50 million euro is guaranteed by the State only up to a maximum of 50 million euro...

- … unless a derogation is authorised by the Minister (Article 8, § 2)

- Result: losses on a loan of 60 million euro are (only) eligible for the portfolio guarantee for 5/6 of the loan

- Article 15: A loan of 60 million euro is taken into account in its entirety in the reference portfolio (so not only for 5/6) for the purpose of calculating the loss thresholds

- Article 27: The fee on a guaranteed loan of 60 million euro is not limited to the first 50 million euro

In this context, a bank that wishes to grant a loan of 60 million euro has the following options, among others:

- split the loan in 50/10 million euro and grant the loan of 10 million euro for a duration of more than one year without a discretionary termination clause, in which case the loan of 10 million euro is completely excluded from the guarantee scheme. In these circumstances, the fact that the loan of 10 million euro is granted for a duration of more than one year should not be considered circumvention behaviour as determined in Article 24 of the Royal Decree

- the borrower requests a derogation for a loan of > 50 million euro pursuant to Article 8, § 2, so the entirety of the loan of 60 million euro falls under the guarantee scheme; this derogation requires a request from the customer to the Minister and should be approved by a Royal Decree deliberated on in the Council of Ministers

- split the loan in 50/10 million euro and deselect the loan of 10 million euro (in which case the loan of 10 million euro is not guaranteed and there is no guarantee fee payable on it, but it is still taken into account in the reference portfolio)

- deselect the loan of 60 million euro in its entirety, in which case it is not guaranteed and there is no guarantee fee payable, but the loan is still taken into account in the reference portfolio

- simply grant the loan of 60 million euro, in which case the part which exceeds 50 million euro is not guaranteed but there is a guarantee fee payable on the entire 60 million euro and the entire loan is taken into account in the reference portfolio

3.23 Does the guarantee scheme also apply to syndicated loans?

Yes, insofar the distinct credit of the participating bank in the syndicate constitutes a sufficiently separated engagement. The guarantee scheme also does not apply to syndicated loans with a maximum duration above 12 months nor to deselected syndicated loans.

3.24 If there are also foreign banks in the syndicate, does the Belgian share still qualify for the guarantee?

Belgian banks in the syndicate are eligible for the guarantee for their share of the loan. The share of the banks concerned must constitute a sufficiently separate commitment per bank.

3.25 What about renewal of a loan/credit line already existing on 1 April and expiring before the end of September 2020?

That is a reinstatement of an existing credit/existing credit line which is not covered by the guarantee scheme.

3.26 Is it possible to submit multiple applications for the same counterparty under the guarantee scheme?

It is possible to grant multiple loans under the guarantee scheme; however, the guaranteed loan limit of € 50 million must be respected. The counterparty must state contractually whether the limit of € 50 million is not exceeded by granting this loan.

3.27 Can a bank give customers a new/higher credit line if they still have scope in their credit line?

Yes, the difference between the higher line (e.g. € 110,000) and the existing line (€ 100,000) is then a new loan that comes under the guarantee scheme. This new loan must then be structured as a separate new loan (of € 10,000, for example) with additional security where possible.

3.28 Can a customer request a new loan or credit line while still having unused scope under an existing credit line?

Yes, it is up to the bank to decide whether or not to grant it. However, the drawings on the existing credit line do not fall under the guarantee scheme.

3.29 Can a bank refuse to grant loans or credit lines to certain customers?

Yes, in the case of new additional loans or credit lines in relation to the amount of loans and credit lines outstanding on 1 April 2020. The guarantee scheme aims at facilitating the granting of new additional credits or credit lines.

3.30 Do loans qualify if they are not used in connection with liquidity problems due to the crisis but are requested for other liquidity or investment needs?

Yes, all new additional loans that meet the conditions (viable customer, maximum term of 12 months, limit of € 50 million), with the exception of the loans mentioned in question 3.15, must be covered by the guarantee scheme.

In this respect, a clear distinction has to be made between the amount of loans/credit lines on 1 April 2020 (=OLD MONEY) and the additional liquidity needs of the customers (=NEW MONEY).

