Economic impact of the Covid-19 health crisis: A scenario

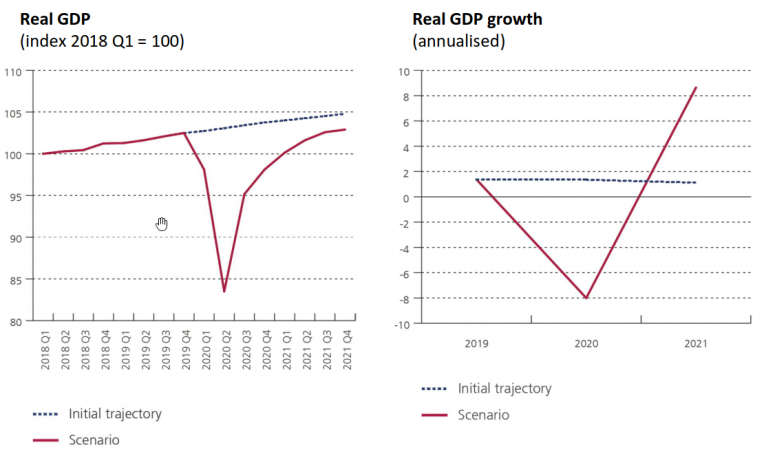

Drawing on a scenario factoring in the restrictive measures currently in force and assuming a period of seven weeks, the National Bank of Belgium (NBB) and the Federal Planning Bureau (FPB) reckon that the country’s real GDP could contract by 8% in 2020. A rebound of 8.6% is now assumed for 2021, provided that the acute phase of the crisis – concentrated in the first six months of 2020 – does no lasting damage to the Belgian economy’s production potential. NBB and FPB expect that the measures taken to protect households’ disposable income will lay the foundation for a rapid recovery in consumption from the third quarter of this year. The analysis also shows that the slump in revenues is putting companies’ cash positions under significant pressure. The strength of the expected recovery in the second half of this year and next is based on the technical hypothesis that this pressure does not lead to solvency issues tipping numerous companies into bankruptcy and, by extension, triggering persistently higher unemployment. The impact on public finances is expected to be proportionate to the shock: the government deficit is likely to work out at no less than 7.5% of GDP and public debt at around 115% by the end of 2020.

The fight against the Covid-19 pandemic has necessitated unparalleled health measures, with whole swathes of the Belgian economy halted and restrictive measures imposed on the population, and normal operations disrupted in nearly all industries. Within the space of a few weeks, temporary unemployment has been sought for 1.2 million employees and over 300,000 self-employed have had to close up shop. This acute and unprecedented crisis faces both companies and households with immediate liquidity issues.

Although swift measures were taken to cushion income losses for numerous economic actors – e.g. faster access to temporary unemployment, bridging benefits for the self-employed, suspension of mortgage payments for households hit by the crisis, bank loans guaranteed by the federal government and regional support for affected companies – these may prove insufficient to safeguard the economy’s production potential in the acute phase of the crisis. Bankruptcies of companies that were profitable prior to the compulsory lockdown measures, or revised investment plans, could cause a longer-lasting deterioration in production capacity and job creation, hampering any economic revival. Striking the right balance between sufficiently robust support measures and a fair distribution of their costs between companies, households and government (including spreading such costs over time) requires as realistic as possible an early assessment of the shock’s probably short-term impact on the economy and of the benefits of safeguarding the production base.

For this reason, NBB and FPB have joined forces to make a first assessment of this impact and the possible shape of any exit from the crisis. This impact analysis differs from any ‘normal’ macroeconomic projections, as these typically reflect the extrapolation of past trends and are not calibrated for an environment of ongoing major uncertainty over both the lockdown period and the pace and way in which restrictive measures will be lifted.

The analysis is predicated on a scenario of four main hypotheses: (1) a calculation of the initial impact of the shock as measured by surveys on the issue[1], (2) the probable duration of the health measures, (3) the pace at which these measures will be lifted and economic activity will recover, and (4) the existence (and the extent) of any permanent deviation in the course of the economy relative to pre-crisis assumptions. These hypotheses are integrated in a model of the Belgian economy to allow subsequent calculations of household income and consumption, companies’ gross operating surplus and public finances.

This scenario is clearly just a snapshot of the state of play and inevitably subject to improvement, as it is underpinned by the available information at the time. Ergo, this scenario is only as relevant as the hypotheses that inform it. The uncertainty of the calculations remains significant and, in contrast with other sets of projections[AG1] , error margins cannot be ascertained. These calculations may be heavily influenced by any new information about the length of the current lockdown measures, their real impact on economic activity, the pace at which these measures are lifted, the international context, and the measures aimed at safeguarding production potential.

