Recovery of business turnover stalls in September

Belgian firms estimate that their turnover is still 14 % below normal levels at the moment, a similar percentage to that recorded in the survey conducted at the end of August. This means that the slow and incomplete recovery of turnover seen over the last few months has stalled. As in the previous survey, companies are not expecting any real improvement in 2021. This is the main conclusion to emerge from the latest ERMG survey among Belgian firms. Furthermore, it is not just investment originally planned for 2020 that has been hit badly, but, even more worryingly, the companies surveyed also expect their investment outlays will be considerably lower in 2021 too.

A new survey was conducted last week by a number of federations of enterprises and the self-employed (BECI, NSZ/SNI, UNIZO, UWE and VOKA). The initiative is coordinated by the NBB and the FEB/VBO. This latest survey follows on from a series of eleven survey rounds conducted since March, with the aim of assessing the impact of the coronavirus crisis and the lockdown measures on economic activity in Belgium and on the financial health of Belgian companies. The survey is now being held on a monthly basis. In all, 2 868 companies and self-employed people responded to this week’s survey . Changes in the indicators cited should be interpreted with caution. Owing to the time lag between survey, a “survivor bias” may appear, particularly in the worst-affected sectors. It is possible that some companies in difficulty have meanwhile filed for bankruptcy and are therefore no longer taken into account. Moreover, the federations and companies taking part in the initiative may differ from one survey to the next, which may influence the composition of the sample. For example, this week, smaller firms and those based in Wallonia and Brussels make up a smaller share of this sample than in the previous survey.

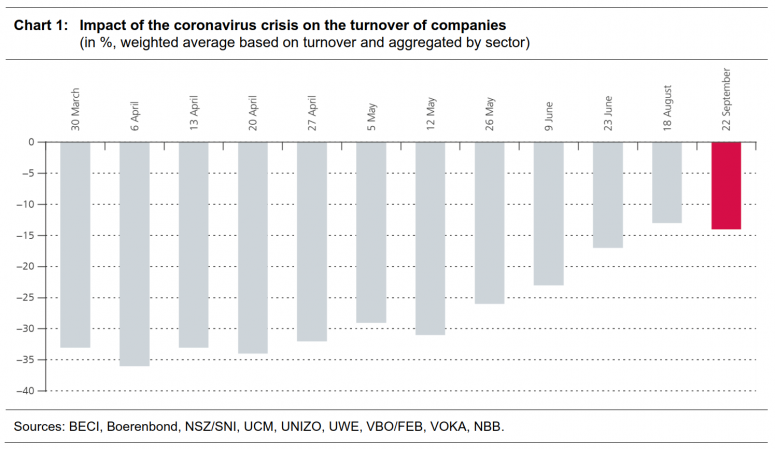

Company turnover has not improved since the last survey carried out in August

Taking account of company size and sectoral value added, firms questioned this week mentioned a 14 % drop in their turnover compared to normal levels, which is virtually unchanged on the figures indicated for the month of August. The lack of any upturn at all over the past month has coincided with the deterioration in the health situation in recent weeks, as shown by the increase in the coronavirus infection rate and the number of related hospitalisations. Fear of the virus as well as the COVID restrictions continue to weigh on the recovery of turnover for many Belgian firms. Weak demand is still by far the main reason behind this loss of turnover and is cited by more than one in every two firms. It is also worth noting that the impact on turnover is two to three times greater for the self-employed and firms with less than ten employees than it is for those with more than 250 employees. On this point, the situation is particularly bad in the Brussels-Capital Region, since the smallest structures there report a much greater negative impact than in Belgium’s other two Regions, which is no doubt due to the additional negative impact of the current intensive recourse to teleworking, implying that the capital is hosting a lot fewer commuters than usual.

