Self-employed and smaller firms continue to be hit the hardest by coronavirus crisis

The loss of turnover incurred by Belgian firms as a result of the coronavirus crisis is still running at 10 %, quite similar to January’s result, taking account of certain changes in methodology. Companies are not expecting any significant recovery before 2022, even though the loss of turnover is likely to be even higher for the hardest-hit sectors. This is the main conclusion to be drawn from the latest ERMG survey among Belgian firms. The survey also touches on rent payments and access to credit. In the worst-affected industries, half of all businesses renting property have seen their rent delayed or have not paid all their rent. Moreover, many self-employed people and small businesses, just like respondents from the hardest-hit sectors, flagged up serious difficulties in getting bank loans.

A new survey was conducted last week by several federations of enterprises and self-employed people (BECI, NSZ/SNI, UCM, UNIZO, UWE and VOKA). The initiative is coordinated by the NBB and the FEB/VBO. This was the eighteenth round of a survey conducted since March 2020, the objective of which is to gauge the impact of the coronavirus crisis and the lockdown restrictions on economic activity and on the financial health of companies. In total, 3 194 companies and self-employed people responded to this week’s survey, which is less than in the previous survey.

Any comparison of the findings of the February survey with those of previous surveys should be interpreted with a degree of caution because the composition of the sample is a bit different this time[1]. In effect, the respective shares of Wallonian respondents and self-employed people are much lower this week, while those of Flemish respondents and medium-sized enterprises are considerably higher. As these latter categories of respondents are, on average, less affected by the coronavirus crisis, the slight improvements observed in the survey findings on the previous survey are probably more a sign of a stable situation.

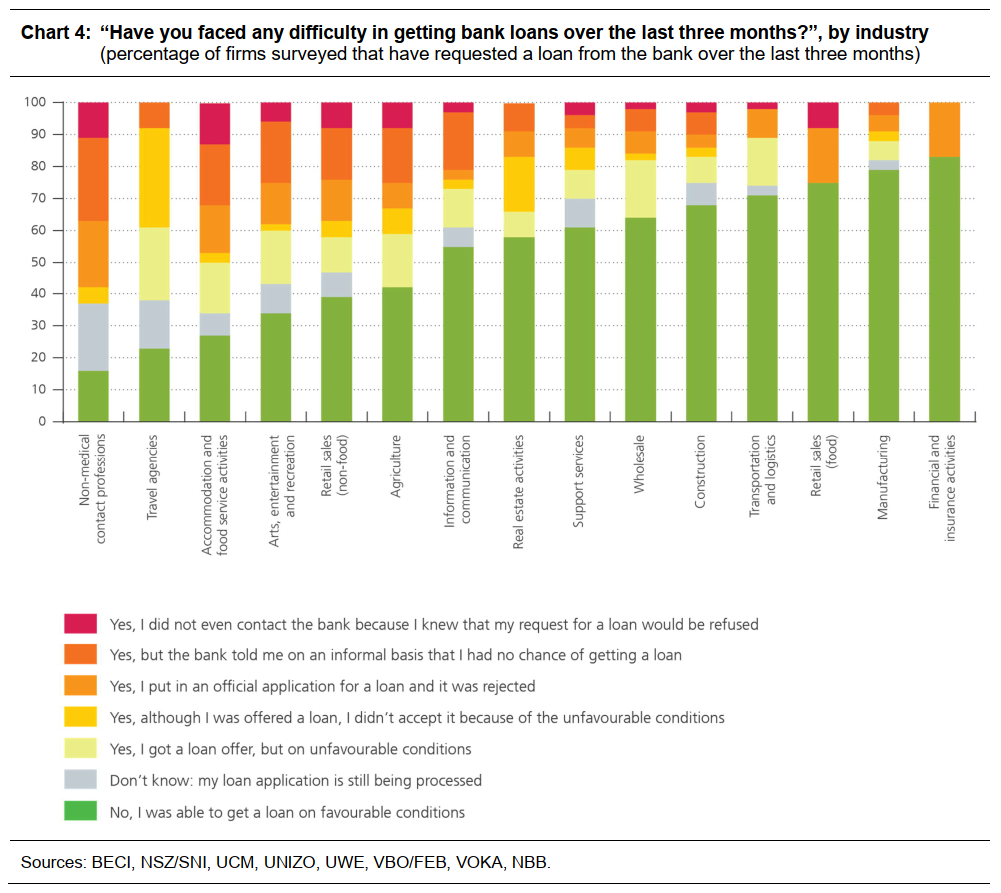

Belgian firms point to a 10 % drop in their turnover in February

Taking account of company size and sectoral value added, firms surveyed this week mentioned a 10.3 % reduction in their turnover from the norm.