Specifically:

- If the new loan is used to repay (= refinancing) or reinstate a loan or credit line outstanding at the date of entry into force of the guarantee scheme that has reached maturity, it does not fall under the guarantee scheme, regardless of whether the borrower encounters payment difficulties due to the corona crisis (= OLD MONEY)

- if the new loan is also used to cover additional liquidity needs, it falls under the guarantee scheme, regardless of whether the borrower faces payment difficulties as a result of the corona crisis (=NEW MONEY). Banks are free to grant a limited amount of such credits with a term of maximum 12 months outside the scope of the guarantee scheme (“deselected credits”).

Example: on 1 April 2020, a company has outstanding loans amounting to 100, 50 of which will mature on 1 May 2020,

- a company that has not (or only slightly) been affected by the corona crisis applies for a new loan with a term of maximum 12 months of 60 => 50 does not fall under the guarantee scheme, 10 falls under the guarantee scheme,

- a company that has been affected by the corona crisis benefits from a payment deferral for 50 (moratorium) and applies for a new credit with a term of maximum 12 months of 10 => 10 falls under the guarantee scheme, unless the bank has chosen to “deselect” the credit and to grant it outside the scope of the guarantee scheme.

3.30/1 May normal repayments of both capital and interest of loans granted before 1 April 2020 be included in the simulator-based liquidity assessment ? Are loans taken out to service these repayments covered by the State guarantee?

It should be noted that, if the loan amount is less than double the total annual wage costs, including social charges, or less than 25% of the borrower’s turnover in the last closed financial year, liquidity needs do not necessarily have to be taken into account for granting a loan under the second guarantee scheme, as a result of the amendment of art. 8, §1, 2° of the Royal Decree of 14 April 2020 by art. 5, b) of the Royal Decree of 16 September 2020, which entered into force on 28 September 2020.

If they are nevertheless taken into account, Article 8, § 1, 2° of the Royal Decree of 14 April 2020 limits the guaranteed principal to the amount of the borrower's liquidity needs, other than for refinancing loans taken out to repay or reinstate loans granted before 1 April 2020. The financing of repayments of a loan granted by the same or another lender prior to 1 April 2020 qualifies as a refinancing loan within the meaning of Article 1, 13° of the Royal Decree regulating the State guarantee, falls outside the guarantee scheme and may therefore not be included in determining the liquidity needs under Article 8 of the Royal Decree. The reason is that a guaranteed loan is not intended to be used to repay an existing loan (OLD MONEY). Moreover, if the conditions of the Business Loan Charter are met, (capital) repayments are eligible for deferral of payment.

On the other hand, the lender should identify the overall liquidity needs of the borrower in order to be able to correctly assess the risks. However, the lender may include repayments of loans granted before 1 April 2020 in this exercise without, however, including them in determining the liquidity needs under the (specific) framework of Article 8 of the Royal Decree. Therefore, for the purposes of determining the amounts covered by the guarantee scheme (NEW MONEY), the repayments are best treated separately in the liquidity simulator.

3.30/2 Should the maximum guaranteed principal of the guaranteed loans granted to a borrower be assessed at group level, and can the borrower thus borrow in excess of his liquidity need at solo level as long as this falls within the limits of the maximum

Yes. The EU Temporary Framework establishes conditions and thresholds applying to the “beneficiary” of the aid, i.e. the “undertaking” to which the aid is granted. The notion of “undertaking” encompasses all entities controlled by the same natural or legal person (for further explanation see Commission Consolidated Jurisdictional Notice under Council Regulation (EC) No 139/2004 on the control of concentrations between undertakings, OJ C 95, 16.4.2008, p. 1).

For example: A, B and C form a group. A has a liquidity need of 40, B of 10 and C of 50. Thus, the maximum guaranteed principal for the group is 100.

The maximum guaranteed principal for which A can take out loans under the guarantee scheme is not limited to 40 (which is its actual liquidity need), but to 100. However, if A were to take out a loan for 60, this would limit B and C’s collective credit possibilities to 40. Naturally, the general principles of creditworthiness and the economic interest of the borrower should be taken into account.

3.30/3 What is the maximum amount that can be granted to a borrower under the first guarantee scheme?

