Seven in every ten firms are in the starting blocks to resume their business activity at a rate of over 50 % of pre-crisis levels

Full resumption of economic activity is certainly not on the cards yet, but the vast majority of firms surveyed are physically ready to resume their business activity at a rate of at least 50 % of pre-crisis levels when the confinement ends. One-third of the companies surveyed even said they could resume business almost at the same level as before. This is the main conclusion to emerge from the latest survey conducted among Belgian companies and self-employed people for the ERMG. Overall, the survey findings are still worrying, whether in terms of falling turnover or the risk of bankruptcy, in particular for small firms and the sectors hit the hardest like catering and accommodation or arts, entertainment and recreation.

For the fourth week in a row, a survey was carried out by a number of federations of enterprises and self-employed people (BECI, SNI, UNIZO, UWE and VOKA). This initiative is being coordinated by the NBB and the FEB/VBO. The objective is to assess the impact of the coronavirus crisis on economic activity in Belgium and on the financial health of Belgian companies week by week. In total, 3 528 enterprises and self-employed people replied to this week’s survey[1].

|

Table 1: Impact of the coronavirus crisis on company turnover1 (in %, weighted average based on turnover and aggregated by industry) |

||||

|

|

27 March - 2 April |

3-9 April |

10-16 April |

17-23 April |

|

Flemish Region |

-34 |

-38 |

-35 |

-34 |

|

Brussels-Capital Region |

-30 |

-32 |

-28 |

-31 |

|

Walloon Region |

-34 |

-38 |

-36 |

-34 |

|

Belgium |

-33 |

-37 |

-34 |

-33 |

|

Sources: BECI, Boerenbond, SNI/NSZ, UNIZO, UWE, FEB/VBO, VOKA, NBB. 1 Representation of the various industries in the sample varies between regions. For the purposes of this calculation, it is assumed that the impact of the crisis by industry does not vary depending on the region. Please also note that figures may differ slightly from previous publication figures due to the inclusion of data obtained afterwards and because the data analysis is continuously refined. |

||||

A sharp drop in turnover is reported for the fourth consecutive week

The drop in turnover from figures recorded before the coronavirus crisis is 33 %, according to the companies surveyed. This figure is in line with numbers observed in the three previous surveys. The regional averages are also marked by a degree of stability and are close to the national average. The slightly lower fall reported in the Brussels-Capital Region during the four surveys is related to the weight of the financial sector, whose activity has been less affected.

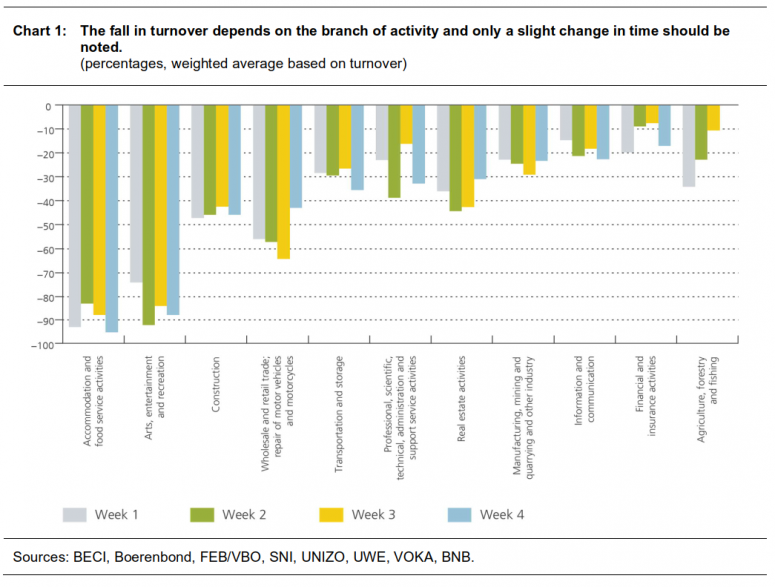

The drop in turnover nevertheless continues to differ from one branch of activity to another. In particular, the banks and insurance sector, as well as information and communication services (which notably include IT-related services) are among the sectors less impacted by the coronavirus crisis, on the one hand because the main activity within these branches has not been prohibited, and on the other hand, because teleworking is possible for many of their employees. In addition, businesses questioned from the agriculture, forestry and fishing sector have not seen their sales decline although caution is in order with the interpretation of figures here in view of the small sample from this branch in this week’s survey. As regards the sectors that have been hit much harder, the findings remain alarming for the arts, entertainment and recreation and catering and accommodation branches, where firms surveyed report an average drop in turnover of respectively 88 % and 95 %.