The scale of the improvement, of around 2 percentage points on January, should nevertheless not be overstated, on the one hand because of the change in the composition of the sample mentioned above, and on the other hand, because of a more precise estimate of turnover losses below 20 % in the February survey[2]. Consequently, our analysis suggests that the real average loss of turnover of Belgian firms has remained relatively stable compared with January. This was expected given that the restrictions and the health situation have not changed much since then.

[1] The ERMG survey is based on the opinions of the firms taking part. Comparison of the survey results over time should be interpreted with a degree of caution because the firms questioned vary from one survey to the next. On the one hand, the federations conducting the surveys of their members may not be the same. On the other hand, firms do not systematically take part in every survey. Although any over-representation in the sample of firms from certain sectors is corrected, it is possible that the firms polled may vary according to other characteristics as time goes by.

[2] In the February survey, the multiple choice questions on loss of turnover were refined in the case of replies reporting a turnover loss of between 0 and 20 % (by replacing it with sub-categories of “0 to 5 %”, “from 5 to 10 %” and “from 10 to 20 %”). This refinement shows that the previously formulated assumption of an average loss of turnover of 10 % or the reply to this question may have been an overestimation.

As in previous surveys, self-employed people and small businesses report a much higher impact of the coronavirus crisis on turnover than for larger firms. On average, the self-employed point to a loss of almost 42 % on normal levels, while the loss comes to 7 % on average for larger companies[1]. One consequence of this gap is that concern among the self-employed and small businesses has remained higher. Measured on a scale of 1 (low concern) to 10 (high concern), the indicator gauging the degree of concern has reached 6.8 for self-employed people and firms with less than ten employees in February, comped with 6.0 for larger companies.

At sectoral level, the turnover situation is comparable to that observed in the January survey. For almost all industries, the revenue loss from normal levels has either remained unchanged or dropped back marginally. A slight improvement between January and February can, in fact, be observed in most of the sectors where turnover had initially been less affected by the coronavirus crisis, such as the manufacturing industry, information and communication or support services and banks and insurance. This improvement is nevertheless lastly the result of a more refined measurement of turnover losses of below 20 % because these revenue loss percentages are flagged up more widely in these industries. Finally, loss of turnover among firms questioned from the non-food retailing and wholesale trade sector remained stable in February, after a clear recovery between November and January. It is possible that these figures have been temporarily inflated by pent-up demand stemming from the temporary closure of non-essential shops in November and the longer seasonal sales period. This would suggest that the structural improvement is a bit smaller and that loss of turnover could start to rise again in the coming weeks.

As far as the hardest-hit sectors are concerned, the situation remains unchanged and particularly alarming. The arts, entertainment and recreation sector recorded a loss of turnover of more than 75 % for the twelfth consecutive month. The heavy revenue losses in accommodation and food service activities as well as in the transport and logistics sector reach respectively 70 and 28 % and also remain unchanged with respect to previous months. These two sectors only posted a temporary and very partial recovery over the summer months. Lastly, non-medical contact professions and travel agencies have posted turnover losses of, respectively, 80 and 92 %. These latter two sectors were analysed individually for the first time during the February survey.

Besides the major intersectoral differences mentioned above, the loss of turnover differs considerably among firms from the same sector. For example, in most industries, there is a significant proportion of companies with a substantial loss of turnover, at the same time as a significant proportion of firms recording a small loss of turnover and a significant proportion of firms for which the impact of the crisis on turnover is positive or zero.

Firms are not expecting a healthy recovery of turnover before next year, while 2021 is likely to remain a transition year

Both in the case of this year and 2022, expectations among firms questioned about the decline in turnover show a slight improvement on the previous survey, but that could once again mainly be explained by changes in the composition of the sample and in the methodology. In all cases, the February findings confirm that 2021 is still likely to be a transition year, with an average loss of turnover of 7 %, while the loss is estimated at just 3 % in 2022. The worst-hit sectors at the moment are expected to continue to suffer enormous turnover losses in 2022, namely, travel agencies (‑31 %), the arts, entertainment and recreation sector (‑22 %), accommodation and food services (‑13 %), non-medical contact professions (‑10 %) and the transport and logistics sector (‑6 %).

Business investment plans also remain practically unchanged on January: on account of the coronavirus crisis, investment is likely to be 20 % below the norm in 2021, and still 12 % down in 2022.