The scenario

The scenario reflects the following hypotheses:

- Current lockdown measures remaining in place for a total period of seven weeks, with an assumed loss of one-third of the private sector’s value added.

- A gradual recovery over a period of nine months, after which economic activity is assumed to return to its pre-crisis growth trajectory, albeit from two percentage points lower. Several other factors also need to be included at the same time: a gradual lifting of the lockdown measures themselves, coupled with a gradual recovery of value chains and production lines, a disrupted and uncertain international environment, as well as potential bankruptcies or investment plan cancellations that would not have happened if the Covid-19 crisis had not erupted. The recovery is expected to be more significant in the third quarter, reflecting probable pent-up demand for some consumer durables.

- Recipients of temporary unemployment benefits are presumed to be full-time workers. As a strongly hypothetical presumption, this could cause the researchers to overestimate disposable income losses for households and underestimate the drop in companies’ gross operating surplus.

- Inflation is pinned down at the initial level when the scenario was drawn up, ignoring the crisis. Consumer prices are currently facing contradictory influences that are hard to gauge (falling oil prices but price increases for products that are running into storage, distribution or supply issues).

- In terms of economic policy, the scenario only factors in the decisions concerning temporary unemployment and bridging benefits. In the absence of reliable information at this stage, it leaves public consumption – i.e. compensation of public employees[AG2] and the purchase of goods and services – unchanged from its original trajectory. Government spending, meanwhile, is being reduced by collapsing construction activity. Any other measures, including regional support to companies, for instance, are not at this stage factored in due to the lack of sufficient reliable data at the time of calculating this scenario.

Outcomes

The impact analysis arising from the model can be summarised as follows:

- Full-2020 GDP shrinking by 8%, with a quarterly fall of around 4% in the first quarter and 15% in the second, followed by a robust recovery in the second half of the year – though not by enough to make up the initial losses. A continuation of this recovery pushes up growth to a positive 8.6% in 2021.

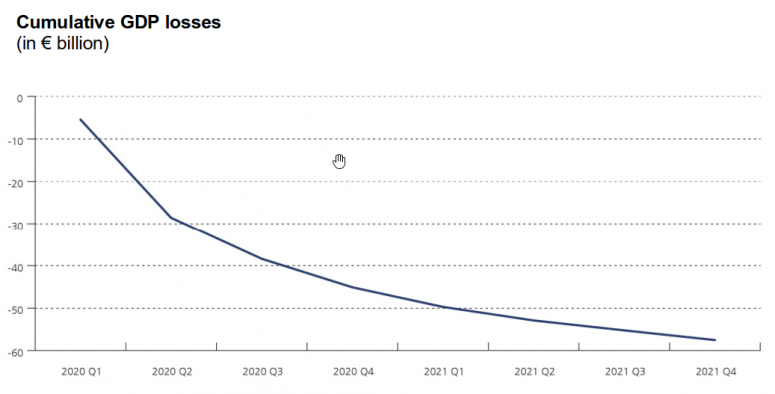

- Compared with a scenario without the Covid-19 crisis, cumulative GDP losses work out at nearly €30 billion at the end of June 2020, at €45 billion by the end of December and at close to €60 billion by the end of 2021.

-

The impact of the shock on the balance of public finances amounts to around 5.3% of GDP, taking the budget deficit to around 7.5% of GDP, mainly because of the automatic stabilisers attached to unemployment benefits, bridging benefits and reduced tax receipts. Debt levels, projected at 115% of GDP by the end of the year, reflect the double whammy of a higher borrowing requirement and a temporary fall in nominal GDP (the debt ratio’s denominator). It is worth noting that none of these calculations factor in measures already taken or rising health care costs in the context of the Covid-19 crisis.