The guaranteed principal of the guaranteed loans granted to a borrower may not exceed the highest of the following amounts, calculated at the level of the group to which the borrower belongs:

1° the borrower’s liquidity needs during a period (starting from the intended date of the granting of the guaranteed loan) of 18 months for SMEs within the meaning of Regulation No 651/2014 and 12 months for other enterprises, as estimated by the borrower in a duly reasoned written statement;

2° the double of the borrower’s total annual wage costs, including social charges, in the last closed financial year;

3° 25 % of the borrower’s turnover in the last closed financial year.

Points 2° and 3° above were added to art. 8, §1, 2° of the Royal Decree of 14 April 2020 by art. 5, b) of the Royal Decree of 16 September 2020, which entered into force on 28 September 2020.

The resulting maximum guaranteed principal should be reduced by the principals of the loans granted to the borrower or other companies belonging to the group of the borrower under the second guarantee scheme.

3.30/4 Does the term "wage cost" as referred to in Article 8, § 1, 2° of the RD of 14 April 2020 also include the remuneration of the manager?

Yes, it may be taken into account insofar as it concerns a remuneration (this in contrast to payments for capital, which may not be counted).

3.31 Can a bank grant new loans which are not covered by the guarantee scheme?

Yes, the credits enumerated in question 3.15, as well as new additional loans for a term of longer than 12 months or in excess of the € 50 million limit.

3.32 If the bank wants to consider delays on a due date or multiple due dates jointly on loans already outstanding on 1 April 2020 and group them in the form of a new loan, is this refinancing or not?

Yes, that is refinancing which is not covered by the guarantee scheme.

3.33 Does the guarantee scheme also apply to existing loans?

No. The guarantee scheme does not apply to the on 1 April 2020 existing loans, nor to the unused amounts on the on 1 April 2020 existing credit lines.

3.34 Can the guarantee scheme still be used if a customer requests a forbearance measure but the bank consequently decides to classify the customer under pre-litigation in order to monitor the case?

Yes, but only for new additional loans to that customer (in addition to loans and credit lines outstanding on1 April 2020), see scope.

3.35 How does the “recovery” take place in case a guaranteed loan cannot be repaid by the customer?

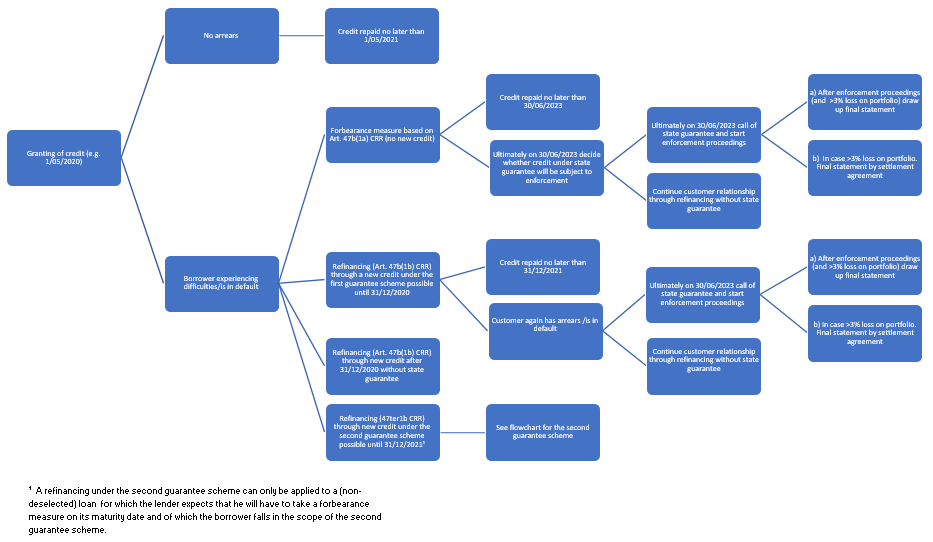

Banks must call on the State guarantee by 30 June 2023 at the latest for the guaranteed loans, and this independently of the date of granting or the duration of the loan. Only then should a decision be taken as to whether or not to terminate the customer relationship. In the meantime, forbearance measures can be taken. The diagram below gives an overview of the various possibilities

3.35/1 If a forbearance measure is a deferral of payments (e.g. in the form of a repayment schedule, extension of the initial loan or otherwise) on the guaranteed loan, are the parties bound by the maximum period of the guaranteed loan (12 months under th

3.35/1 If a forbearance measure is a deferral of payments (e.g. in the form of a repayment schedule, extension of the initial loan or otherwise) on the guaranteed loan, are the parties bound by the maximum period of the guaranteed loan (12 months under the first guarantee scheme)?