As for employment forecasts in the private sector in 2021, the companies surveyed are now predicting a small increase of 19 000 units (a rise of 0.8 %), compared with a drop of 1 800 units in January. Over the course of the ERMG surveys, this figure has nevertheless turned out to be quite volatile at the aggregate level, and the February result may also be an over-estimation due to the different composition of the sample. As in the previous survey, the hardest-hit sectors are expecting a sharp drop in the number of employees, while some sectors that have an important weight in the Belgian economy, such as the manufacturing industry or support services, are anticipating a slight rise. The net job losses expected in the worst-hit sectors could thus be offset by net job creations in other sectors. However, the final impact on employment will also depend on the ability of labour market policies to facilitate transitions between industries. Lastly, it is also worth noting that these figures only concern salaried employees and the total impact on employment in the private sector also includes self-employed businesses that go bankrupt as a result of the coronavirus crisis.

The perception of the risk of bankruptcy and liquidity problems is still worrying for the hardest-hit industries, self-employed workers and small firms

While almost no respondents at all said they were currently involved in bankruptcy proceedings, 5 % of them said they were expecting to file for bankruptcy within the next six months, which is a similar finding to that in January. This percentage figure differs widely from one sector to another and is higher for travel agencies (32 %), the arts, entertainment and recreation sector (26 %), accommodation and food services (24 %) and, to a lesser extent, non-food retailing (8 %), the transport and logistics sector (7 %) and non-medical contact professions (6 %). The risk of bankruptcy is also a lot higher among self-employed people and the smallest firms questioned: 9 % of them are expecting to file for bankruptcy in the next six months, compared with 3 % of medium-sized enterprises and 0 % of large firms.

Like in January, many companies reported liquidity problems. The share of firms needing an additional capital injection or new loans within the next three months at most to meet their current financial liabilities has remained stable, at around 20 % in February. This rate is also a lot higher for the hardest-hit industries as well as for self-employed people and small businesses.

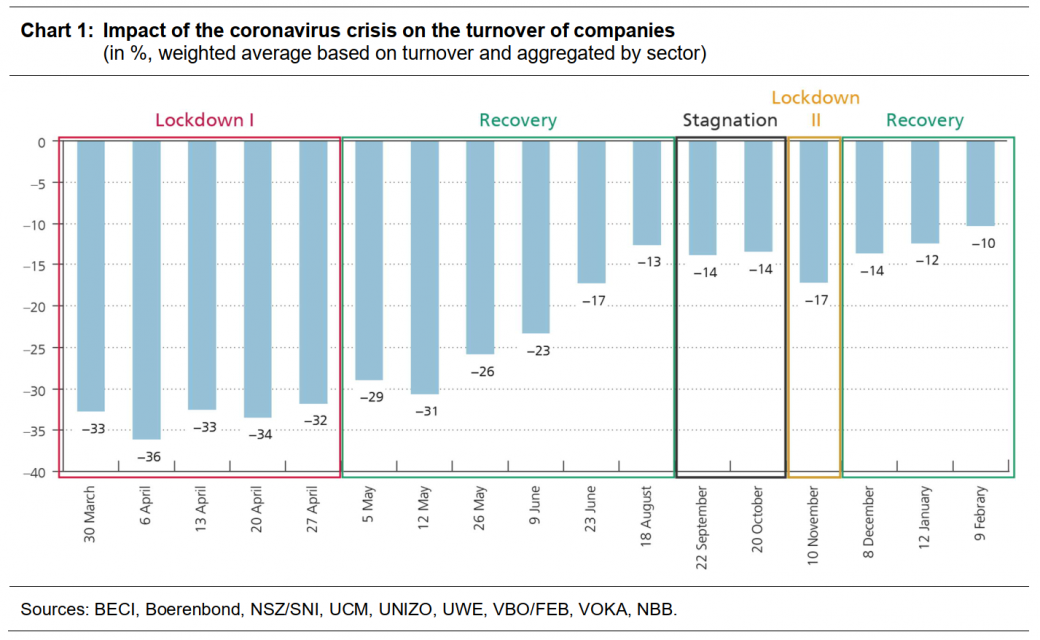

In the worst-hit sectors, half of all firms renting commercial property have seen their rent postponed or not paid all their rent

The fact that liquidity problems are greater for the worst-affected industries is mainly due to the scale and duration of turnover losses in these sectors. Moreover, companies’ liquidity problems also depend on liquidity buffers built up before the coronavirus crisis and on their capacity to cut costs. In this respect, the cost of renting a commercial building is a hefty expenditure item for many businesses that rent property. With this in mind, the February questionnaire included a question asking what had happened about payment of commercial rent since the start of the crisis.

