Households save a large chunk of energy aid

The explosive growth in energy prices has prompted the government to support households. To find out more about the impact of these measures, we examined how households react to an increase in their energy bills and the aid introduced by the government to help mitigate the effects of higher energy prices.

We gauged these effects using the National Bank of Belgium's consumer confidence survey. In May, June and July, we added several questions to the survey. First, we asked about households' monthly energy bills. We then asked them to assume that a price change caused their bill to fluctuate by a certain amount at constant consumption. This amount varied randomly from family to family, ranging from a decrease of €50 to an increase of €20, €50 or €100. Next, we asked how the household would adjust its energy consumption, other expenditures and saving due to the price change. Finally, we checked whether there was a correlation between these responses and household characteristics such as age and net income.

Price reductions fuel savings

One of the parameters we measured was the marginal propensity to consume (MPC) after payment of the energy bill. This parameter indicates how an increase or decrease in disposable income affects consumption. An MPC of 80%, for example, means that if a household’s disposable income increases by €100, it will spend €80 of this amount and save €20.

Figure 1 shows the MPC for the four tested scenarios. For energy price increases, households absorbed the drop in disposable income by cutting back by about 60% on other expenditures and saving about 40% less. For larger price increases, the shock was absorbed slightly more through saving.

However, when the energy bill became cheaper due to a fall in prices as the result, for example, of a VAT reduction, the MPC was much lower, around 40%. In other words, a €100 increase in disposable income led to only a €40 rise in consumption. It thus appears that household consumption expenditure reacts more strongly to an increase in the energy bill than a decrease.

Several household characteristics have been found to affect MPC, especially when a price increase causes a decline in disposable income. We found that, in this case, consumption drops more noticeably in households with low income, little savings and greater financial uncertainty. Furthermore, consumption falls even more sharply when the head of the household is a woman, but households adjust their consumption less if they had already planned to spend more in the coming year.

In the scenario of a price drop, only households with little savings and those with members above the age of 65 appeared to increase their consumption. In the latter case, the increase may be attributable to the fact that this group has fewer reasons to save for future spending than younger households.

Questioning the effectiveness of energy aid

For policymakers, it is important to know how the MPC varies across households as this parameter determines to what extent energy aid translates into consumption expenditure. In short, when such aid is provided to households with a high MPC, it will effectively boost the economy. The opposite is true, however, for energy aid to households with a low MPC. In that case, the additional money will mainly be saved.

When governments can successfully funnel energy aid to households with a high MPC, such support measures have been shown to be very effective in stimulating the economy.

Let us now look at two different household profiles, financially vulnerable households with low income and savings and a precarious financial future, on the one hand, and financially secure households with high income and savings and an easily predictable financial future, on the other hand.

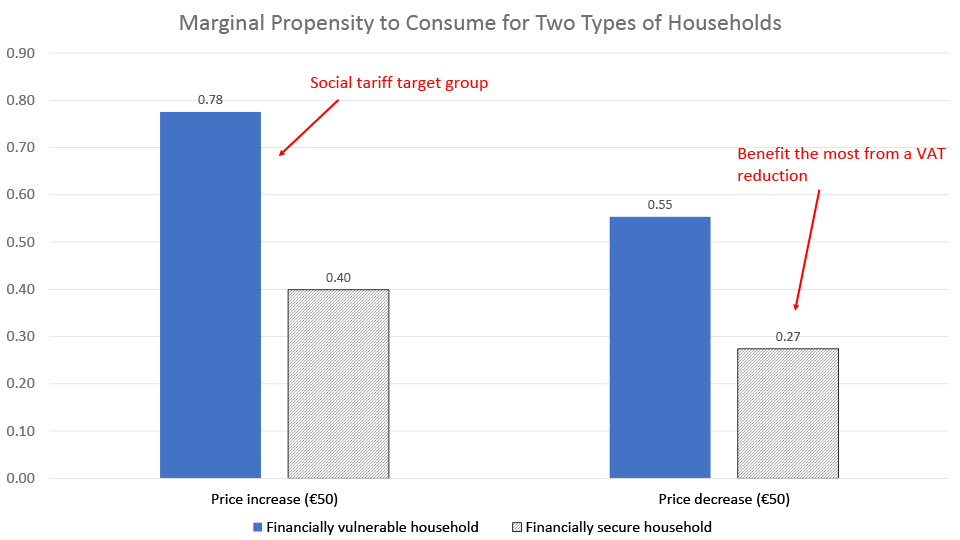

Figure 2 illustrates the MPCs for these two types of profiles. It is striking how much they differ. Across the board, the MPC of financially secure households is about half that of financially vulnerable households. Moreover, the MPC of financially secure households is below 0.5, meaning they absorb fluctuations in disposable income (due to an energy price shock) mainly through savings behaviour. Financially vulnerable households, on the other hand, are more likely to do so through consumption expenditure.

These findings reveal that the government's aid measures have different effects. For the reduction of VAT, from 21% to 6%, on gas and electricity for all households, we found that the average household saves the bulk of the increase in disposable income, as the MPC is 40% (see Figure 1). What's more, Figure 2 shows that financially secure households allocate barely 27% of the increase in disposable income to other expenditures and save the rest. Since these households benefit the most from a VAT reduction as they have higher energy bills on average, this measure does very little to shore up the economy.

Social tariffs more effective in stimulating consumption expenditure

The opposite is true for social tariffs, however. Households that qualify for the social tariff, including the extension thereof in May 2021, have seen their energy prices increase much less over the past year than others. Since we did not know which specific households that responded to the survey were eligible to receive the tariff, we assumed financially vulnerable households could claim it. Three-quarters of the benefit (78%) translated into other consumption expenditures, and only 22% was saved, meaning social tariffs appear to be effective in stimulating household consumption.

More information on this topic, including the results of our study, can be found in our working paper, an abridged version of which was published in Gentse Economische Inzichten (in Dutch).