War, inflation and the energy crisis: is financial stability in jeopardy?

In its capacity as the Belgian banking supervisor, the National Bank closely monitors new developments that could undermine financial stability in our country. It also ensures that the financial sector continues to fulfil its role in the economy and society. As far as direct repercussions of the war in Ukraine for the financial sector are concerned, the Bank’s recently published Financial Stability Report is reassuring: the direct consequences are limited, although there could be indirect consequences.

Rising energy prices could indirectly impact banks

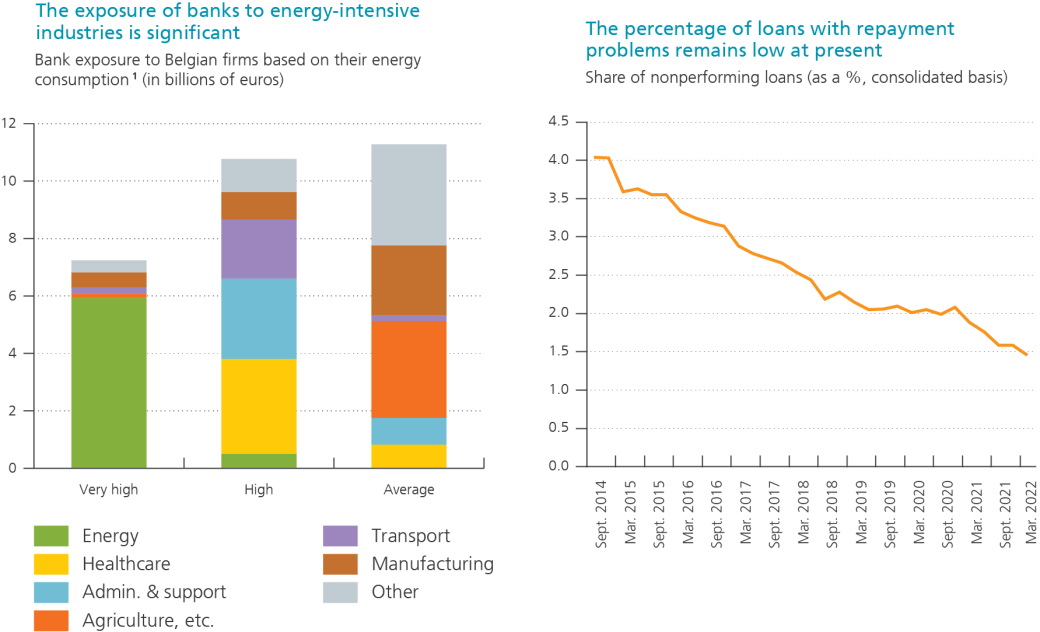

As a result of the Russian-Ukrainian conflict, energy and commodity prices have soared. Energy-intensive sectors are likely to suffer the most, with the possibility of knock-on effects on banks, many of whose credit portfolios include businesses in such sectors (see Figure 1, left chart).

Higher energy bills could also make it more difficult for households to meet their loan payments.

Fortunately, our figures indicate that this is not the case at present (see Figure 1, right chart).

Even if defaults and delinquencies were to rise, the financial sector has sufficient capital buffers (larger than those required by supervisors) to absorb them, as evidenced by its ability to withstand the coronavirus crisis.

The NBB expects the financial sector to provide proactive support to borrowers experiencing payment difficulties, as it did during the coronavirus crisis.

The NBB states in its report that it expects the financial sector to provide proactive support to borrowers experiencing temporary or structural payment difficulties, as it did during the COVID-19 crisis. During the pandemic, this support prevented an increase in borrower defaults. In other words, the NBB is telling banks that they should draw lessons from the crisis and continue to apply a formula that clearly works.

Targeted measures for the real estate sector

The residential property market is extremely important to the Belgian financial sector since mortgage loans make up a large share of its activity. In recent years, household debt levels have risen significantly, along with housing prices. The NBB closely monitors these developments given that a marked increase in mortgage repayment problems could undermine financial stability.

Specifically, the NBB has promoted two targeted measures to help preserve financial stability.

