Belgian firms see an improvement in both their current turnover and the outlook in December

Brussels, December 2020 – The turnover loss suffered by Belgian firms as a result of the coronavirus crisis came to 14 % in December, a 3 percentage point improvement on the November situation and comparable to the figures seen before the second lockdown. The easing of certain restrictions at the beginning of December, such as the reopening of non-essential shops, had a very positive impact on the turnover of the trade sector and real estate activities, while many other sectors recorded a slight improvement. That is the picture presented by the new ERMG survey of Belgian businesses. In addition, the outlook for 2021 has become a little less gloomy; that is true for predicted turnover, investment plans, employment and the risk of bankruptcy, even though the economic impact of the coronavirus crisis remains severe for the year ahead. Finally, it should be noted that almost 45 % of employees are working at home, two-thirds of them full-time. It is striking that, on average, according to respondents, recourse to working at home in its current form has a negative impact on staff productivity.

Last week a new survey was conducted by a number of federations of businesses and self-employed workers (BECI, UCM, UNIZO, UWE and VOKA). The initiative is coordinated by the NBB and the FEB/VBO. That survey is the sixteenth in a series of surveys conducted since March, with the aim of assessing how the coronavirus crisis and the restrictions are affecting economic activity and the financial health of businesses.[1] Altogether, 3 798 firms and self-employed workers took part in the survey this week.

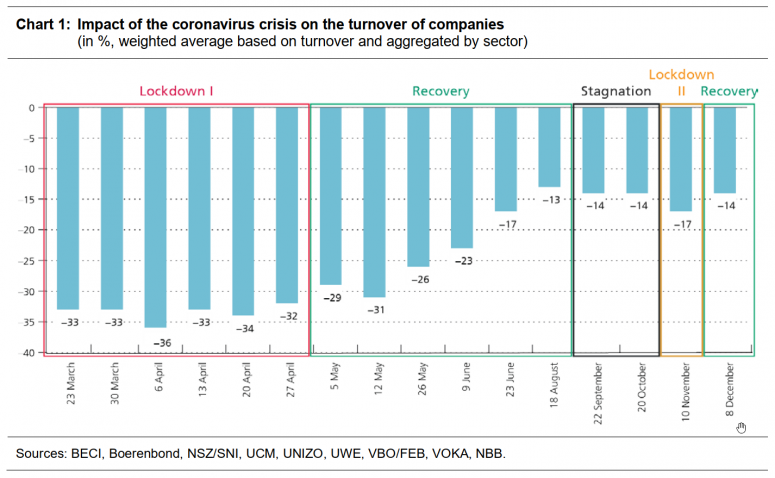

The turnover of Belgian firms picks up in December

Taking account of firm size and sectoral value added, the firms polled this week reported that their turnover was down by 14 % compared to normal. That is a 3 percentage point improvement on the November survey results and roughly equal to the figure preceding the second lockdown. At regional level, the impact is still greater, on average, in the Brussels-Capital Region while it is close to the national average in the Flemish Region and the Walloon Region. Turnover is picking up mainly in the case of small firms and self-employed workers, but these two categories are still by far the hardest hit at present.

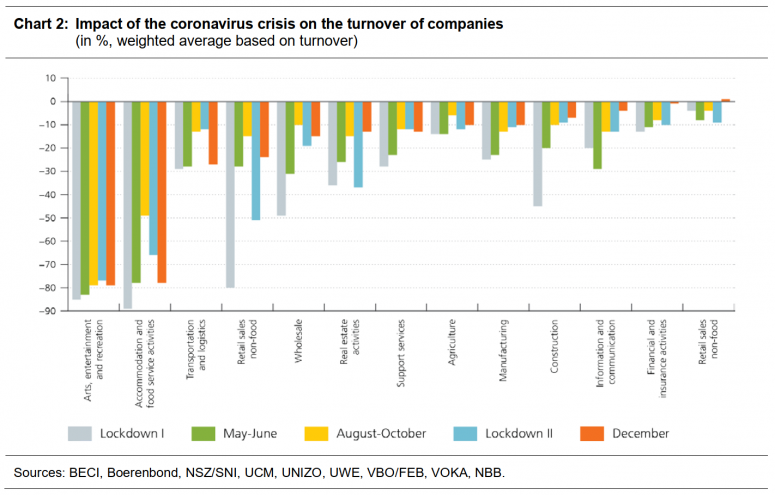

This month’s improvement is due mainly to the marked upswing in non-food retail sales, wholesale turnover and real estate activities[2], following the steep decline in November. This upswing is due to the easing of certain restrictions, particularly the reopening of non-essential shops and real estate agencies from December, and the resumption of property viewings by potential purchasers and renters from mid-November, albeit on condition that the estate agent and the current occupants are not present. However, at 24 %, the drop in non-food retail sales is still considerably higher than the October figure, which already constituted a marked deterioration compared to August.

