Belgian businesses estimate that the loss of turnover due to the coronavirus crisis remains more or less constant at 37 %

Belgian companies and entrepreneurs remain under pressure as they continue to confront the coronavirus crisis, even though the loss of turnover has remained more or less stable in relation to last week. That was the finding of a survey of firms and self-employed workers commissioned by the Economic Risk Management Group (ERMG). As last week, the survey reveals that around four out of ten firms polled report that the coronavirus crisis has reduced their sales by over 75%. The impact on the hotel and catering industry, the arts, entertainment and recreation sector and the retail sector continues to exceed that figure. In addition, almost 50% of firms in the survey report cash-flow problems. In the hardest hit sectors such as the hotel and catering industry, the firms polled considered that their solvency could be at risk.

For the second consecutive week, a number of federations of enterprises and the self-employed (BECI, SNI, UNIZO, UWE and VOKA)[1] conducted a survey which was coordinated by the NBB and the FEB/VBO. The aim is to assess the impact of the coronavirus crisis on economic activity in Belgium and on the financial health of Belgian businesses week by week. A total of 6906 firms and self-employed workers responded to this week’s survey.

|

Table 1: Impact of the coronavirus crisis on the company's turnover1 (in %, weighted average based on aggregate turnover per sector) |

||

|

|

27 March – 2 April |

3 April – 9 April |

|

Flemish Region |

-34 |

-38 |

|

Brussels-Capital Region |

-30 |

-32 |

|

Walloon Region |

-35 |

-38 |

|

|

|

|

|

Belgium1 |

-34 |

-37 |

|

Sources: BECI, Boerenbond, FEB/VBO, SNI, UNIZO, UWE, VOKA, NBB 1 Representation of the various branches in the sample varies between Regions. For the purposes of this calculation, it is assumed that the impact of the crisis by branch of activity does not vary depending on the Region. |

||

The hotel and catering industry and the arts, entertainment and recreation sector are in the front line

The figure for the reduction in sales is comparable to last week’s finding. Over the past week, if the firm’s turnover and the weight of the branch of activity in the Belgian economy are both taken into account, the firms polled reported an average decline of 37%, compared to the previous figure of 34%.[2] Furthermore, almost four out of ten firms polled saw their turnover fall by more than 75%. Once again, it is smaller firms that are suffering a greater decline. The weighted fall in sales does not show any significant regional disparity, although the reduction is slightly larger in the Flemish Region and the Walloon Region (-38%).

There is a greater disparity between branches of activity: the ones reporting a sharper decline are still the “arts, entertainment and recreation” sector (-92%), the hotel and catering industry (-83%) and the retail sector (-59%). Within these three branches of activity – which already recorded the biggest impact last week – a large swathe of firms polled state that the main reason for this decline is the government’s order to shut down the activity in question (85%, 77% and 56% respectively of the respondents from the sectors concerned). In the sample as a whole, the lack of demand is still the factor most frequently mentioned.

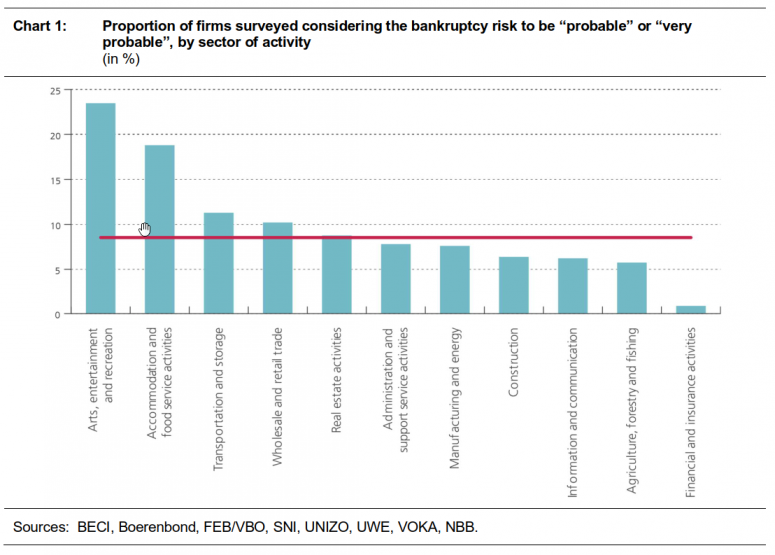

One in two of the firms polled faces cash-flow problems, a figure comparable to that seen last week. As regards solvency issues, fewer than one in ten firms states that it is likely, or very likely, to go bankrupt, and it is mainly small firms that are at higher risk. That said, there are sectoral disparities regarding the perception of the risk of bankruptcy. Within the hotel and catering industry and the “arts, entertainment and recreation” sector, roughly one in five of the firms polled reports a high risk of bankruptcy, whereas that ratio is considerably lower in the other branches of activity.

[1] The survey was also conducted among UNISOC members, but as the enterprises polled belong to the non-profit sector (for which the value added in the national accounts is determined differently from that of other sectors), these responses are not aggregated here with those of self-employed workers and firms taking part in the survey of other organisations. They form the subject of a separate analysis.

[2] In comparison with the press release dated 3 April 2020, supplementary data have been included and the aggregation method has been modified. In particular, the sample has been stratified by branch of activity according to the weight in value added in Belgium. Participation in the survey by some federations whose members operate in a specific sector of activity may lead to sampling errors. For instance, companies from one by branch of activity may be strongly represented in our sample while accounting for a smaller share of the economy as a whole. We therefore balanced our sample according to the value added of the branch of activity. Nevertheless, the results are still relatively similar.

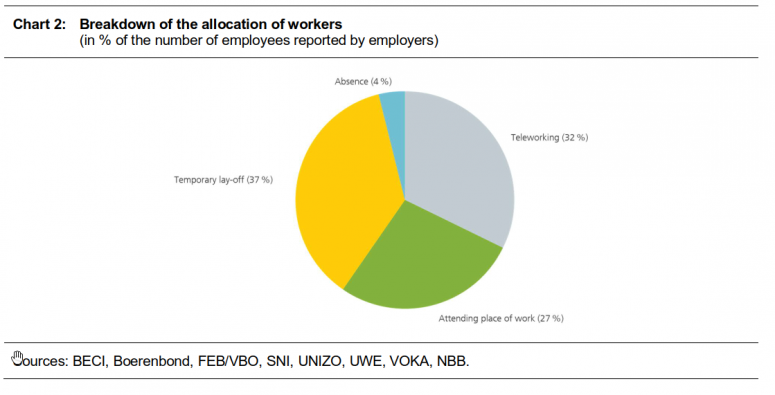

One in two firms is already resorting to temporary lay-offs

For many of the firms surveyed – and in most branches of activity – some staff have already been laid off temporarily. Logically, the three branches of activity which had previously been pinpointed as the hardest hit are making extensive use of this system. Overall, almost one in two firms surveyed state that they are now resorting to temporary lay-offs, and 9% of firms polled expect to do so within the next month.

Furthermore, 32% of staff are teleworking, and 27% are still attending their place of work. Absence for medical or other reasons accounts for only 4% of cases, according to the responses by firms in the survey.

On a scale of 1 (a little concerned) to 10 (very concerned), the firms surveyed put their level of concern at 7.2, compared to 7 last week. The business leaders polled are therefore still seriously concerned, and that may reduce their willingness to invest.