Roughly half of all firms surveyed said they rented property, and 84 % of them (accounting for 42 % of all firms surveyed) declared that they had paid the full rent for the entire period since the beginning of the coronavirus crisis. In the case of 12 % of property-renting firms questioned (accounting for 6 % of all firms surveyed), their landlords have done them a favour, either by postponing rent payments (4.6 %), or by reducing the amount due (7.6 %). The remaining 3.5 % said they had not paid all their rent without the landlord’s consent.

The average calculated at aggregate level nevertheless masks big differences between sectors. The proportion of businesses renting commercial property that have not paid all their rent or have benefited from a rent holiday comes to around 55 % in accommodation and food service activities and roughly 35 % for non-medical contact professions, non-food retailing, the arts, entertainment and recreation sector and travel agencies.

[1] These results neither take account of company size in terms of turnover, nor the respondents’ sector.

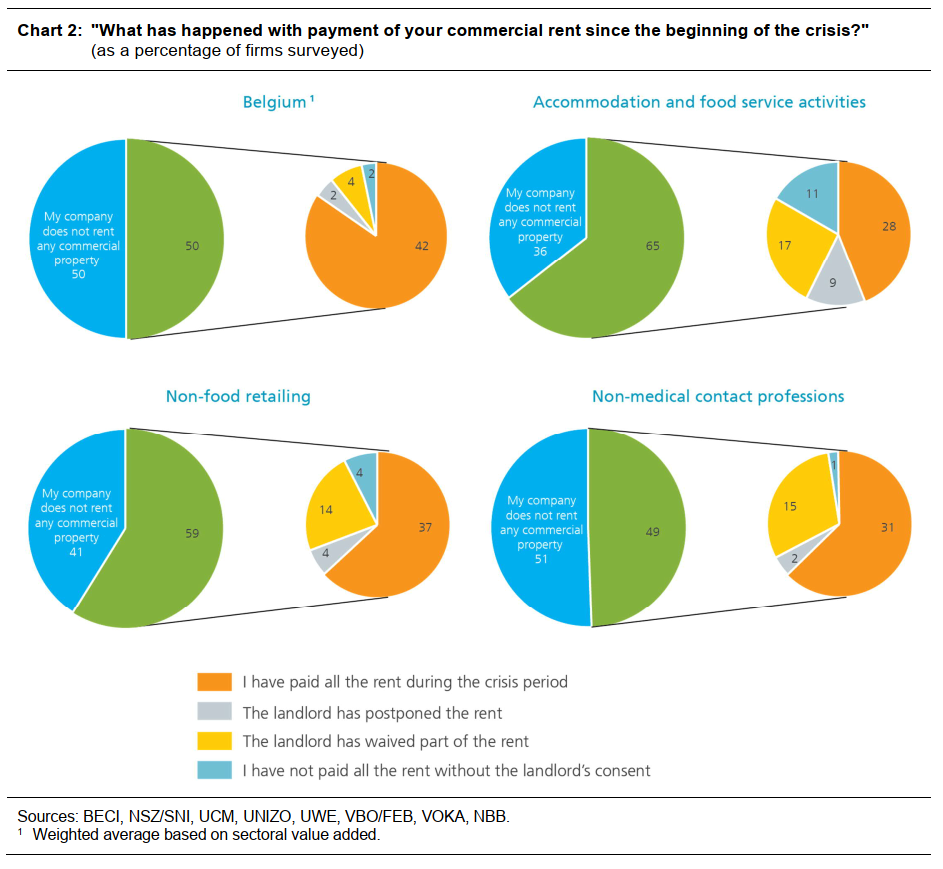

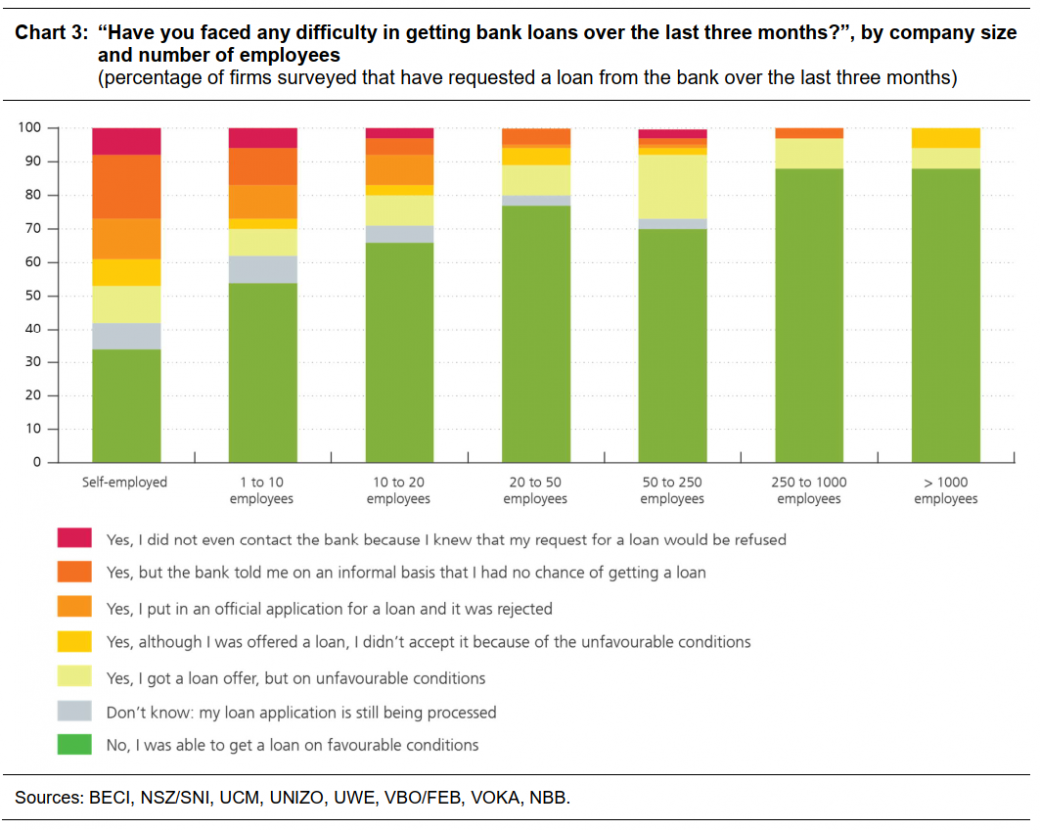

Like the hardest-hit sectors, the self-employed and small firms flag up serious difficulties in getting bank loans

Liquidity problems have also driven firms to seek extra sources of finance. In the January survey, the results revealed that the sources of finance used since the beginning of the coronavirus crisis have varied considerably by industry and company size. Wider recourse to bank loans has been reported principally by medium-sized enterprises, while the smallest firms and, above all, self-employed people have hardly resorted to borrowing from the banks at all.

The February survey has continued the analysis of recourse to bank loans and has specifically sounded out firms on the difficulties they have faced in obtaining a loan from the bank over the last three months. On the one hand, the results revealed that businesses show different degrees of interest in bank credit depending on their size. While 60 % of medium-sized enterprises have wanted to