-

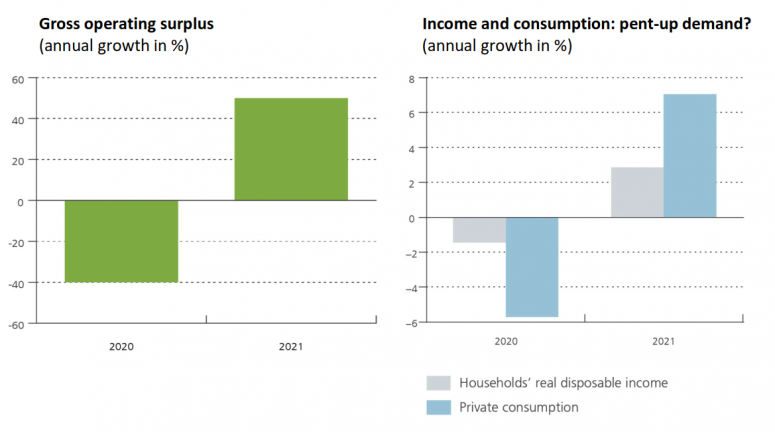

The shock to value added shows up in a loss of households’ real disposable income of 2.8%, i.e. a 1.5% drop on 2019. This relative fall is a lot smaller than the GDP contraction figure. Companies’ gross operating surplus, in its turn, records a drop of 40% compared with 2019.

- The lockdown measures hamper households’ opportunities to consume. Consumption therefore declines by 5.7% in real terms compared with 2019, with the drop especially visible in the first six months of the year. Given the relatively more moderate fall in real disposable incomes, the scenario suggests an accumulation of enforced (aggregate) savings which might in part be released by the reopening of retail stores and other currently closed activities. This also suggests that consumption will pick up markedly from the third quarter of 2020.

Generally speaking, the scenario assumes that the negative effects of the crisis will be temporary and be chiefly concentrated in the first two quarters of 2020. Households will see their disposable incomes and consumption slow, as companies face a sudden but passing slowdown in their operating surplus.

While social security systems and temporary moratoria on some financial obligations largely protect households from the scenario’s uncertainties, measures taken to assist companies have been mostly about liquidity support (secured credit facilities, deferral of tax payment deadlines, etc.).

The underlying technical hypothesis is that these measures reduce the risk of bankruptcy for companies that were viable pre-crisis. However, the above aggregate numbers disguise very different situations by sector or industry. For one thing, not every sector is able to accumulate major cash reserves and so they are not all equally positioned to weather the shock. And besides, the intensity of the shock is not the same for all sectors and industries either. Illiquid companies with limited equity or which are harder hit by the crisis run a distinctly greater risk of going bust. To defuse this risk, additional measures focusing on these companies will soon need to be taken, to ensure their solvency – measures that should be temporary from the outset and be calibrated on real losses suffered.

Risks

The considered scenario’s quantified orders of magnitude are in line with the most recent macroeconomic forecasts from a range of sources, including international financial institutions. However, the uncertainty surrounding this exercise is great and risks abound that could bring about even less favourable situations. To mention but a few:

- Less favourable epidemiological dynamics than currently expected, calling for a lengthier and even stricter lockdown.

- Ever-increasing production losses during the lockdown period as a result of wider disruption to value chains over time.

- An economic recovery hobbled by countless bankruptcies and significant job losses in sectors that are fundamentally more vulnerable to liquidity shortages and that are more deeply impacted by the health measures.

- A temporary risk of accelerating inflation accompanying consumption bouncing back faster than production and distribution capacity can be restarted. Conversely, persistently subdued demand – caused, for instance by a greater accumulation of precautionary savings – could depress prices and imply an increased risk of deflation.

- A lengthy deterioration in the international environment, due to the risk of more negative spill-over effects between economies, for instance in the event of a resurgence in the pandemic.

In more favourable conditions, of course, a swifter return to a normal situation would make the crisis less severe.

Lessons for economic policy

The figures in this scenario clearly lay bare the deep cuts the crisis is making in the economy and in public finances. After this highly challenging 2020, Belgium should, once again, be able to make a relatively rapid recovery, with the right support and guidance. The negative effects are tough, but are of a temporary and exceptional nature.

The wide range of support and assistance schemes provided by Belgium’s federal and regional authorities, as well as by its banking and insurance industries, have combined to bring initial concerns largely under control, i.e. liquidity issues for companies and disposable income for households. But there is no reason for complacency, as firms and the self-employed will be facing solvency issues in the days and weeks ahead. Addressing these should be top priority to protect both the country’s economic fabric and employment.

The country’s economic infrastructure is – as yet – unharmed. Once the pandemic is under control and the health authorities give the green light, normal company activity can gradually resume, as the Belgian economy’s collective capacity has remained intact. But even at the post-pandemic stage, support will remain necessary.

What is needed now is to support healthy companies or sectors that find themselves up against solvency challenges, as far as possible, in order for them to survive this crisis period. This is crucially important to prevent this crisis from causing structural unemployment and to keep public finances healthy after the temporary shock caused by the crisis.

NBB and FPB will closely monitor the situation in the days, weeks and months ahead, to which end the research services of both institutions will work closely together.