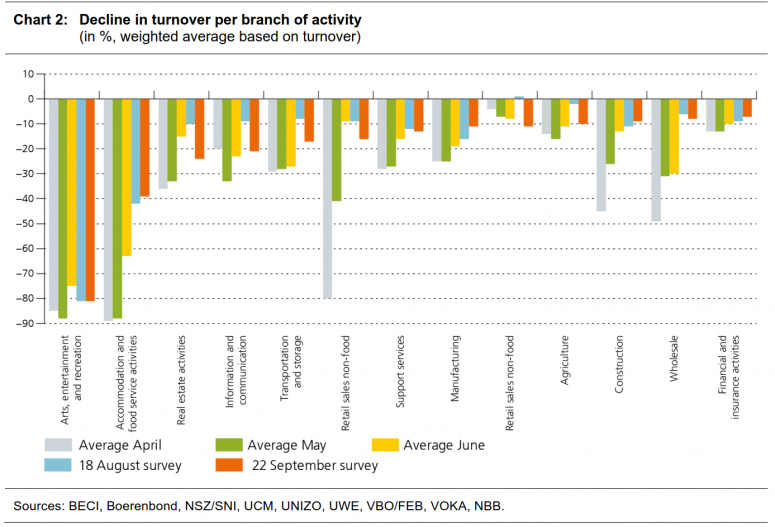

For the two worst-hit sectors, namely the arts, entertainment and recreation sector and catering and accommodation, the situation remains worrying and comparable to what had been observed in August. On average, firms questioned in the arts, entertainment and recreation sector still point to a drop in their turnover of as much as 81 % from normal levels, where it has languished for the sixth consecutive month. According to the survey results, catering and accommodation is still the second worst-hit sector by the coronavirus crisis, with an average drop in turnover of 39 % compared to the norm. In both sectors, the firms questioned say the loss of turnover is mainly due to the health and social distancing measures, the (partial or total) prohibition of certain activities and weak demand.

The other sectors post a different trend in turnover in this survey. While the financial services sector, construction and, above all, manufacturing industry have registered an improvement in their turnover, it has remained stable in support services and wholesale trade, while it has deteriorated in the information and communication sector, in transport and logistics and food and non-food retailing[1]. However, the deterioration of turnover figures in this latter sector may be partially seasonal and related to the end of the sales which were held in August this year, although sales over this period have generally been disappointing. According to the survey carried out this week, the prospects for next year in terms of turnover are unchanged from the previous survey, and firms surveyed continue to predict that their turnover will remain 10 % below the norm in 2021. The prospects for an improvement in turnover between now and next year are therefore very limited, and all the sectors of activity considered in this study are still expecting a drop in turnover from the norm next year. As is the case with the current turnover loss, it is firms in the arts, entertainment and recreation sector and catering and accommodation that appear the most pessimistic, with anticipated losses of turnover of, respectively, 53 and 18 % compared to the norm in 2021. It should nevertheless be noted that the survey was carried out before the decision taken last Wednesday by the National Security Council, which could brighten the prospects for the events sector a little.

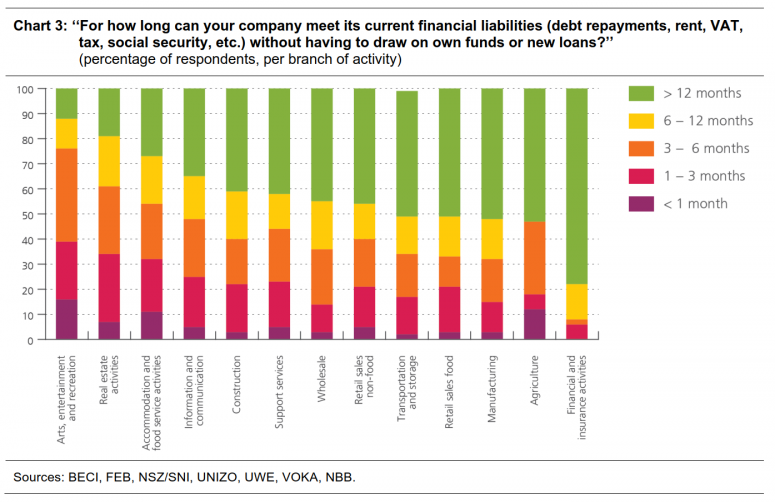

One in five firms will not be able to meet its financial liabilities for more than three months without having to draw on supplementary capital or loans

The coronavirus crisis has severely tested many companies’ finances. This week, one in every four firms questioned mentioned cash-flow problems. This figure is nevertheless an improvement on the highly precarious situation observed at the beginning of April, when almost one in every two firms said they faced liquidity problems. This improvement in the cash-flow position of firms over the last few months can be explained by the partial recovery of turnover and the measures taken by the government to support the liquidity of companies.