The recovery is also supported by a slight rise in turnover in most of the sectors less directly affected by the restrictions. This applies to financial activities and insurance, industry, construction, the information and communication sector, food retailing and agriculture. Given the weight of these sectors of activity in the Belgian economy, these small increases also make a significant contribution to the average turnover recovery of Belgian firms.

[1] The ERMG survey is based on the opinions of the firms taking part, and the results should therefore be interpreted with a degree of caution. The firms questioned vary from one survey to the next, partly because the federations conducting the surveys of their members may not be the same, and partly because firms do not participate systematically in every survey. It is therefore sometimes difficult to make comparisons over time. Although we correct any over-representation in the sample of firms from certain sectors, it is possible that the firms polled may vary according to other characteristics as time goes by.

[2] The decline in turnover reported in the real estate activities sector has been rather volatile from one survey to another, which is why the results for that sector should be interpreted with caution.

Conversely, turnover has remained static or declined in the sectors most affected. For the ninth consecutive month, the decline in turnover has stood at almost 80 % in the arts, entertainment and recreational services sector. In the accommodation and food services sector, following a limited, brief revival in the summer, turnover has deteriorated sharply again since the new closure of cafés and restaurants from mid-October and is now about 80 % below normal in December. Finally, firms in the transport and logistics sector reported a steep fall in turnover in December, averaging 27 %. This loss of turnover is very marked for firms in aviation (85 %), while it is smaller for road passenger transport (23 %) and logistics (8 %).[1]

Nevertheless, December’s improvement in turnover should not conceal the fact that a drop of 14 % compared to normal is still a serious shock for Belgian companies in absolute terms. The situation is all the more worrying for certain sectors of the economy which have suffered a much more severe loss of turnover for months now, notably because of a formal ban on their activities.

The outlook for Belgian firms has become a little less gloomy

The outlook for the coming year improved in December, be it in regard to turnover, the degree of concern, investment and employment. This renewed optimism for the year ahead may be attributable largely to the recent announcements concerning the development and efficacy of various vaccines. Also, the very recent bad news about the absence of any further reduction in the number of infections is not reflected in the responses to the December survey, as that took place at the beginning of last week.

First, the expectations of the firms questioned about the decline in turnover caused by the coronavirus crisis in 2021 have improved, with the impact of the crisis down from 12 % in the November survey to 9 % in the December one. That is the least adverse result recorded so far, remembering that the question about turnover expectations has only been asked since August. In addition, the firms polled expect that the loss of revenue will already be down to 11 % in the first quarter of 2021. Finally, for the first time in this survey, a question was asked about expected turnover in 2022. According to the firms polled, the coronavirus crisis will still depress their turnover by 6 % in 2022 compared to a situation without the coronavirus crisis. Although this is a further improvement, it also suggests that the economic damage inflicted by the coronavirus is likely to persist for some time.

The degree of concern about the firm’s current commercial activity, measured on a scale ranging from 1 (not very concerned) to 10 (very concerned), has diminished from 6.9 in November to 6.5 in December. There has also been a slight improvement in the level of investment for 2021: the detrimental impact of the coronavirus crisis on investment plans has now declined from 23 % in the November survey to 20 %. Finally, the renewed optimism is also reflected in expectations regarding job losses in the private sector. While the job losses reported for 2020 remain unchanged at around 84 000 employees, job losses for 2021 have been revised downwards: from 60 000 employees (or 2.4 % of private sector employees) in the November survey to only 23 000 (or 0.9 % of private sector employees) in the December survey. However, it should be noted that these figures relate solely to paid employees, and that the overall impact on private employment also includes self-employed persons who go bankrupt as a result of the coronavirus crisis.

