Belgian corporations estimate that the coronavirus crisis is reducing their turnover by a third

Belgian corporations and entrepreneurs have been taking a beating since the coronavirus crisis began. A survey of 4,725 corporations located in Belgium, commissioned by the Economic Risk Management Group (ERMG), reveals that four out of ten firms surveyed report a drop in sales by over 75%. The hotel and catering industry as well as the arts, entertainment and recreation sector and the retail sector are heavily affected. In addition, 50% of firms are reporting liquidity issues.

On Monday 30 and Tuesday 31 March, a survey was carried out by a number of federations of enterprises and self-employed persons (BECI, VOKA, UNIZO and UWE)[1] among 4,725 private enterprises located in Brussels, Flanders and Wallonia. This very large survey was made possible by a unique collaboration between the federations as well as coordination by the NBB and the FEB/VBO. This initiative is expected to be repeated on a weekly basis. It assesses the impact of the coronavirus crisis on economic activity in Belgium and on the financial health of the Belgian corporations surveyed. It should be noted that the survey was mainly aimed at private corporations. Also, certain public sectors such as education are not represented, though they are also impacted.

|

Table 1: Impact of the coronavirus crisis on the company's turnover (percentages) |

||

|

|

Simple average |

Weighted average2 |

|

Flemish Region |

-55 |

-35 |

|

Brussels-Capital Region |

-53 |

-31 |

|

Walloon Region |

-53 |

-30 |

|

|

|

|

|

Belgium1 |

-54 |

-33 |

|

Sources: BECI, FEB/VBO, UNIZO, UWE, VOKA, NBB 1 Weights based on the share of private employment in the Flemish Region, Brussels-Capital Region and Walloon Region. 2 Weights based on sales reported by companies. |

||

Company size plays an important role

As regards the impact of the coronavirus crisis, 87% of the corporations surveyed – which, it should be reminded, represent only a sample of the total population of Belgian corporations ‑ report a drop in turnover, and 40% of the corporations surveyed mention a drastic drop (more than 75%). The average fall in turnover reported by respondents exceeds 50%. Taking into account the size of the various companies surveyed, this corresponds to a reduction in total sales of about one third. The scale of the contraction in total sales is more or less the same in the three regions, with firms in the Flemish Region (-35 %), the Walloon Region (-30 %) and the Brussels-Capital Region (-31 %) reporting an average fall close to the national average.

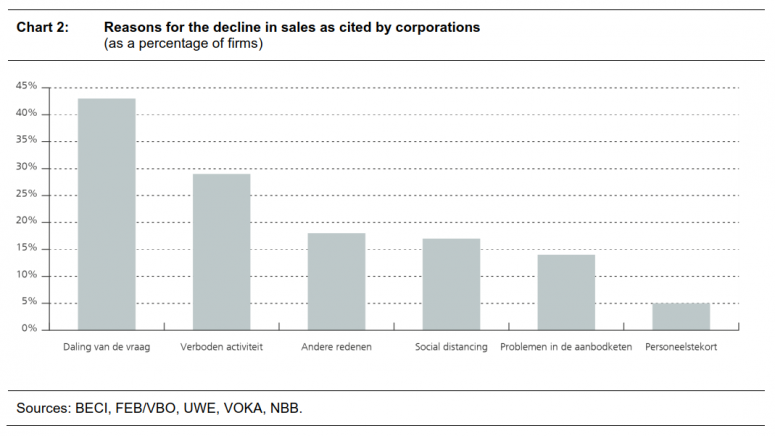

Firm size is definitely a decisive factor, with small and medium-sized enterprises more heavily affected by the current crisis, partly because they are more exposed to the closure imposed by the Belgian government. More than half of the self-employed and corporations with fewer than ten employees report a fall in sales of more than 50%. Larger corporations, which are mainly active in sectors recognised as essential, also recorded a drop in sales on average, albeit to a lesser extent. At the aggregate level, the main reason cited by corporations for the decline in sales is weak demand. Other reasons are the closure imposed by the government as part of the fight against the spread of Covid19‑ , the inability to meet social distancing obligations, supply problems, and also lack of staff.

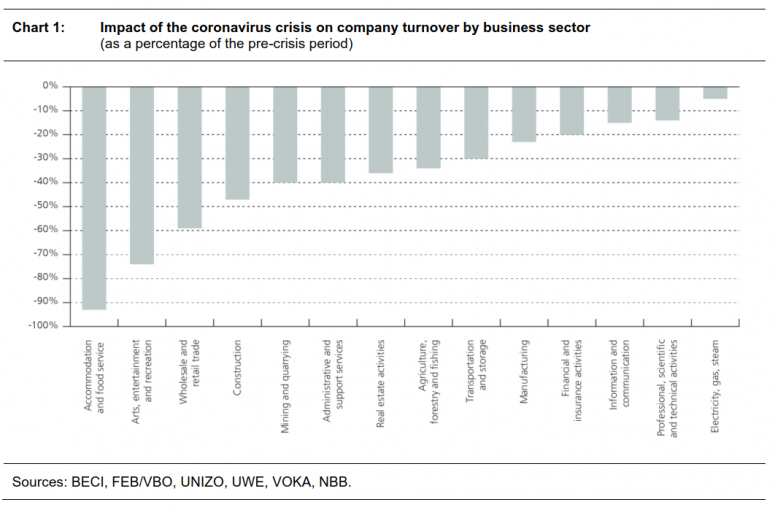

The breakdown of results by industry suggests that, on average, all sectors are negatively affected by the coronavirus crisis. However, there is a substantial difference in the magnitude of the impact. For example, the energy sector reports a drop in turnover of approximately 5%. Conversely, the three most affected sectors are hotels and restaurants, the arts, entertainment and recreation sector, and trade, which reported average drops in turnover of 93%, 74% and 59% respectively. Within these three sectors, the majority of businesses reported using temporary unemployment for a large proportion of their employees. Across all sectors, half of the firms surveyed have already resorted to temporary unemployment, while others plan to do so in the coming month (13% of the sample).

[1] The survey is also being conducted by Boerenbond, SNI/NSZ and UNISOC among its members and the results will be incorporated into next week's survey.

Chart 1: Impact of the coronavirus crisis on company turnover by business sector

(as a percentage of the pre-crisis period)

Sources: BECI, FEB/VBO, UNIZO, UWE, VOKA, NBB.

Chart 2: Reasons for the decline in sales as cited by corporations.

(as a percentage of firms)

Sources: BECI, FEB, UNIZO, UWE, VOKA, BNB

Furthermore, one in two firms cites liquidity problems such as insufficient access to credit or unpaid bills, but less than one in ten consider bankruptcy to be either likely or very likely.

In conclusion, the results of this wide-ranging survey confirm the significant effect of the coronavirus crisis on corporations. The survey suggests that a large number of the Belgian corporations surveyed have witnessed a drastic fall in sales, jeopardising in particular the smallest structures. Corporations’ current perception is tinged with pessimism, though the actual decline in GDP growth in 2020 will primarily depend on the duration of the containment measures.