The stable figures for drop in turnover reported within the different branches of activity should nevertheless be seen in the context of no major change in the confinement measures over these last four weeks. That said, over the past week, the firms from the trade sector surveyed stand out as an exception and report a strong improvement on the previous week. They effectively reported a 43 % drop in turnover from pre-crisis levels, compared with a decline of 64 % a week earlier, due to a combination of an improvement in both food and non-food retailing. In the latter case, this may be linked to the reopening of certain commercial activities since 18 April.

[1] Participation in the survey by some federations whose members operate in a specific sector of activity may lead to sampling errors. For instance, companies from one by branch of activity could be strongly represented in our sample but not actually have much weight in the economy as a whole. The sample by branch of activity is therefore stratified depending on the weight in value added in Belgium.

The perception of risk of bankruptcy is broadly similar to that observed the week before and, by way of example, 7 % of companies surveyed once again raised the prospect of bankruptcy being “likely” or “very likely”. This figure is as high as 10 % for the sample of self-employed people and small businesses with less than ten employees. The proportion of firms facing cash-flow problems is also characterised by a degree of stability and 36 % of firms questioned do not think they will be able to maintain their cash-flow position for more than three months without a liquidity injection (compared with 38 % in the previous survey). As there is still great uncertainty surrounding the conditions for resuming business, it is logical to see the concern mentioned by surveyed firms stagnate at a high level. On a scale of 1 (not very concerned) to 10 (very concerned), the average score among the firms questioned worked out at 6.9, compared with 7.1 last week.

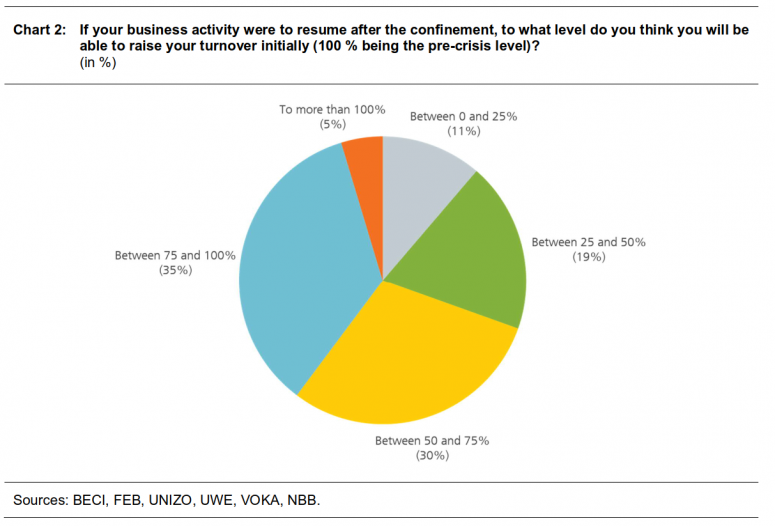

Although a large part of the economy is still at a standstill at the moment, the resumption of activity and its scale are worrying subjects for many company managers. At an aggregate level, 40 % of enterprises surveyed are expecting to turn out at least three-quarters of their pre-crisis production in the first phase after the confinement period. This proportion rises to 70 % if the threshold is set at half of their pre-crisis production. On an even brighter note, 5 % of respondents even said that, by the end of the confinement, they are expecting to reach a higher level of activity than before the crisis. There are potentially multiple reasons why firms’ capacity to resume business activities at pre-crisis levels may be limited. For instance, they could face insufficient supplies of goods or raw materials, and demand may be weak, they may have difficulty in applying the social distancing rules, some workers may not be available or certain events may still be banned.

The scale of these various restrictions largely depends on the branch of activity. According to the survey results, in the banks and insurance and information and communication sectors, eight out of ten firms said they should be able to resume half or more of their business activity to start with after the confinement. By contrast, in the arts, entertainment and recreation and catering and accommodation branches, only four in every ten companies say they will be able to resume work at this level as easily after the confinement.