1. Limitation on (mortgage) loans with a low down payment

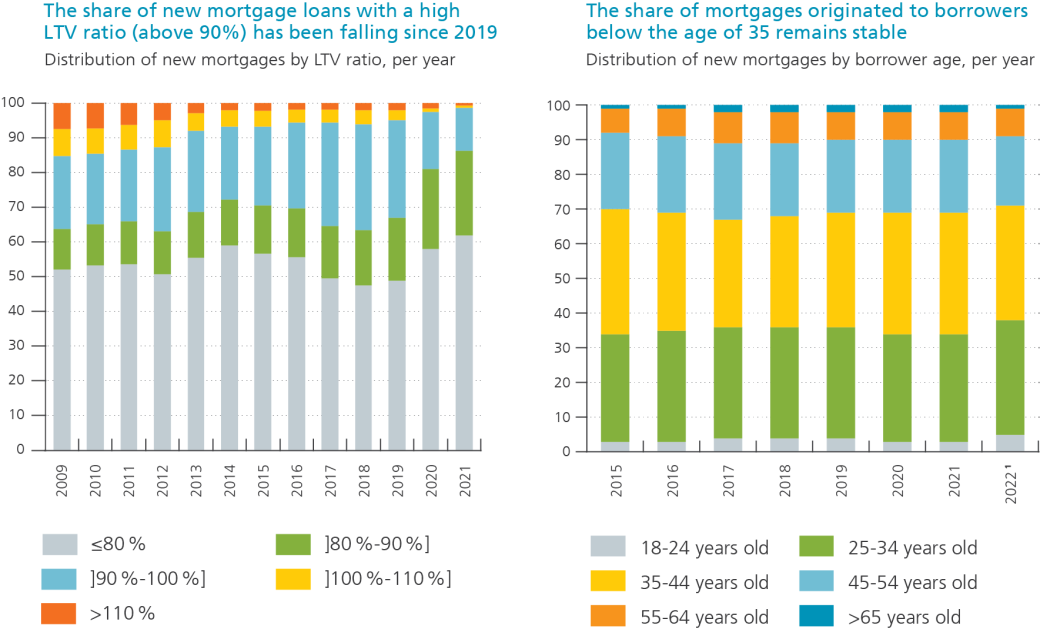

Since early 2020, the NBB has advised banks (and other credit providers) to limit the number of loans with a high loan-to-value (LTV) ratio. This ratio expresses the percentage of the purchase price to be financed by the loan. The higher the borrower’s down payment, the lower the loan-to-value ratio. This advice was followed and, consequently, the percentage of loans with an LTV ratio above 90% has been falling since 2019 (see Figure 2, left bar chart).

Our figures show that access for young people to the housing market has remained stable despite this measure (see Figure 2, right bar chart), which was also an express objective. The key to this success lies in the decision to allow banks to exercise more discretion in the origination process for mortgages to first-time homeowners. For such borrowers, banks can accept a higher LTV ratio (and thus a lower down payment). It should be noted that banks have not taken full advantage of this leeway.

This measure has reduced the risk to which banks are exposed while ensuring access to credit. In the current uncertain economic climate, the NBB believes it should be maintained.

2. Capital requirement

For the past ten years, the NBB has required banks to build up additional capital buffers in the event of problems affecting their mortgage portfolios. If defaults were to rise sharply, the NBB could decide to relax this requirement, so that banks would be able to use the excess reserves to support struggling borrowers, for example by granting a mortgage deferral. The need to do so has not yet arisen, however. Therefore, the capital requirements remain in place for the time being.

Energy efficiency

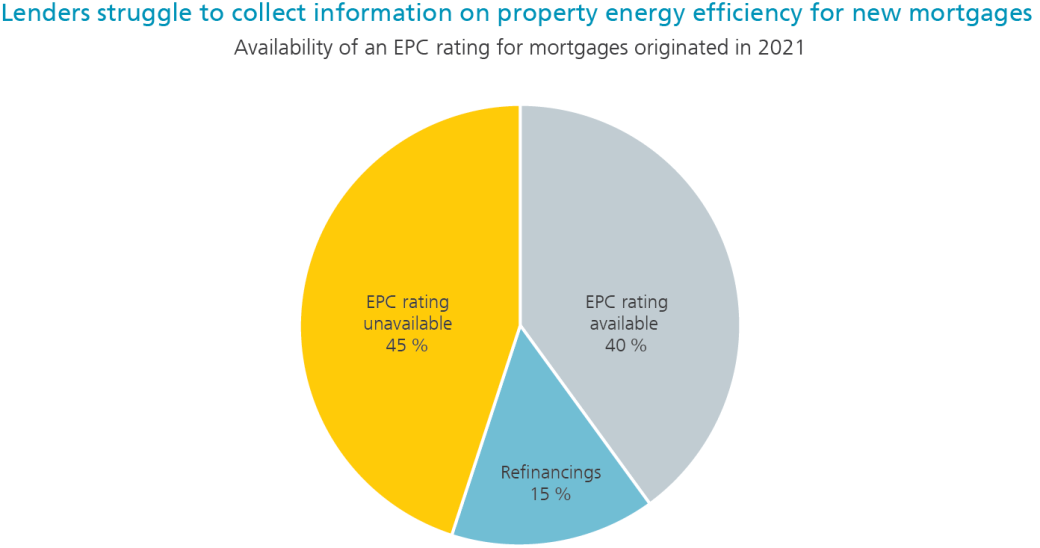

In addition, since 2021, lenders have been required to collect information on the energy efficiency of properties financed by mortgage loans (usually in the form of an energy performance certificate or EPC). If the lender cannot obtain this information from an official source, it must request it from the borrower.

The current and future energy efficiency of a residential dwelling is indeed a factor taken into account by banks when originating a mortgage and will only become more important in the future.

That being said, it should be noted that the data collected thus far are still incomplete and insufficient (see Figure 3). Therefore, the NBB expects the sector to make additional efforts in this area.

Would you like to know more?

The topics discussed above are covered in more detail in the National Bank’s Financial Stability Report 2022.