No, the maximum period of 12 months does not apply here. Please refer to the schedule as included in question 3.35: a forbearance measure can only be granted up to the last date on which the State can be called upon to honour the State guarantee. This last date is 30 June 2023 for the first guarantee scheme.

3.35/2 Is an additional premium payable by the borrower if a forbearance measure is a deferral of payments (e.g. in the form of a repayment schedule, extension of the initial loan or otherwise) on the guaranteed loan?

No. If the borrower is unable to repay the loan on the contractual maturity date, the authorised payment deferral must be regarded as a forbearance measure within the meaning of Article 47b(1)(a) of Regulation (EU) No 575/2013 and no additional premium is due. In this case, however, the requirements of Article 22, 1° Royal Decree of 14 April 2020 must be taken into account (see question 3.35/3).

3.35/3 How should the "proportionate application" of forbearance measures (taking into account the available or outstanding principal and the maturity date) be understood exactly (Article 22, 1° Royal Decree of 14 April 2020)?

“Proportionate application” means that, if a forbearance measure is granted in the form of a deferral of payments on a guaranteed loan, the other loans not covered by the State guarantee should also benefit from a payment deferral for at least the same period.

For example, if a forbearance measure is granted for a guaranteed loan, in the form of a payment deferral (e.g. repayment of a 6-month loan postponed by 6 months), all other current loans must also benefit from a deferral for the same period of at least 6 months (e.g. a 5-year investment loan must also benefit from a deferral of at least 6 months).

If there are other current loans covered by the State guarantee, the proportional payment deferral has no impact on the maintenance of the State guarantee.

For example, for a loan granted under the first guarantee scheme with a contractual term of 12 months, a payment deferral of 6 months is granted. Suppose that the same borrower also has a current loan with a contractual term of 36 months covered by the second guarantee scheme. By granting a 6-month deferral of payments on the guaranteed loan under the first guarantee scheme, the loan covered by the second guarantee scheme must also benefit from a 6-month payment deferral (in accordance with the principle of proportionality), thereby exceeding the initial repayment period of 36 months. However, this extension of the repayment period pursuant to a forbearance measure for a loan covered by the State guarantee under the first guarantee scheme does not result in the loss of the State guarantee for the loan covered by the second guarantee scheme.

3.35/4 Does the proportional application referred to in question 3.35/3 apply to any forbearance measure, including, for example, refinancing?

No. The principle of proportionality only applies to the forbearance measures referred to in Article 47b(1)(a) of Regulation (EU) No 575/2013.

3.36 When it is decided to terminate the customer relationship and to call on the guarantee, what should a bank do to ensure that the losses relating to the guaranteed loans are taken into account in calculating the State guarantee (enforcement privilege)

The bank will first have to "enforce" the customer (i.e. draw on all of the customer's funds, collateral, guarantees, etc.) before the residual amount can be considered as a loss for calculating the State guarantee. This enforcement does not have to occur or be finalised at the moment that the State guarantee is called on.

3.37 Can a bank transfer one or more guaranteed loans?

In principle it cannot, except as collateral for any financing granted to a bank by the National Bank of Belgium in the context of its legal mission.

3.38 How do the different guarantees provided by the Regions and the federal State interact?

Clarification with an example:

A retail business has an outstanding loan of € 500,000 with the bank, with a total interest rate (incl. fee) of 1.5%. This is the only outstanding loan of the borrower with the bank. The term of the loan is 1 year and interest is paid at the end of the year. This loan complies with the conditions of the federal guarantee scheme and was not deselected. When the loan was taken out, the commercial property was also included in the guarantee. The (realisable) value of the property is estimated at 150,000. If the retail business goes bankrupt, there will still be €10,000 cash in the bank and the business owns a van worth €10,000.