[1] The trend in the loss of turnover in the transport and logistics sector must be interpreted with caution because it depends very much on the firms taking part in the survey. For example, the loss of turnover in the aviation sector was seriously underestimated in recent months owing to the under-representation in the sample of firms in the air passenger transport sector, which has been hard hit by the coronavirus crisis.

The assessment of the bankruptcy risk and liquidity problems is also improving, but the situation remains worrying for certain sectors

A rise in turnover in most sectors combined with a turn for the better in the outlook for next year has improved the perception of the bankruptcy risk among the firms questioned. In December, a smaller proportion of the firms polled considered that bankruptcy was likely or very likely, namely 10 % of respondents compared to 12 % in November. That decline is borne out by the answers to other questions in the December survey concerning the bankruptcy risk. First, the firms questioned consider that the proportion of businesses in their own sector filing for bankruptcy or involved in bankruptcy proceedings has declined. Next, the proportion of firms reporting that they were following a bankruptcy procedure or would begin one in the next six months was also down in December. However, it should be noted that the change in the bankruptcy risk may be explained in part by the lower proportion of small firms – which face a higher bankruptcy risk – in the December sample compared to the November one. In absolute terms, the bankruptcy risk nevertheless remains very high, particularly for accommodation and food services or the arts, entertainment and recreational services sector.

The liquidity position of firms likewise shows a modest improvement: 33 % of the firms polled stated that they were encountering liquidity problems at the time of the December survey, compared to 35 % in the November survey. The liquidity problems less frequently mentioned in December include lower revenues and late payments by certain customers. Conversely, liquidity problems due to late payments by the government are more frequent in December, and that is particularly marked in the case of Walloon businesses (5 % of respondents in Belgium, compared to 8 % in the Walloon Region). Answers to the question “For how long can your company meet its current financial liabilities without having to rely on an additional capital injection or supplementary loans?” also show a slight improvement, as 24 % of the firms polled stated that they could cope for no longer than three months, compared to 27 % in the November survey. Here, too, despite the relatively widespread improvement, the liquidity position of firms in certain sectors of activity, such as accommodation and food services, the arts, entertainment and recreational services, and non-food retailing, is still very worrying.

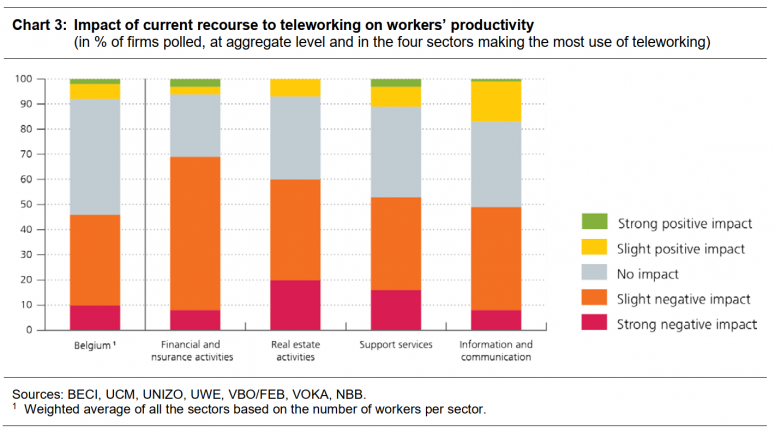

According to Belgian firms, teleworking in its current form reduces productivity

Since full-time teleworking is still the general rule, the proportion of employees working entirely at home has remained steady at around 30 %. A further 13 % of employees work partly at home, a modest increase compared to the November figure (9 %). In the December ERMG survey, business leaders were asked about the impact of teleworking in its current form on their employees’ productivity. 46 % of respondents consider that teleworking in its current form does not affect productivity. However, a large proportion of the firms questioned consider that teleworking is detrimental to productivity: it has a strong negative impact according to 10 % of respondents and a slight negative impact according to 35 % of respondents. Fewer than one in ten business leaders think that teleworking improves their workers’ productivity (strong positive impact for 3 % of them and a slight positive impact for 6 % of them).

Recourse to temporary lay-offs has declined, according to the December survey responses: while the firms polled stated that 11 % of private sector employees were temporarily laid off in November, the December figure is 9 %. That fall is mainly apparent in non-food retailing, the main sector to benefit from the easing of restrictions at the beginning of December.