Mapping the payment behaviour of Belgians

Consumers are using cash less and less and paying more by electronic means, according to a recent ECB study. A few mouse clicks or taps on a smartphone, and a payment is done. But these simple actions mask a complex network of payment service providers: banks, payment institutions and e-money institutions.

A few mouse clicks or taps on a smartphone, and a payment is done. But these simple actions mask a complicated network of payment service providers.

The National Bank ensures smooth and secure payments and closely follows developments in payment systems and instruments. The volume of payment statistics it collects has increased tremendously since 2022. These data provide insight into how, where and to whom Belgian residents, businesses and public authorities make payments. It should be noted that they do not cover cash payments, for which no record is kept by payment service providers. Cash withdrawals and deposits, on the other hand, are included.

The data tell us that in the first half of 2022, Belgian residents, businesses and public authorities engaged in more than 2.5 billion payment transactions (including cash withdrawals), with a total value of around €4 000 billion.

Card payments in first place

In the first half of 2022, card payments represented more than half of all payments in volume terms, followed by credit transfers (almost a third) and direct debits (around one in 10). Based on the value of payments, however, transfers accounted for more than 90 percent. This is because card payments are, in many cases, subject to a limit and used primarily by individuals. Transfers, on the other hand, are mainly used for larger amounts, with businesses paying their invoices in this way. They therefore contribute much more in value terms.

New payment methods

We expect ‘new’ payment methods such as mobile P2P transfers, contactless payments and instant transfers to become the ‘new normal’.

The payments statistics also provide insight into more recent trends in payment transactions:

- The number of transfers from a mobile device (smartphone or tablet) is growing, but the number of person-to-person (P2P) transfers (in Belgium, mainly via Payconiq) remains limited.

- More than half of card payments at retail establishments or merchants are contactless, meaning the card or smartphone does not physically touch the payment terminal.

- Instant transfers, by which the payment is received on the beneficiary’s account within seconds, are relatively new but already account for almost one in 10 transfers.

These ‘new’ payment methods are currently used for relatively small amounts, but we expect them to gain importance in the coming years and to become the ‘new normal’.

Facial and fingerprint recognition

Technology is constantly evolving, and payments are getting easier and easier. That’s why it’s crucial to have secure and reliable payment systems. In a previous blog post our colleague Reinout Temmerman explained what is meant by strong customer authentication (SCA) and how it helps reduce payment fraud. SCA involves identifying oneself when making a payment, for example by entering a PIN or card reader code or by means of facial recognition or electronic fingerprint recognition.

Most card payments and credit transfers make use of SCA. This helps reduce payment fraud.

The statistics reveal, for each means of payment, the number of payments made with and without SCA. The latter concerns, for example, small payments or those made to trusted beneficiaries. In the first half of 2022, more than 80 percent of the value of card payments and credit transfers involved SCA. This probably explains why there are so few incidents of payment fraud for these means of payment.

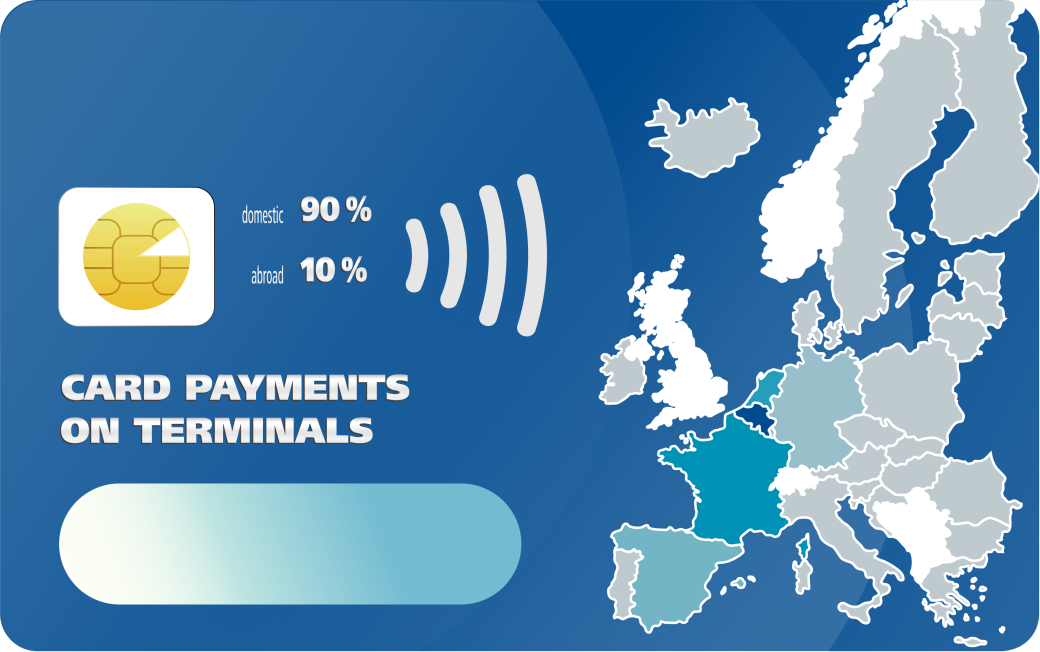

From the Costa del Sol to the après-ski bar

Of course, Belgian residents don’t make payments only in Belgium. When you use your credit card (or a relative’s) to shop in Maastricht, withdraw cash at the Costa del Sol or pay with your mobile phone at an après-ski bar, these transactions are also included in the payments statistics. Moreover, the data collected indicate the location of the beneficiary.

For example, in the first half of 2022, 90 percent of card use at POS terminals was in Belgium. The remainder consisted of purchases abroad. Unsurprisingly, France, the Netherlands and Spain were the most common foreign countries for card payments by Belgian residents in the first half of 2022.

More information

The NBB has been collecting and publishing statistics on payment transactions by Belgian residents, businesses and public authorities for some time. The ECB collects payment statistics from the European Union central banks and makes them available in its Statistical Data Warehouse.

The new payment statistics will be published in the fall.