Case (a): no other (e.g. regional) guarantees were provided for this loan. In this case, the loss is determined by first liquidating all of the business’s assets (including the cash, the van) and by selling the trading premises. The estimated value thereof is € 170,000. The remainder of the amount (principal of the loan plus interest) € 500,000*(1 + 1.5%) - € 170,000 = € 337,500 is included in the "loss" taken into account on the basis of the first paragraph of Article 14 of the R.D. when applying the State guarantee to the loan portfolio of the bank in question. Whether this loss will ultimately be (partially) compensated by the State depends on whether the losses of the total portfolio of the bank exceed 3% (first loss) of the bank's reference portfolio.

Case (b): The loan also benefits from a regional guarantee (without pari passu clause) covering a loss of €100,000. In this case, the loss is determined by first liquidating all of the business's assets (including the cash, the van), and by selling the trading premises. Subsequently, the regional guarantee is called on for the full amount of the losses covered. The estimated recoverable value amounts thus to €170,000 + €100,000. The amount that cannot be recovered by the bank, namely € 500,000*(1 + 1.5%) - € 170,000 - € 100,000 = € 237,500, is included in the "loss" taken into account on the basis of the first paragraph of Article 14 of the R.D. when applying the State guarantee to the loan portfolio of the bank in question. Whether this loss will ultimately be (partially) compensated by the State depends on whether the losses of the total portfolio of the bank exceed 3% (first loss) of the bank's reference portfolio.

Case (c): The loan also benefits from a regional guarantee (with pari passu clause) covering a loss of €100,000. In this case, the loss is determined by first liquidating all of the business's assets (including the cash, the van) and by selling the trading premises. We assume that the pari passu qualification of the guarantee granted by the Region makes it clear that this guarantee is reduced by half as a result of the fact that the guaranteed loss of € 100,000 can also be covered within the framework of the bank's portfolio guarantee. In this case, the Region will not reimburse €100,000 on the basis of the guarantee, but only €50,000. Article 14, second paragraph of the R.D. stipulates that the amounts that cannot be recovered from the Regions because of the pari passu clause (in this case €50,000) will be included in the loss. The estimated recoverable value amounts thus to €170,000 + € 50,000. The remainder of the amount € 500,000*(1 + 1.5%) - € 170,000 - € 50,000 = € 287,500 is included in the "loss" taken into account on the basis of the first paragraph of Article 14 of the R.D. when applying the State guarantee to the loan portfolio of the bank in question. Whether this loss will ultimately be (partially) compensated by the State depends on whether the losses of the total portfolio of the bank exceed 3% (first loss) of the bank's reference portfolio.

Case d): The loan also benefits from a regional guarantee covering a loss of € 100,000 and an additional Credendo guarantee of € 50,000 (both with pari passu clause). In this case, the loss is determined by first liquidating all of the business's assets (including the cash, the van) and by selling the trading premises. We assume that the pari passu classification of the guarantees granted by the Region and Credendo make it clear in each case that these guarantees are proportionally reduced as a result of the fact that part of the guaranteed loss can also be covered within the framework of the bank's portfolio guarantee. Such pari passu arrangements involve a pro-rata allocation of the losses between the different parties. With regard to the first loss tranche of € 50,000, the pari passu clauses stipulated by the Region and Credendo have the consequence that they each reimburse a loss of only € 16,666.66. For the second loss tranche of € 50,000, the pari passu clause in the guarantee of the Region has the consequence that the Region will only pay € 25,000. Pursuant to Article 14, second paragraph of the R.D., the amount that cannot be recovered from the Region or Credendo because of the pari passu clauses is included in the loss. The estimated recoverable value is thus € 170,000 + 2* € 16,666.66 + € 25,000. The remainder of the amount € 500,000*(1 + 1.5%) - € 170,000 - 2* € 16,666.66 - € 25,000 = € 279,170 is included in the "loss" taken into account on the basis of the first paragraph of Article 14 of the R.D. when applying the State guarantee to the loan portfolio of the bank in question. Whether this loss will ultimately be (partially) compensated by the State depends on whether the losses of the total portfolio of the bank exceed 3% (first loss) of the bank's reference portfolio.