This week, we also asked an extra question about the company’s cash-flow position: ‘‘For how long can your company meet its current financial liabilities (debt repayments, rent, VAT, tax, social security, etc.) without having to draw on supplementary capital or new loans?’’. 4 % of respondents to this question replied that they could cope for less than a month, 15 % between one and three months and 18 % between three and six months. Small firms signaled major difficulties: 31 % of self-employed respondents and 24 % of firms with less than ten employees will not be able to meet their financial liabilities beyond three months without extra financial support. These percentages only reach 2 and 10 % respectively in the case of enterprises with more than 1 000 employees and those with between 250 and 1 000 employees on their payroll. At sectoral level, it is companies in the real estate sector2, the arts, entertainment and recreation sector, as well as catering and accommodation, that report more fragile liquidity positions.

However, the fall in the number of firms raising liquidity problems does not necessarily mean that the corporate situation is on a sustainable recovery path. In this regard, the perception of risk of bankruptcy is still under study. This week, 4 % of respondents said the bankruptcy of their company was either likely, or very likely. This is a sharp reduction from the previous survey, but the change in the composition of our sample should still be taken into consideration. In this week’s survey, the sample comprises fewer self-employed and fewer firms located in Wallonia or Brussels (owing, among other things, to the absence of UCM from the participating federations). Up until now, these two categories had a lot higher perception of risk of bankruptcy, so the findings need to be interpreted with some caution, all the more so because the survival bias can also exert some influence. Furthermore, 4 % of firms surveyed are expecting to file for bankruptcy within six months. The two sectors reporting a higher risk of bankruptcy are, logically, those that are hit by a bigger drop in turnover too. Most notably, respectively 16 and 14 % of firms surveyed in catering and accommodation and the arts, entertainment and recreation sector are expecting to go under in less than six months.

However, these results do not take account of firms that have gone bankrupt since the beginning of the coronavirus crisis. Firms questioned in catering and accommodation and the arts, entertainment and recreation sector reckon that almost 30 % of companies operating in their own sector of activity have already filed for bankruptcy, or are currently involved in bankruptcy proceedings because of the coronavirus crisis (compared with 8 % in the total sample). This therefore suggests that the survival bias could water down some of the survey, especially for the worst-hit sectors.

The coronavirus crisis has taken a heavy toll on investment prospects for 2021

The degree of concern about the firm’s commercial activity, measured on a scale of 1 (little concerned) to 10 (very concerned), has slightly improved this week compared to the end of August (from 6.7 to 6.3). The level nevertheless remains quite high and close to that recorded in the survey carried out at the beginning of June. Just as for turnover, the upturn that has been observed since May for the degree of concern has ground to a halt over the last two months.

The lack of predictability is naturally a factor strongly influencing companies’ investment decisions, while the uncertainty, whether political, economic or health-related, may lead to some private investment projects being postponed. Just for this year, surveyed companies reckon that the coronavirus crisis has reduced their investment by 21 % on average.

A particularly worrying element lies in the investment prospects for 2021, which remain bleak, reinforcing the impression that the recovery will take some time. In fact, firms surveyed expect the sums invested to be 19 % below what they would have been without the coronavirus crisis. These results suggest that there will be only a very slight recovery of investment in 2021.

Companies remain pessimistic about employment

The impact of the coronavirus crisis on employment is still regarded as very heavy this week. Firms surveyed thus estimate the number of jobs lost in the private sector between the beginning of the crisis and the end of the year at 84 000 (down by 3 %). It should nevertheless be noted that the temporary lay-off scheme has been extended until the end of the year for certain sectors, which means that part of the coronavirus crisis-related job losses could be put off until next year. According to the survey findings, 6 % of employees in the private sector are recorded as being on temporary lay-off, the vast majority of whom are in the two worst-hit sectors, catering and accommodation and arts, entertainment and recreation.

As far as the place of work is concerned, the share of employees who are working from home part of the time has increased sharply, rising from 15 % at the end of June to 26 % today. On the other hand, the share of employees who only work at home has dropped back from 16 % at the end of June to 9 % now. The current intensive recourse to teleworking will also have a lasting impact on future ways of working because, in the last survey, one in every three firms said they would make more use of working from home than before the crisis.

[1] Participation in the survey by some federations whose members operate in a specific sector of activity may lead to a sampling error. In particular, companies from one by branch of activity could be more strongly represented in our sample than in the Belgian economy as a whole. The sample is therefore stratified by industry based on the weight in value added in Belgium. Note that the changes over the weeks should be interpreted with caution, as the companies that reply to the survey are not necessarily the same each week. It should also be noted that the figures may differ slightly from previous publication figures due to the inclusion of data received afterwards and because the data analysis is constantly being refined.

[2] The results for the real estate and agriculture sectors need to be interpreted with caution owing to the small number of firms in the sample.