contract a bank loan over the last three months, that has only been the case for about 40 % of firms with less than 20 employees and for 22 % of the self-employed. These lower percentages in the case of self-employed people can be explained by preference for other sources of finance such as an injection of capital from the company owner.

On the other hand, the results show that, among the self-employed who have expressed an interest in borrowing from the bank over the last three months, only one in three actually got a loan on acceptable conditions. In the case of firms with less than 10 employees, that concerns roughly half of all the survey respondents who had asked for a bank loan. One major conclusion here is that the rates of refusal of formal loan applications (strongly) under-estimate the difficulties in gaining access to bank credit. Apart from formal rejections, the firms surveyed also flag up unfavourable borrowing conditions, informal refusals by their bank and even reluctance to contact their bank because loan applicants knew that their request for a loan would be refused anyway. On the other hand, the vast majority of medium-sized enterprises and, especially, very large enterprises have had no problem in getting a loan at acceptable conditions.

Access to bank credit is also closely associated with the sector of business activity. It is the hardest-hit sectors that admit they face the greatest difficulty in gaining access to bank credit on acceptable conditions. For example, among the firms surveyed in the non-medical contact professions who have expressed an interest in borrowing from the bank over the last three months[1], only 16 % obtained a loan on acceptable conditions. This percentage is also very low for travel agencies (23 %), accommodation and food service activities (27 %), the arts, entertainment and recreation sector (34 %) and non-food retailing (39 %).

[1] The proportion of respondents who have expressed an interest in borrowing from the bank over the last three months is 20 % for in the non-medical contact professions and between 35 and 45 % for the other badly affected sectors.